Solana’s DePIN ecosystem is rapidly transforming the blueprint for real-world infrastructure, setting new benchmarks in market capitalization, on-chain revenue, and global adoption. As of April 2025, Solana’s Decentralized Physical Infrastructure Networks (DePIN) have posted a cumulative on-chain revenue of $5.98 million, a dramatic leap from just $4,000 per week two years prior. This momentum is not just about numbers, it signals a paradigm shift in how compute power, connectivity, and data are provisioned at scale.

Solana DePIN Ecosystem in 2025: Market Leadership and Revenue Growth

With the current market capitalization of Solana-based DePIN projects reaching $3.25 billion (out of a global $7.1 billion), Solana has emerged as the leading blockchain for decentralized infrastructure innovation. The average market cap per project stands at an impressive $191.3 million, far outpacing rival ecosystems.

The sector’s monthly revenue hit a record high of $458,000 in April 2025, marking a 33% year-over-year increase and underscoring robust demand for decentralized wireless networks, GPU compute marketplaces, mapping platforms, and data exchanges. This growth is powered by five standout projects that exemplify the diversity and real-world impact of the Solana DePIN movement:

Top 5 Solana DePIN Projects Powering Infrastructure in 2025

-

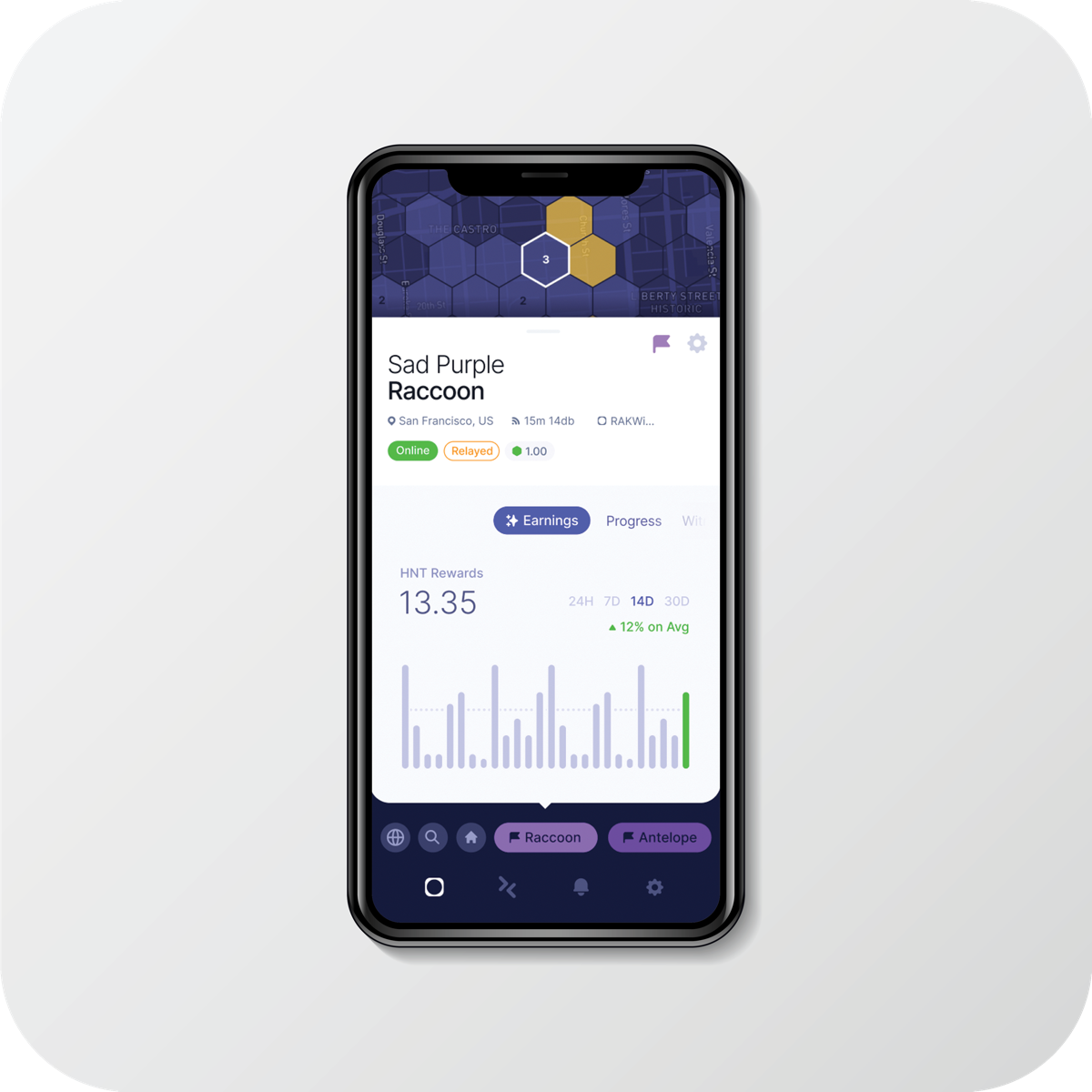

Helium Network (IoT & 5G): Helium is a decentralized wireless network enabling individuals to deploy hotspots that provide IoT and 5G mobile connectivity. In April 2025, Helium achieved $2.29 million in total on-chain revenue, accounting for 60% of the DePIN sector’s weekly revenue and solidifying its role as a leading decentralized connectivity provider on Solana.

-

Render Network (Decentralized GPU Compute): Render Network offers distributed GPU rendering and compute services for 3D graphics and AI workloads. In 2025, it leads the Solana DePIN ecosystem with $2.65 million in total revenue and a record weekly peak of $300,000, powering decentralized compute infrastructure for creators and enterprises.

-

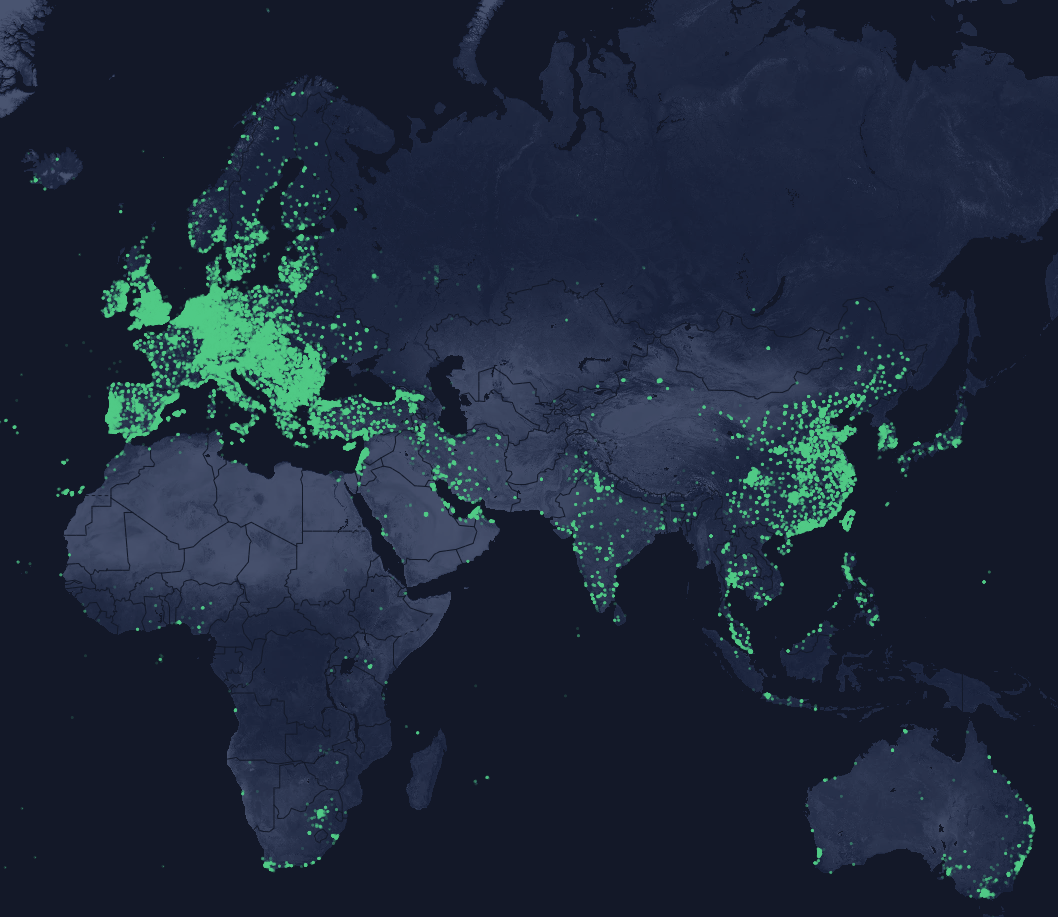

Hivemapper (Decentralized Mapping): Hivemapper is a community-driven mapping network where users collect street-level imagery via dashcams. By April 2025, it operated 77,483 nodes and distributed over $60,000 per week in HONEY token rewards, making it a leading decentralized alternative to traditional mapping services.

-

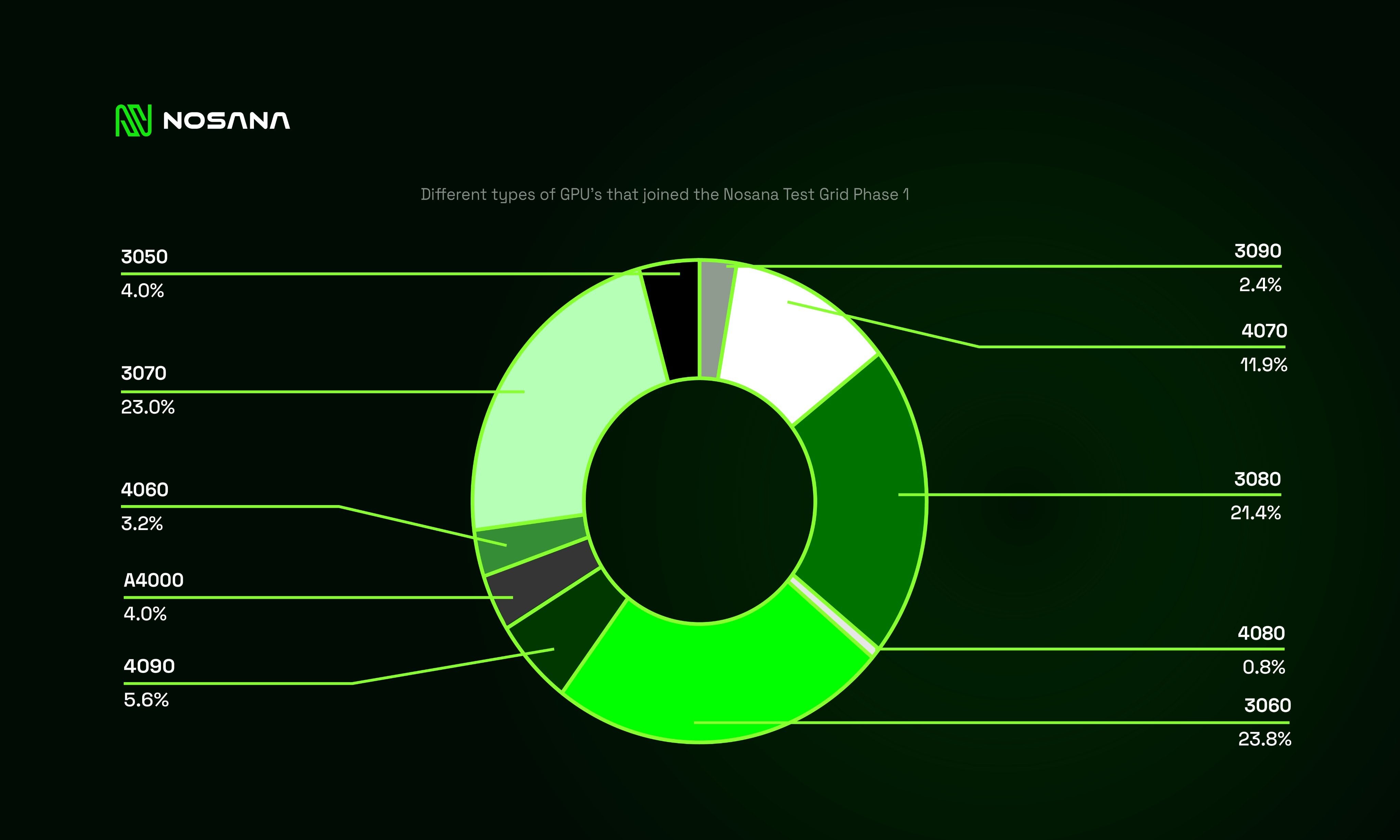

Nosana (Decentralized DevOps Compute): Nosana provides a decentralized compute marketplace focused on AI inference and DevOps workloads. After launching its GPU marketplace in January 2025, Nosana’s daily active nodes doubled to over 600, supporting scalable, censorship-resistant compute for developers worldwide.

-

Grass (DePIN Data Marketplace): Grass is a decentralized data marketplace leveraging Solana’s DePIN infrastructure. It enables users to monetize their unused bandwidth and data, fostering a global, permissionless network for real-time data sharing and analytics in 2025.

Key Projects Powering Real-World Infrastructure on Solana

1. Helium Network (IoT and 5G): After its migration to Solana, Helium has become the backbone for decentralized wireless connectivity, spanning IoT sensors to community-powered 5G hotspots. In April 2025 alone, Helium generated $2.29 million in total on-chain revenue with weekly peaks at $60,000, accounting for nearly 60% of sector-wide earnings.

2. Render Network (Decentralized GPU Compute): Render leverages Solana to orchestrate distributed GPU rendering for AI inference and graphics workloads at scale. With total revenue topping $2.65 million and weekly highs reaching $300,000 (late 2024), Render has proven that decentralized compute can rival centralized cloud services both in cost efficiency and reliability.

3. Hivemapper (Decentralized Mapping): Hivemapper’s global network now exceeds 77,483 nodes, rewarding contributors with HONEY tokens for street-level imagery that powers next-generation maps. Weekly rewards surpassed $60,000 in April, a testament to growing user engagement and valuable data generation.

4. Nosana (Decentralized DevOps Compute): Nosana’s launch of its decentralized GPU marketplace in January 2025 catalyzed a surge in daily active nodes from 300 to over 600 by mid-year. By enabling distributed AI inference tasks across a global grid of GPU hosts, all settled via Solana, Nosana is democratizing access to high-performance computing for developers worldwide.

5. Grass (DePIN Data Marketplace): Grass unlocks new value streams by letting users monetize their unused bandwidth or device data through secure peer-to-peer exchanges on Solana’s high-throughput ledger.

Diversified Use Cases: From Wireless Connectivity to Data Marketplaces

The diversity among these top projects illustrates why the Solana DePIN ecosystem is attracting developers and investors alike:

- Helium Network delivers low-cost IoT coverage while expanding into mobile broadband via community-run hotspots.

- Render Network supports everything from NFT rendering farms to enterprise-grade AI model training.

- Hivemapper‘s crowdsourced mapping is upending traditional geospatial monopolies by rewarding open participation.

- Nosana‘s decentralized DevOps enables scalable machine learning without centralized gatekeepers or prohibitive costs.

- Grass‘s marketplace model empowers everyday users to monetize their digital resources directly with minimal friction.

Solana Technical Analysis Chart

Analysis by Monica Sharpe | Symbol: BINANCE:SOLUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Begin by drawing a primary uptrend line from the July lows (around $140) connecting higher lows through August and into September, terminating near the $217.32 current price. Overlay a secondary, steeper uptrend from late August to mid-September, capturing the acceleration phase toward the local highs near $250. Mark key horizontal support levels at $215 (current reaction zone), $200 (psychological and historical support), and $180 (prior consolidation base). Identify resistance at $233 (recent swing high and failed retest) and $250 (local peak). Highlight the recent breakdown from $233 to $217 as a potential short-term bearish signal but contextualize it within the larger uptrend. Use rectangles to shade the consolidation ranges in July ($140-160) and in early September ($215-230). Annotate the chart with callouts noting the strong revenue and fundamental support from DePIN sector growth, particularly around reversal and breakout points.

The Road Ahead: Scaling Impact With On-Chain Efficiency

This explosive growth trajectory is supported by Solana’s unique blend of ultra-low transaction costs and high throughput, enabling microtransactions that underpin many DePIN business models.

If you’re seeking deeper analysis about why Solana became the go-to blockchain for this new wave of infrastructure projects, and how these economics translate into long-term value creation, explore our comprehensive breakdown at How Solana Became the Top Blockchain for DePIN Projects in 2025.

As the Solana DePIN ecosystem matures, its influence is becoming increasingly tangible beyond the crypto sphere. The interplay between robust on-chain revenue, user-driven participation, and real-world infrastructure deployment is catalyzing new models for global resource distribution, models that are more accessible, scalable, and transparent than their Web2 predecessors.

Network Effects and User Growth: Device Onboarding and Community Engagement

Device onboarding is a critical metric for DePIN success. In 2025, Helium’s migration to Solana not only improved transaction speeds but also unlocked seamless onboarding for thousands of new IoT devices and 5G hotspots monthly. Hivemapper’s network expansion to over 77,000 active nodes demonstrates the power of incentivized community mapping at scale. Nosana’s doubling of daily active nodes since launching its GPU marketplace signals rising developer trust in decentralized compute offerings.

Grass’s peer-to-peer data marketplace model continues to lower entry barriers for individuals looking to participate in the digital economy with minimal technical overhead. This democratization of access, whether it’s bandwidth sharing or GPU compute, is a hallmark of Solana-powered DePIN projects and a key reason why developer activity remains high across the ecosystem.

Device Growth & User Incentives: Top Solana DePIN Projects (2025)

-

Helium Network (IoT & 5G): Helium leads Solana’s DePIN sector in device deployment, with tens of thousands of active IoT and 5G hotspots worldwide. In 2025, the network achieved on-chain revenue of $2.29 million and weekly earnings peaking at $60,000. User incentives remain robust, with HNT token rewards distributed to hotspot operators for network coverage and data transfer, driving steady device growth and high operator engagement.

-

Render Network (Decentralized GPU Compute): Render boasts the highest total revenue among Solana DePIN projects, reaching $2.65 million in 2025 and achieving a record weekly revenue of $300,000. Device growth is fueled by onboarding GPU node operators, who earn RNDR tokens for providing rendering and AI compute power, making user incentives directly tied to resource contribution and network demand.

-

Hivemapper (Decentralized Mapping): Hivemapper’s device growth surged to 77,483 active nodes by April 2025. Contributors install dashcams to collect street-level imagery and are rewarded with HONEY tokens, with weekly user rewards exceeding $60,000. This strong incentive structure has driven rapid expansion of its decentralized mapping network.

-

Nosana (Decentralized DevOps Compute): Nosana’s decentralized GPU marketplace, launched in January 2025, doubled its daily active nodes from 300 to over 600 within months. Users earn NOS tokens by providing compute resources for AI inference and DevOps tasks, with incentives scaling as network demand and device participation grow.

-

Grass (DePIN Data Marketplace): Grass incentivizes users to share unused bandwidth and device resources in exchange for GRASS tokens. While specific device growth numbers are less public, the platform’s focus on rewarding everyday users for contributing to its decentralized data marketplace has attracted a rapidly expanding participant base in 2025.

Revenue Sustainability: From Tokenomics to Real-World Demand

The sustainability of DePIN revenue hinges on genuine demand for decentralized services rather than speculative token flows. Render Network’s consistent weekly revenue, peaking at $300,000, and Helium’s dominance in sector earnings reflect real-world utility as organizations seek alternatives to legacy cloud or telecom providers. Hivemapper’s growing contributor base and stable weekly rewards further validate that open networks can attract both users and enterprise partners when incentives are aligned.

Nosana’s niche focus on AI inference tasks positions it well as enterprises look to cut costs while accessing scalable compute power. Grass represents an emerging frontier where even casual users can tap into recurring income streams by monetizing underutilized digital assets or connectivity.

Challenges Ahead: Scaling Without Compromising Decentralization

Despite these gains, challenges remain. As more devices come online and network effects accelerate, maintaining decentralization, both at the validator level and within individual projects, will be crucial for long-term resilience. Regulatory clarity around data marketplaces (like Grass) and cross-border wireless deployments (as seen with Helium) may also shape future growth trajectories.

The competitive landscape is evolving rapidly as rival blockchains attempt to replicate Solana’s success in DePIN verticals. However, with SOL trading at $216.88 as of September 2025, and technical indicators aligning with continued sector expansion, the fundamentals point toward sustained leadership if current adoption trends persist.

Why It Matters: Solana’s Blueprint for Decentralized Infrastructure

The five flagship projects, Helium Network, Render Network, Hivemapper, Nosana, and Grass, are not just case studies; they are blueprints for what decentralized infrastructure can achieve when paired with high-throughput blockchains like Solana. Their collective momentum is reshaping everything from urban connectivity to global data commerce while offering resilient alternatives to centralized monopolies.

For those tracking macro trends or seeking exposure to next-generation infrastructure plays within crypto markets, understanding the mechanics behind these projects is essential. As capital inflows continue and adoption widens, from developers building novel dApps on top of these networks to enterprises integrating decentralized services, the potential upside remains significant.