Solana’s DePIN (Decentralized Physical Infrastructure Networks) sector is on fire, and the numbers don’t lie. By mid-2025, cumulative on-chain revenues for Solana DePIN projects have cracked the $3 million mark, solidifying Solana as a powerhouse for decentralized infrastructure innovation. This surge isn’t just a blip – it’s a signal that real-world utility and blockchain can coexist at scale, with earnings to match.

Solana DePIN Revenue: The $3M and Monthly Milestone

Let’s talk about the headline stat: $3 million and in monthly earnings across Solana-based DePIN projects. This isn’t theoretical revenue or speculative hype – it’s on-chain, verifiable income generated by live networks powering wireless connectivity, decentralized computing, mapping, and environmental monitoring. The growth curve is steep and sustained, with June 2024 marking an inflection point as new device onboarding and user participation accelerated.

“Solana DePIN projects are rewriting the rules of infrastructure monetization – what used to be centralized and opaque is now transparent, scalable, and lucrative. ”

The uptick in Solana DePIN revenue comes from several high-performing sectors:

- Wireless Connectivity: Helium Mobile led the charge with $1.5 million in on-chain revenue in 2025, thanks to explosive growth in user subscriptions and data offloading. Wayru onboarded 1,500 and devices this year alone, each tied to unique NFTs for deployment tracking. Dabba doubled its connected devices while tripling bandwidth consumption from January to June 2025 – token burns soared from $134,000 to $348,000 over that period.

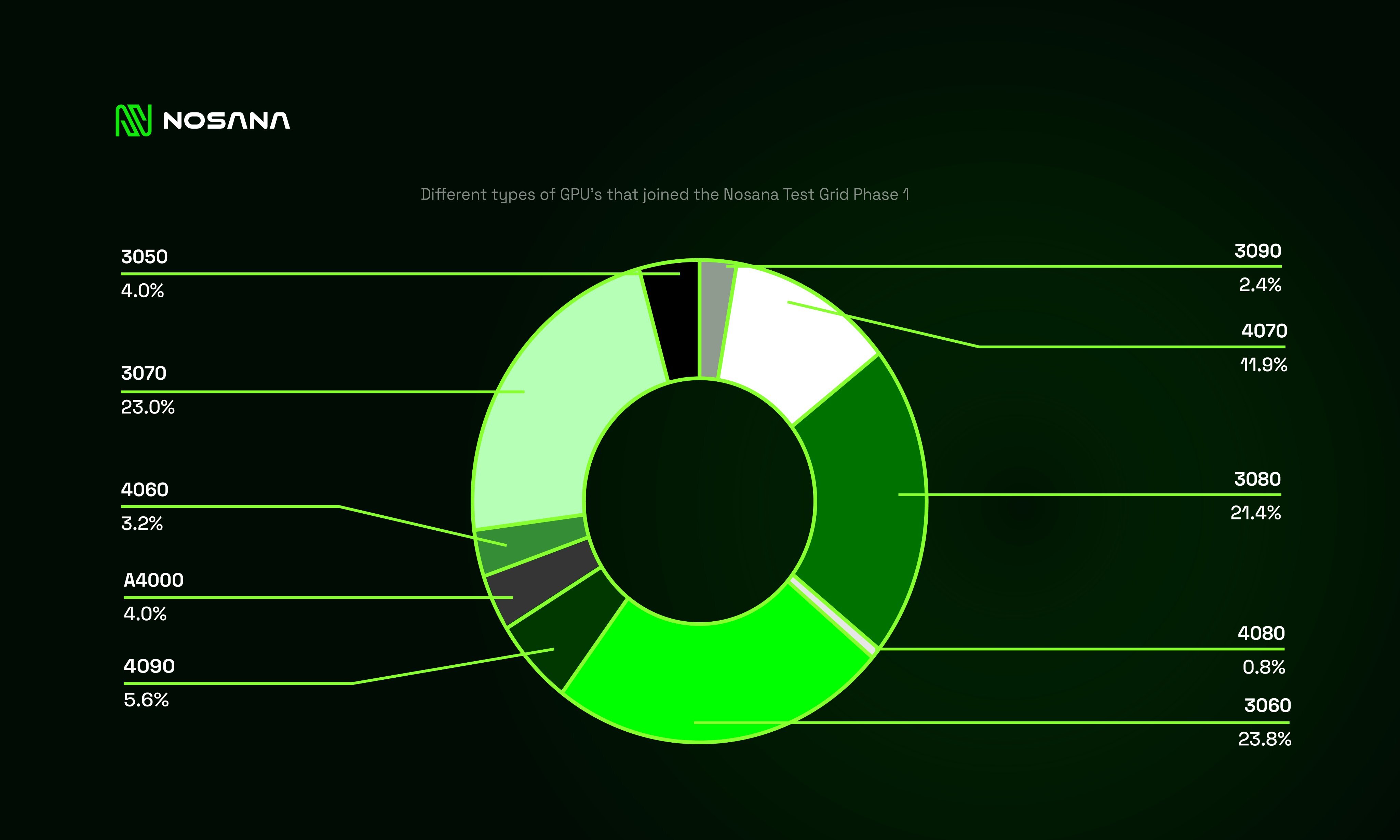

- Decentralized Computing and AI: Render posted an impressive $2.65 million in total revenue by April 2025, making it a flagship for decentralized GPU power. Nosana processed over 766,000 jobs with monthly averages up 78% versus late 2024.

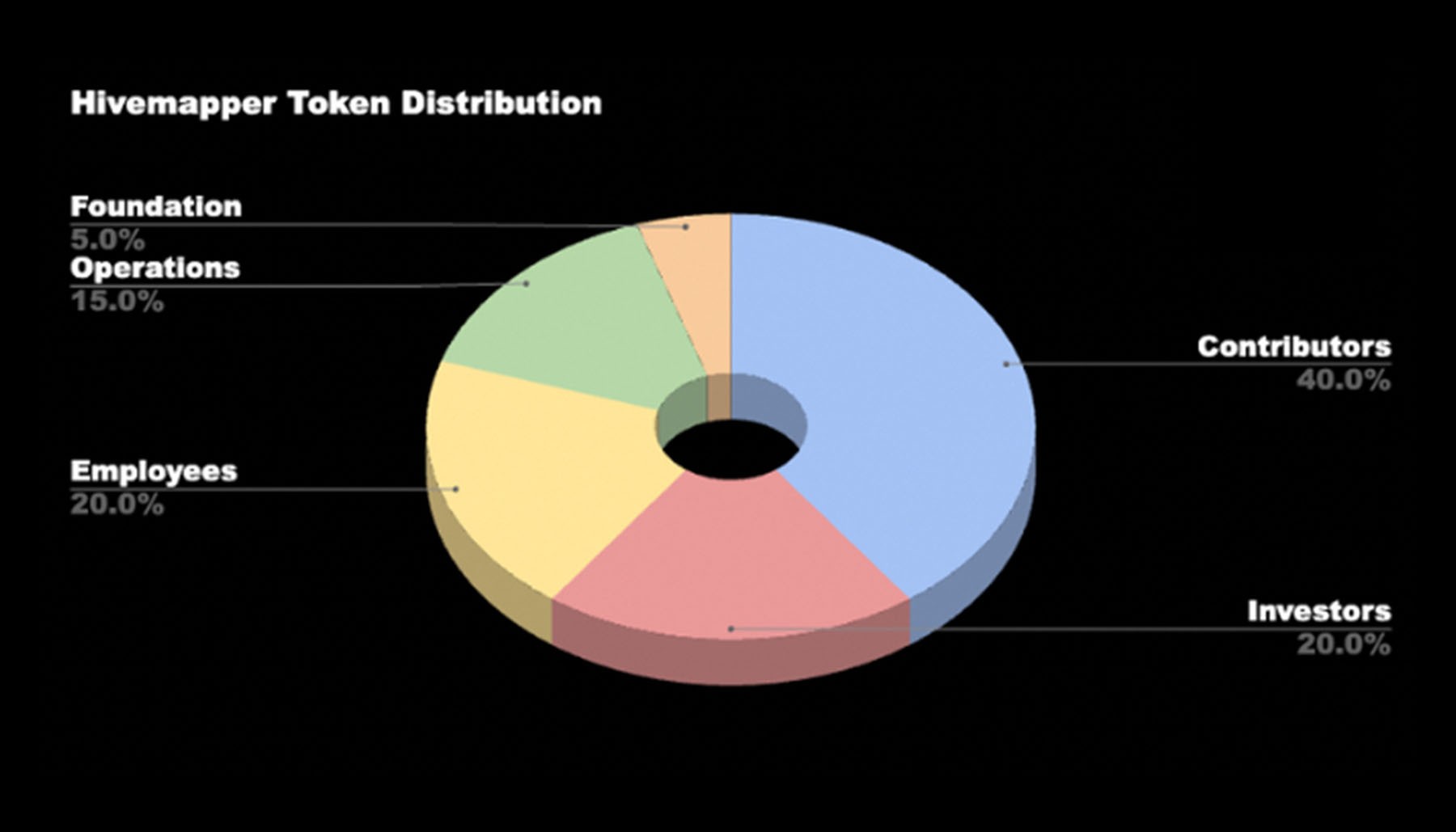

- Mapping and Environmental Monitoring: Hivemapper mapped a staggering 139 million kilometers in H1 2025 with roughly 6,000 active monthly contributors; NATIX saw revenue jump 72% in June alongside a parallel spike in contributors.

Diverse Use Cases Fueling Real-World Earnings

The secret sauce behind Solana’s DePIN success? It’s all about diversity of use cases and relentless device onboarding. From wireless mesh networks blanketing cities to decentralized render farms powering AI startups, Solana’s high-throughput blockchain enables rapid scaling without bottlenecks or prohibitive fees.

Solanafloor.com’s deep dive reveals how projects like Helium Mobile have become not just proof-of-concept experiments but viable businesses with recurring income streams. Meanwhile, Dabba’s token burn mechanics directly tie network usage to value accrual – as more bandwidth gets consumed, more tokens are burned out of circulation.

Top Solana DePIN Projects Powering Revenue Growth

-

Helium Mobile: The leader in Solana DePIN revenue, Helium Mobile generated $1.5 million in on-chain earnings in 2025. Its decentralized wireless network is rapidly expanding, fueled by user subscriptions and increased data offloading.

-

Render: As the top decentralized computing project on Solana, Render amassed $2.65 million in revenue by April 2025. It connects users needing GPU power with providers, driving innovation in AI and graphics workloads.

-

Hivemapper: This global mapping platform mapped 139 million kilometers in the first half of 2025 and boasts around 6,000 monthly active contributors, rewarding users for dashcam data collection.

-

Nosana: Nosana completed over 766,000 jobs on its decentralized compute marketplace, with monthly averages up 78% from late 2024. It enables distributed AI and compute workloads on Solana.

-

Dabba: Dabba doubled its connected devices and tripled bandwidth consumption in early 2025. Token burns soared from $134,000 to $348,000 between January and June, highlighting rapid network growth.

-

Wayru: Focused on wireless connectivity, Wayru onboarded 1,500+ devices in 2025 and issues NFTs for each deployment, expanding decentralized internet access.

-

NATIX: NATIX saw a 72% revenue increase in June 2025, with a 71% rise in active contributors. The project leverages AI-powered dashcams for real-time environmental monitoring.

The Role of Onboarding and Contributor Incentives

No decentralized infrastructure network can thrive without active participants – that means real people deploying hardware and contributing data or compute resources. In mid-2025 alone:

- Dabba doubled its device count, fueling exponential bandwidth growth.

- NATIX increased its contributor base by 71%, translating directly into higher network earnings.

- Hivemapper kept engagement high, maintaining around 6,000 monthly active mappers who are rewarded per kilometer mapped.

This virtuous cycle of onboarding → usage → rewards is exactly what sets Solana apart from slower-moving chains bogged down by high fees or lackluster developer support. As more devices come online and more contributors join the fold, total network value rises – both for users earning rewards and for investors eyeing sustainable yield opportunities within the Solana ecosystem.

Solana (SOL) Price Prediction 2026-2031

Based on DePIN revenue growth, ecosystem expansion, and evolving market dynamics

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $140.00 | $220.00 | $320.00 | +12% | Possible post-bull cycle correction; DePIN continues steady growth but macro market volatility weighs on price. |

| 2027 | $155.00 | $260.00 | $380.00 | +18% | Ecosystem matures, more DePIN projects onboard; regulatory clarity improves institutional participation. |

| 2028 | $185.00 | $315.00 | $470.00 | +21% | Wider adoption of decentralized infrastructure, Solana scales throughput—strong sector leadership solidifies. |

| 2029 | $210.00 | $370.00 | $560.00 | +17% | Market cycle uptrend, cross-chain DePIN integrations, and continued revenue growth support higher valuations. |

| 2030 | $245.00 | $425.00 | $660.00 | +15% | Potential new ATH as next crypto cycle peaks; increasing real-world utility and enterprise adoption. |

| 2031 | $220.00 | $390.00 | $600.00 | -8% | Cycle correction phase, but DePIN revenue provides price floor; competition from other L1s intensifies. |

Price Prediction Summary

Solana’s price outlook through 2031 is underpinned by robust DePIN revenue growth, expanding use cases, and a maturing ecosystem. While volatility and market cycles will create fluctuations, sustained infrastructure adoption and increasing network revenues are likely to drive progressive price appreciation. Maximum price scenarios assume bullish market cycles and widespread decentralized infrastructure adoption, while minimums reflect potential corrections and competitive pressures.

Key Factors Affecting Solana Price

- Continued growth and diversification of DePIN projects on Solana

- Sustained on-chain revenue increases and real-world utility

- Broader adoption of decentralized infrastructure by enterprises and developers

- Regulatory clarity in major jurisdictions

- Potential technological upgrades improving scalability and security

- Competition from other smart contract platforms (Ethereum, Avalanche, etc.)

- Macro crypto market cycles and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

What’s striking is how decentralized infrastructure revenue on Solana is no longer a niche story. The blend of token incentives, real-world utility, and rapid device onboarding has created a snowball effect. Projects like Wayru are onboarding hundreds of devices monthly, each tracked via NFTs for transparency and accountability. Meanwhile, Helium Mobile’s $1.5 million in on-chain revenue shows that decentralized wireless isn’t just a dream, it’s a thriving business model.

The numbers tell only part of the story. The real magic lies in the mechanics: as Dabba’s bandwidth consumption tripled from January to June 2025, token burns jumped from $134,000 to $348,000, directly linking network usage to token economics. This alignment between network health and token value is attracting both technical contributors and savvy investors hunting for sustainable yield within the Solana DePIN projects ecosystem.

Why Solana? Speed, Scale, and Cost Advantage

Let’s not undersell Solana’s technical edge here. With transaction fees consistently low and throughput that leaves older chains in the dust, Solana provides fertile ground for DePIN builders. Device onboarding can happen at scale without fee anxiety or slow confirmations, crucial for projects like NATIX (where contributor counts surged 71% in June 2025) or Hivemapper (with 139 million kilometers mapped already this year).

The network effect is compounding: more contributors mean richer data sets and better service coverage, which in turn attracts more users and enterprise partners. It’s a feedback loop that centralized incumbents just can’t match, especially with transparent on-chain accounting for every device and dollar earned.

What’s Next? The Road Ahead for DePIN Earnings on Solana

If current trends hold, and there’s little reason to doubt them provides DePIN earnings on Solana could soon dwarf today’s $3 million monthly milestone. Several high-profile projects are preparing major airdrops in October (like Meteora and AllDomains), likely to turbocharge user acquisition even further (eurybia.xyz). Plus, new hardware launches such as the Seeker smartphone with SKR Token integration are pushing boundaries for both consumer adoption and developer experimentation.

The competitive landscape is heating up across all verticals:

- Wireless: More devices deployed means more data offloaded, and more revenue flowing to node operators.

- Decentralized Compute: Render and Nosana are setting new benchmarks for job volume and payout reliability.

- Mapping and Sensing: Hivemapper and NATIX continue to reward contributors while building datasets valuable far beyond crypto-native circles.

The bottom line: Decentralized infrastructure isn’t just possible on Solana, it’s profitable at scale, with live networks paying out millions every month.

If you’re a builder, investor, or user looking for real-world blockchain impact, and real earnings, the data backs it up: Solana has become the home base for decentralized infrastructure innovation. As device onboarding accelerates through 2025 and beyond, expect even bigger headlines, and even more impressive revenue milestones, in the months ahead.