Solana’s Alpenglow upgrade, approved by 99% of network validators, is redefining the performance frontier for decentralized physical infrastructure networks (DePIN). With the latest Binance-Peg SOL (SOL) price at $193.80, the ecosystem stands at a pivotal moment. This protocol overhaul slashes block finality from 12.8 seconds to a near-instant 150 milliseconds, positioning Solana not just as a fast Layer-1, but as a serious contender for real-time, enterprise-grade decentralized infrastructure.

Alpenglow’s Core Innovations: Votor and Rotor

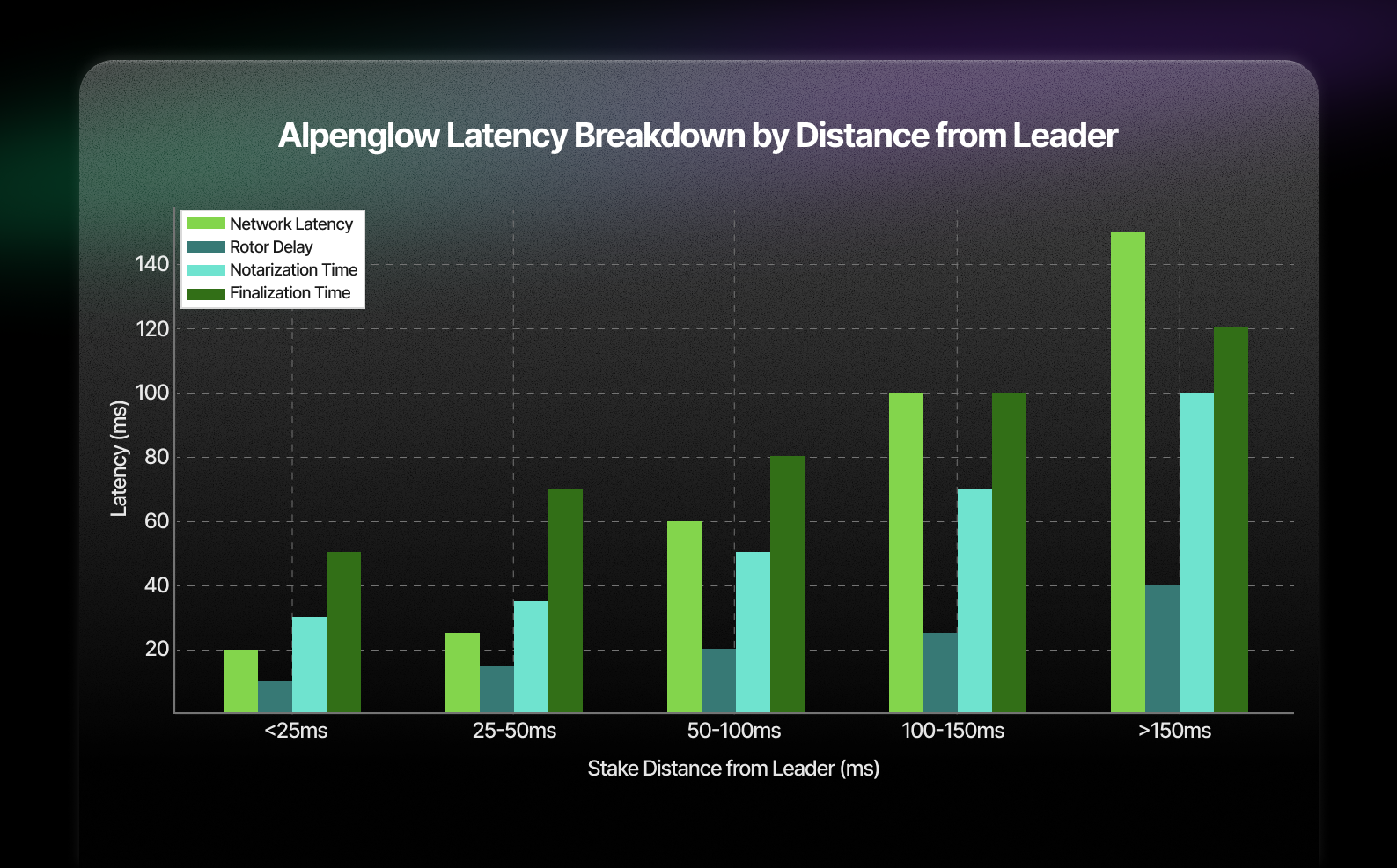

The heart of Alpenglow lies in its dual-pronged consensus and data propagation redesign. The Votor consensus mechanism replaces TowerBFT, enabling blocks to finalize in just one or two rounds, a quantum leap from past designs. Meanwhile, Rotor optimizes network-wide data dissemination, sharply reducing latency and ensuring that transactions not only confirm quickly but propagate across the validator set with minimal delay.

This technical synergy delivers not just speed but also resilience. The new “20 and 20” model allows the network to remain operational even if up to 20% of validators act adversarially while another 20% are unresponsive, an unprecedented standard in blockchain fault tolerance.

Why DePIN Projects Are Flocking to Solana Post-Alpenglow

The impact on DePIN is transformative. Infrastructure categories like decentralized energy grids, supply chain management, and IoT networks demand real-time data immutability and rapid settlement, requirements that legacy blockchains cannot meet due to multi-second or minute-long finality windows. With Alpenglow’s 150ms block finality, Solana now supports:

- Instantaneous device-to-chain recording: IoT sensors can log critical events on-chain with negligible lag.

- Real-time automated settlements: Power grids or mobility networks can reconcile microtransactions in near-real time.

- Synchronized global state: Supply chain events update across continents without bottlenecks.

This leap is already prompting major DePIN projects to migrate infrastructure onto Solana, seeking both technical advantage and cost efficiency. Validator operating costs are projected to fall from roughly $60,000 per year to just $1,000, a dramatic reduction that democratizes participation and decentralization for smaller operators.

The Market Context: Institutional Capital Flows and Network Effects

The broader market response has been swift. Following validator approval of Alpenglow, institutional total value locked (TVL) on Solana has climbed past $8.6 billion according to recent industry analyses, while corporate treasury allocations have surged by $1.72 billion since the upgrade’s announcement cycle began. These figures underscore growing confidence not only in Solana’s technical roadmap but also its capacity to underpin mission-critical DePIN applications at scale.

Solana (SOL) Price Prediction Post-Alpenglow Upgrade: 2026-2031

Professional Forecast Based on the Impact of Solana’s Alpenglow Upgrade and DePIN Adoption Trends

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change (Avg y/y) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $170.00 | $235.00 | $320.00 | +21.3% | Network adoption accelerates, new DePIN use cases |

| 2027 | $210.00 | $298.00 | $420.00 | +26.8% | DePIN sector matures, increased institutional capital |

| 2028 | $240.00 | $362.00 | $540.00 | +21.5% | Global regulatory clarity, Solana cements DePIN leadership |

| 2029 | $210.00 | $400.00 | $680.00 | +10.5% | Competition rises, but Solana maintains edge |

| 2030 | $195.00 | $440.00 | $810.00 | +10.0% | Broader Layer-1 competition, but real-time infra drives value |

| 2031 | $160.00 | $495.00 | $1,050.00 | +12.5% | Mass adoption of DePIN, network effects peak |

Price Prediction Summary

Solana’s Alpenglow upgrade is a transformative step, positioning SOL as the backbone for real-time DePIN applications and enterprise-grade blockchain infrastructure. The upgrade is expected to drive sustained price growth, with average SOL prices projected to more than double over the next six years. While volatility and competition will remain, Solana’s technical edge in speed, cost, and resilience should underpin its market leadership, especially in the DePIN sector. Bullish scenarios see SOL exceeding $1,000 by 2031 if mass adoption occurs; bearish cases reflect macro risks or setbacks in network adoption.

Key Factors Affecting Solana Price

- Alpenglow’s 150ms finality, enabling new DePIN and real-time applications

- Lower validator costs, supporting greater decentralization and resilience

- Growing institutional and corporate adoption (TVL, treasury allocations)

- Potential regulatory headwinds or global crypto policy shifts

- Competition from other high-performance Layer-1 blockchains

- Macro market cycles and liquidity conditions

- Execution risks or technical challenges in ongoing Solana upgrades

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The convergence of lower costs, higher throughput, and robust security is setting new benchmarks for decentralized infrastructure on any public blockchain, not just within the Solana ecosystem but across the entire Web3 landscape.

For developers and enterprises evaluating DePIN deployment, the calculus has fundamentally changed. The latency and throughput bottlenecks that once forced teams to compromise on user experience or operational reliability are now largely eliminated. With Solana block finality at 150ms, decentralized infrastructure can finally rival centralized solutions in responsiveness, while maintaining the trustless guarantees essential to open networks.

Consider the implications for real-time data markets, decentralized mobility (e. g. , ride-sharing, micro-mobility), and automated energy trading. These sectors require not only fast confirmation but also deterministic settlement, critical for machine-to-machine transactions where milliseconds can mean millions in value exchanged or lost. Alpenglow’s consensus overhaul allows these use cases to flourish natively on-chain, without resorting to off-chain workarounds or trusted intermediaries.

Decentralization Without Sacrificing Performance

The reduction in validator operating costs from $60,000 to $1,000 per year is more than an economic footnote, it alters the decentralization profile of the entire network. Smaller entities and geographically distributed operators can now participate meaningfully in consensus without prohibitive capital requirements. This enhanced validator diversity strengthens Sybil resistance and mitigates centralization risks that have historically plagued high-performance chains.

Moreover, the “20 and 20 resilience model” means Solana can continue processing transactions even under partial network failure or targeted attacks, a critical property for infrastructure supporting physical world assets and IoT devices. These advances are not merely incremental; they are foundational for building trust in mission-critical DePIN applications.

Risks and Open Questions

No upgrade is without its challenges. Some experts have voiced concerns about the complexity of Alpenglow’s new consensus mechanisms and potential attack surfaces introduced by rapid finality. Rigorous testing and ongoing audits remain paramount as adoption accelerates, especially as more real-world assets and regulated entities enter the ecosystem.

Additionally, while initial market reactions have been positive, with SOL trading at $193.80: sustained network reliability under peak loads will be closely watched by both investors and enterprise users alike. The next wave of DePIN projects migrating to Solana will serve as a stress test for these new capabilities.

What Comes Next for Solana DePIN?

The Alpenglow upgrade is not just a technical milestone but a catalyst for broader adoption across decentralized infrastructure verticals. As more projects leverage Solana’s sub-second finality and resilient architecture, expect a proliferation of use cases previously deemed impractical on public blockchains, from autonomous vehicle coordination to decentralized wireless networks and beyond.

The race is now on between chains seeking to capture the burgeoning DePIN market segment. With its blend of speed, cost-efficiency, and security guarantees post-Alpenglow, Solana has seized a first-mover advantage that will shape industry standards well into 2026.

For a deeper dive into how Alpenglow and Rotor are reshaping decentralized infrastructure on Solana, see our comprehensive guide here.