As Solana’s native token trades at $133.59, its DePIN ecosystem is positioning itself at the epicenter of the 2026 AI compute surge. Decentralized physical infrastructure networks on Solana are not just hype; they’re delivering real GPU firepower for AI workloads, slashing costs, and outpacing centralized giants. Projects like io. net, Nosana, and Render Network are already proving this with tangible metrics, while builders such as Kuzco and Grass gear up to amplify the momentum.

Solana’s high-throughput blockchain makes it ideal for solana depin ai compute, enabling seamless coordination of distributed GPU resources. Unlike Ethereum’s congestion-prone setup, Solana processes thousands of transactions per second, crucial for real-time AI inference and training. This technical edge, combined with low fees, draws developers building solana gpu networks 2026. By democratizing access to idle compute power, these networks address the AI crunch where hyperscalers like AWS charge premiums for scarce GPUs.

Render Network and Nosana Set Benchmarks in Decentralized GPU Utility

Render Network stands out in depin solana ai infrastructure, boasting over 3,800 active GPU nodes by mid-2025. Users burned more than 121 million RNDR tokens for services, with weekly revenues hitting $300,000 peaks and settling around $70,000. This isn’t speculative froth; it’s proof of demand from AI, gaming, and VFX sectors hungry for cost-effective rendering.

Nosana complements this with a grid optimized for AI inference. Completing 766,000 jobs by mid-2025, it saw monthly volumes rise 78% from late 2024. For builders, Nosana’s Solana integration means predictable, sub-second settlements, fostering trust in solana depin gpu compute.

Nosana’s growth underscores how Solana DePIN turns idle hardware into revenue streams, balancing supply with exploding AI needs.

io. net Leads the Charge in Aggregated Compute Marketplaces

io. net aggregates idle GPUs and cloud resources into a marketplace that’s exploding for AI devs. June 2025 revenues doubled to $2.5 million, signaling massive adoption. By connecting providers directly to users, io. net optimizes costs 90% below traditional clouds, a game-changer for ai depin projects solana.

These leaders aren’t isolated; they’re part of a symbiotic ecosystem. Render handles rendering-heavy tasks, Nosana nails inference, and io. net scales broadly. Investors should note their tokenomics reward node operators, creating aligned incentives for long-term resilience.

Builders Like Kuzco, Grass, and Rivalz Network Fuel the Next Wave

Kuzco emerges as a Solana-native DePIN for distributed storage and compute, tailored for AI data pipelines. Its focus on verifiable compute positions it for 2026’s data-intensive models. Grass, meanwhile, monetizes unused internet bandwidth for AI scraping, turning passive users into contributors without hardware hassles.

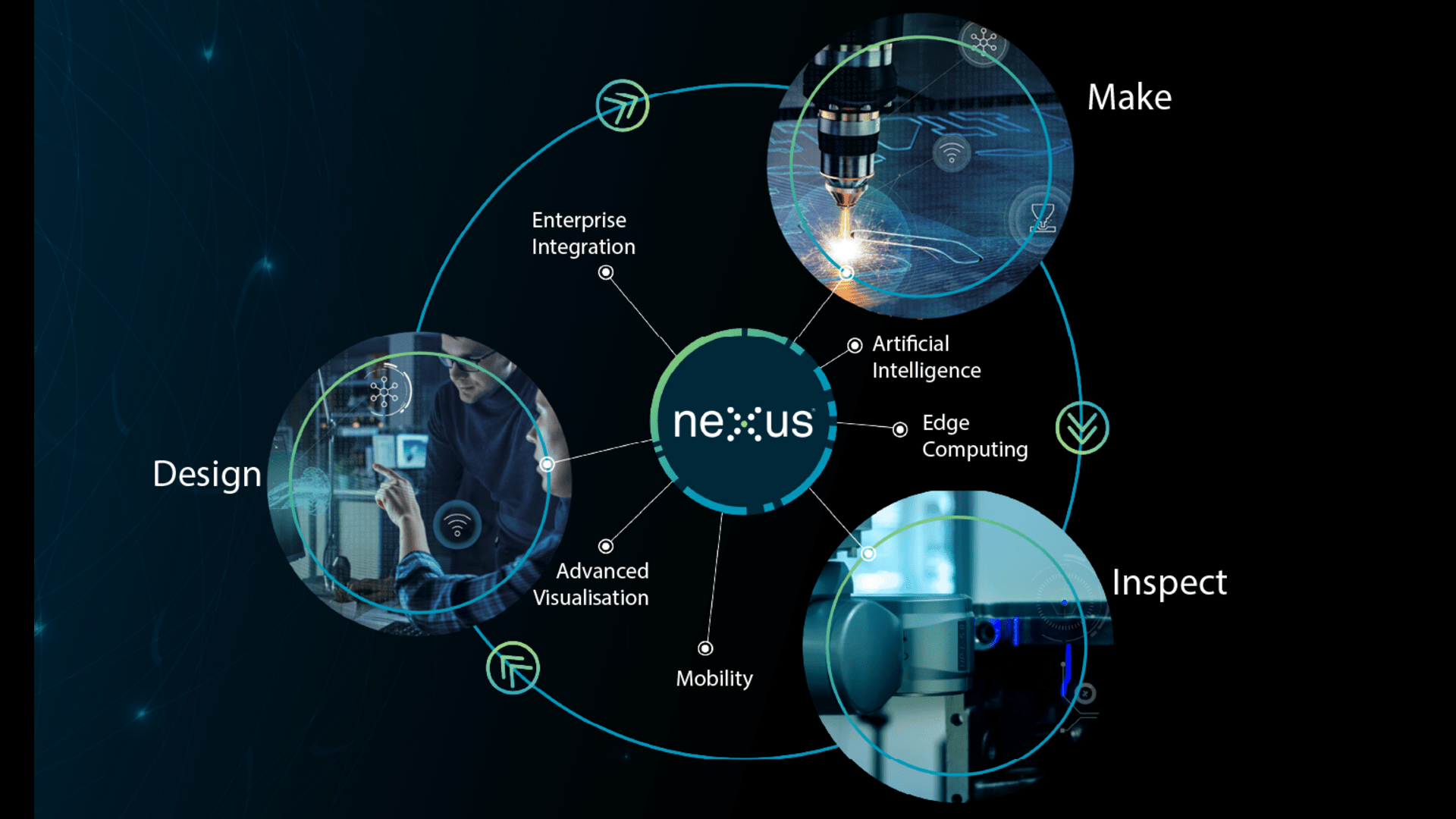

Rivalz Network brings AI orchestration, enabling seamless job distribution across GPUs. Oasis AI specializes in privacy-preserving compute, vital as regulations tighten. Nexus and Aggregata round out the pack: Nexus for edge computing networks, Aggregata for aggregated data layers supporting AI training.

Solana (SOL) Price Prediction 2026-2031: DePIN AI Compute Explosion

Predictions driven by growth in Solana DePIN projects like io.net, Nosana, Render Network, and emerging AI compute networks amid 2025 market baseline of ~$134

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $220 | $350 | $600 | +161% |

| 2027 | $350 | $550 | $950 | +57% |

| 2028 | $450 | $750 | $1,300 | +36% |

| 2029 | $650 | $1,050 | $1,800 | +40% |

| 2030 | $900 | $1,450 | $2,500 | +38% |

| 2031 | $1,200 | $1,950 | $3,300 | +34% |

Price Prediction Summary

Solana (SOL) is set for substantial appreciation from 2026 to 2031, propelled by the DePIN AI compute boom. Average prices are projected to climb from $350 in 2026 to $1,950 by 2031, with minimums reflecting bearish regulatory or competitive pressures, and maximums embodying bullish AI adoption and market cycle peaks. This outlook assumes continued DePIN innovation, Solana’s technical superiority, and favorable macro trends.

Key Factors Affecting Solana Price

- Explosive growth in Solana DePIN AI projects (io.net, Nosana, Render Network, Rivalz, Oasis AI)

- Rising demand for decentralized GPU compute and AI inference

- Solana’s high TPS, low fees attracting builders and adoption

- Emerging market expansion (e.g., Nairobi, Manila) driving DePIN utility

- Post-halving bull cycles and institutional inflows

- Potential regulatory clarity boosting confidence

- Technological upgrades and competition from L1s/L2s as risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Check out deeper insights on how DePIN networks power decentralized AI compute on Solana. These nine projects – io. net, Nosana, Kuzco, Render Network, Grass, Rivalz Network, Oasis AI, Nexus, and Aggregata – form a robust lineup. Their combined traction suggests Solana could capture 30% of DePIN’s AI market share by 2026, driven by emerging markets where compute is scarce but ambition high.

While Render, Nosana, and io. net have set the pace, the remaining builders in this cohort offer complementary strengths that could accelerate Solana’s dominance in solana gpu networks 2026. Let’s break down their unique value propositions.

Top 9 Solana DePIN AI Compute Projects

-

#1 io.net: Decentralized GPU marketplace aggregating idle GPUs for AI developers. In June 2025, revenue doubled to $2.5 million.

-

#2 Nosana: AI inference grid on Solana with a decentralized GPU compute network. Completed 766,000 jobs by mid-2025, up 78% monthly.

-

#3 Kuzco: Distributed storage and compute platform enabling scalable DePIN infrastructure for AI workloads.

-

#4 Render Network: GPU rendering network supporting AI and VFX. Over 3,800 active nodes by July 2025, weekly revenues around $70,000.

-

#5 Grass: Bandwidth-sharing network for AI data scraping and processing, contributing unused internet to DePIN.

-

#6 Rivalz Network: AI orchestration platform coordinating decentralized compute for intelligent agents and workflows.

-

#7 Oasis AI: Privacy-focused compute network ensuring secure, confidential AI processing on Solana.

-

#8 Nexus: Edge computing DePIN delivering low-latency AI inference at the network edge.

-

#9 Aggregata: Data aggregation platform for DePIN, curating high-quality datasets for AI training.

Grass stands apart by tapping into underutilized internet bandwidth rather than GPUs, enabling everyday users to contribute to AI data collection without specialized hardware. This lowers barriers to entry, potentially onboarding millions in bandwidth-rich emerging markets. Rivalz Network, on the other hand, focuses on intelligent job routing across heterogeneous compute resources, ensuring optimal efficiency for complex AI workflows.

Privacy and Edge: Oasis AI, Nexus, and Aggregata Fill Critical Gaps

Oasis AI addresses a pressing need in depin solana ai infrastructure: confidential computing. As AI models ingest sensitive data, Oasis’s secure enclaves protect computations from prying eyes, aligning with global privacy standards. Nexus pushes compute to the edge, reducing latency for real-time applications like autonomous vehicles or AR/VR, where milliseconds matter. Aggregata, meanwhile, specializes in curating high-quality datasets from decentralized sources, a foundational layer for training robust AI models.

These projects aren’t operating in silos. Kuzco’s storage backbone supports data-heavy operations for Oasis and Aggregata, while Nexus’s edge nodes enhance Grass’s scraping efficiency. This interconnectedness amplifies network effects, a hallmark of resilient DePIN ecosystems on Solana.

Key Metrics for Top Solana DePIN AI Compute Projects

| Project | Active Nodes | Jobs Completed | Revenue | Notes |

|---|---|---|---|---|

| Render Network | 3,800+ | — | $70,000 weekly (peaked at $300,000) | July 2025; 121M RNDR tokens burned for services |

| Nosana | — | 766,000 | — | Mid-2025; +78% average monthly jobs vs. H2 2024 |

| io.net | — | — | $2.5 million | June 2025; revenue doubled |

From an investment perspective, with Solana at $133.59, these tokens present a balanced opportunity. Node operators earn yields from real utility, not just speculation. io. net’s revenue trajectory suggests sustained token demand, while Nosana’s job growth points to sticky adoption. However, risks loom: regulatory scrutiny on data privacy could impact Oasis AI, and competition from centralized providers might pressure margins if DePIN scaling lags.

Yet Solana’s architecture mitigates these. Its sub-second finality ensures reliable payouts, and Firedancer upgrades promise even higher throughput, fortifying solana depin gpu compute. Emerging markets, from Nairobi to Manila, will drive the next leg, where affordable nodes turn local hardware into global assets.

Balance supply constraints with Solana’s speed, and 2026 becomes the year DePIN eclipses Web2 compute monopolies.

For builders, the path forward involves hybrid models blending on-chain verification with off-chain execution. Rivalz exemplifies this, orchestrating jobs while Kuzco verifies outputs. Investors should allocate 5-10% of portfolios to this basket, diversifying across GPU-heavy (Render, io. net) and lightweight (Grass, Nexus) plays. Monitor node counts and job volumes weekly; sustained 50% and quarterly growth signals conviction buys.

Explore further on how Solana DePIN networks power decentralized AI infrastructure in 2025. As these nine projects mature, they won’t just ride the AI wave; they’ll steer it toward a decentralized future, where compute abundance meets Solana’s efficiency at $133.59 per SOL.