Solana’s DePIN sector has turned heads in 2025, with protocols racking up $17 million in total revenue and Helium alongside Hivemapper delivering over 800% growth. This isn’t just hype; it’s a fundamental shift where decentralized networks are outpacing traditional infrastructure providers. Helium Mobile’s daily active users hit 2.5 million by late December, a tenfold jump year-over-year, fueled by seamless data offload mechanics on Solana. Meanwhile, Hivemapper’s mapping efforts have covered 139 million kilometers, backed by 6,000 monthly active contributors. As Helium’s HNT trades at $0.9058, down slightly 0.0592% in the last 24 hours from a high of $0.9754, the momentum suggests bigger moves ahead for solana depin revenue.

Helium’s Rocket-Fueled Revenue Trajectory

Helium stands out in the helium solana growth story, posting 787% year-to-date revenue increases by October 2025, surpassing $2 million monthly. Syndica’s deep dives reveal on-chain revenue climbing to all-time highs, like nearly $400,000 in July alone, the fifth straight monthly rise. This stabilization at peak levels, with Helium joining Render, Hivemapper, UpRock, NATIX, and Geodnet to exceed $2 million collectively each month, underscores Solana’s edge in handling high-throughput DePIN workloads.

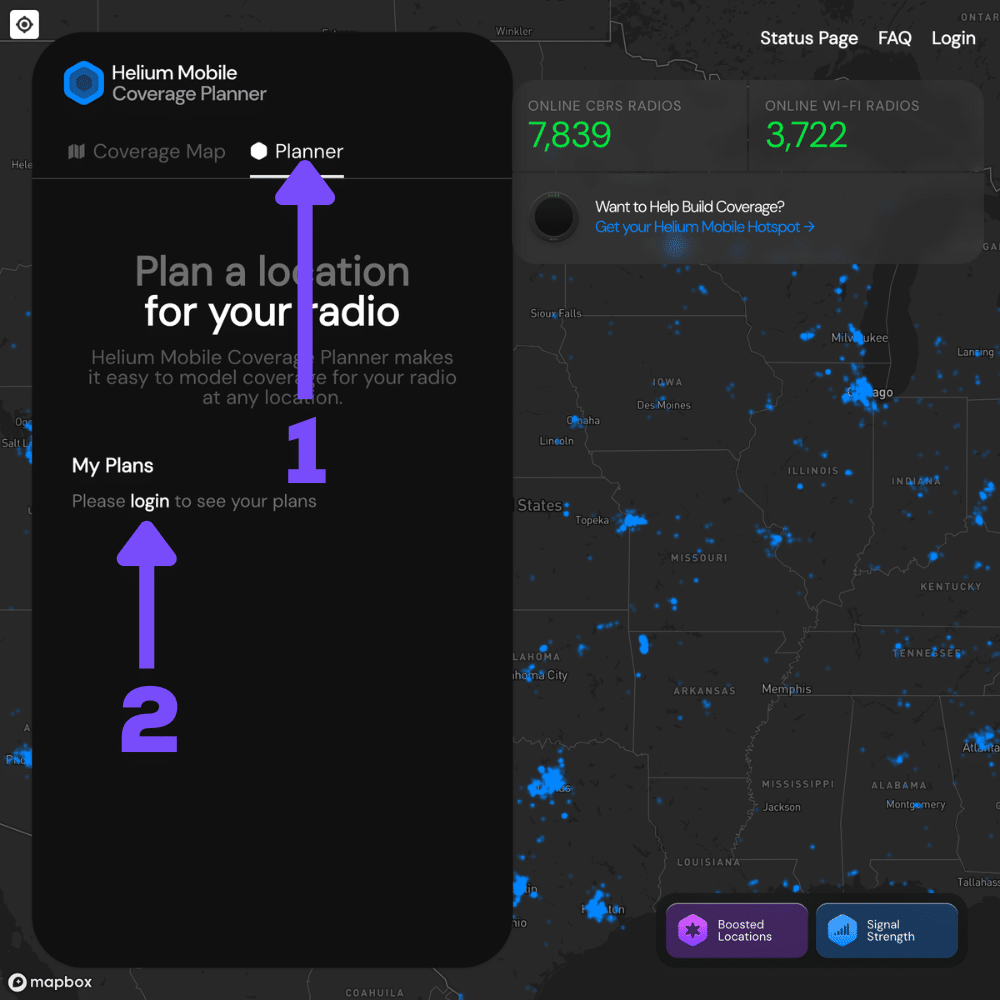

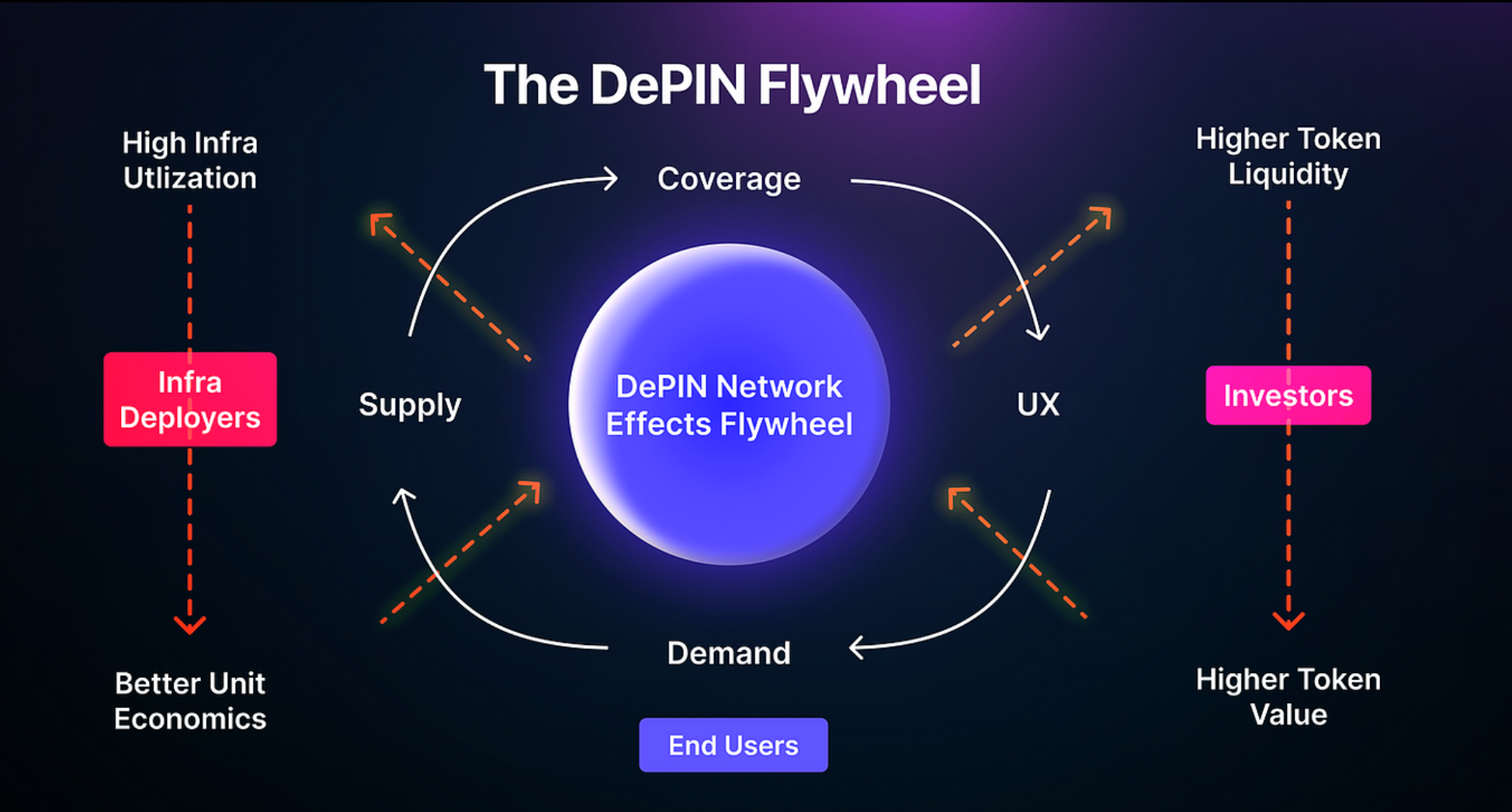

What drives this? Helium Mobile’s data offload model incentivizes users to share connectivity, creating a flywheel of adoption. Daily active users surging to 2.5 million signals real-world utility, not speculative froth. In my view, as a long-term investor, this positions Helium to capture untapped markets in IoT and wireless, especially as Solana’s low fees and speed enable micro-transactions at scale. December 2024 saw Helium, Render, and Hivemapper peak over $1 million monthly, a harbinger of the full-year explosion.

Hivemapper’s Mapping Revolution Gains Altitude

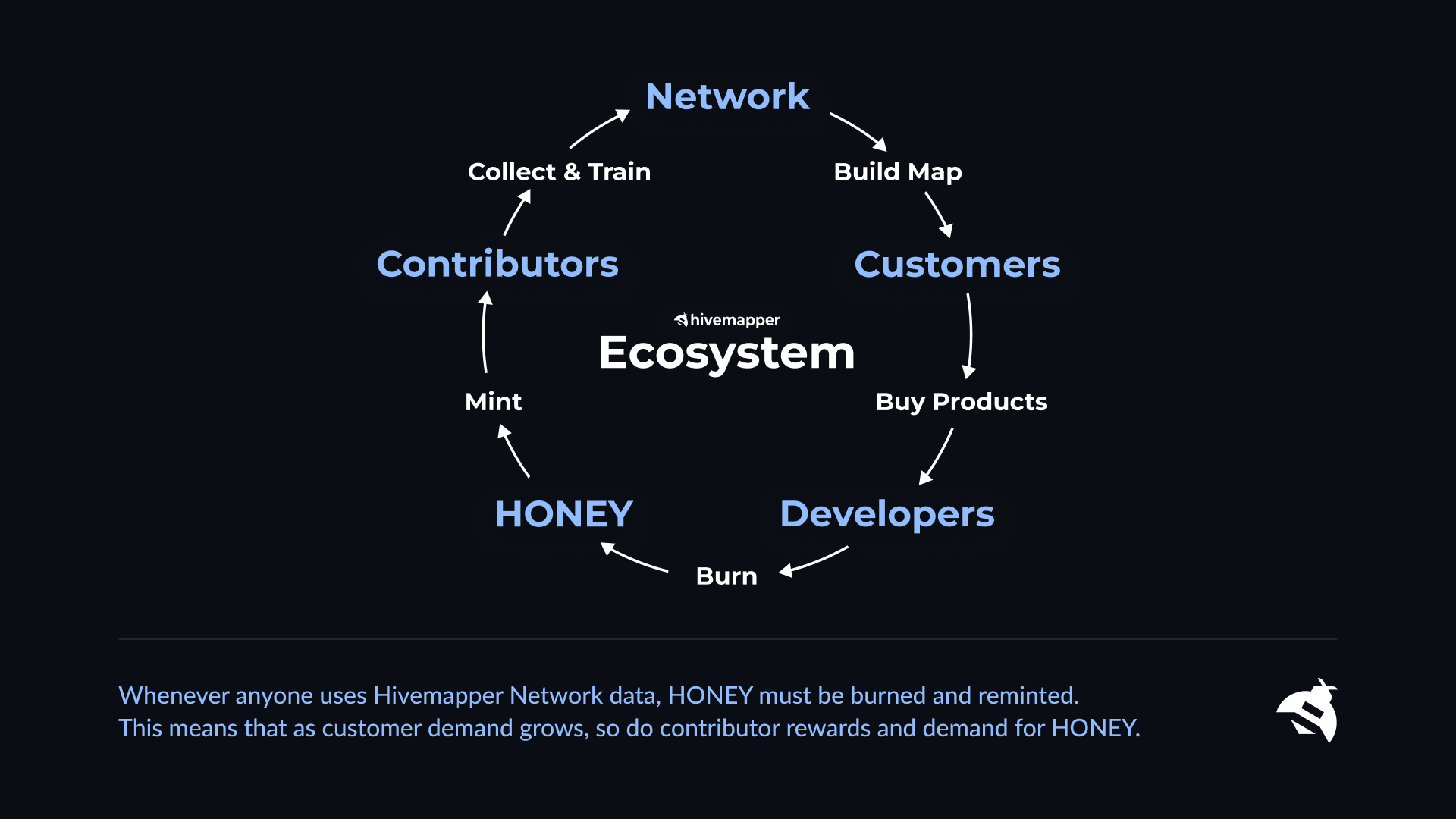

Hivemapper complements Helium in the hivemapper solana niche, evolving from early leader to sustained contender. By October 2025, its network mapped over 139 million kilometers, with an 81% spike in token burn rate and $114,000 year-to-date revenue. Contributors numbering around 6,000 monthly active users reflect a vibrant community building the world’s freshest map data through dashcams and AI.

Unlike centralized giants like Google Maps, Hivemapper rewards participation, aligning incentives via Solana’s efficient tokenomics. Reports note steady on-chain revenue at $1,500 weekly into 2025, but the real story is scalability. Helium overtook early on with its mobile launch, yet Hivemapper’s persistence in mapping verticals positions it for synergies, like integrating with Helium’s hotspots for location-aware services. This duo exemplifies how Solana DePIN projects monetize physical assets without middlemen.

Solana DePIN’s Foundation for 2026 Dominance

Zooming out, Solana hosts 30 active DePIN networks across compute, wireless, IoT, mapping, and energy, a sixfold leap from under five previously. Market value soared to $3.25 billion by April 2025, eclipsing rivals. This ecosystem maturity, per analyses from SolanaFloor and Syndica, sets a bullish stage for solana depin 2026 projections.

Revenue streams stabilized post-2024 peaks, with collective figures underscoring viability. Solana’s technical prowess handles the data-intensive nature of DePIN, from helium mobile data offload to real-time mapping. Investors should note Solana’s price forecasts eyeing $215 to $644, propelled by institutional inflows and upgrades. Helium’s path to $100 million annual revenue feels plausible if trends hold, blending adoption with token accrual.

Helium (HNT) Price Prediction 2027-2032

Projections based on Solana DePIN 800% revenue surge, Helium leadership, and 2026 growth trends

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $1.20 | $2.80 | $5.50 | +208% |

| 2028 | $1.80 | $4.50 | $9.00 | +61% |

| 2029 | $2.50 | $7.00 | $14.00 | +56% |

| 2030 | $3.50 | $11.00 | $22.00 | +57% |

| 2031 | $5.00 | $15.00 | $30.00 | +36% |

| 2032 | $7.00 | $20.00 | $38.00 | +33% |

Price Prediction Summary

Helium (HNT) is set for strong growth from 2027-2032, driven by its dominance in Solana’s DePIN sector with 800% revenue surges and projections up to $100M annually. Average prices may rise from $2.80 to $20.00, a ~22x increase from 2026 levels ($0.91), with mins reflecting bearish cycles and maxes capturing bullish adoption scenarios.

Key Factors Affecting Helium Price

- 800%+ revenue growth for Helium and Hivemapper in 2025

- Solana DePIN revenue stabilizing at $2M+ monthly peaks

- Helium Mobile DAUs surging to 2.5M, boosting utility

- $100M annual revenue potential for Helium in 2026

- Synergies with Hivemapper’s mapping network and token burns

- Bullish Solana ecosystem growth ($215-$644 in 2026)

- Regulatory clarity for DePIN infrastructure

- Technological advancements in wireless and IoT networks

- Crypto market cycles favoring altcoin rallies post-2026

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Delving into 2026 specifics, Helium’s trajectory hinges on expanding its mobile network beyond current hotspots. With HNT holding steady at $0.9058, the project’s ability to scale data offload will dictate token demand. Projections peg annual revenue at $100 million, assuming DAUs maintain or exceed 2.5 million. This isn’t pie-in-the-sky; it’s extrapolated from 2025’s 787% surge and monthly peaks over $2 million shared across top protocols.

Hivemapper’s HONEY token benefits from deflationary mechanics, with that 81% burn rate acceleration signaling scarcity. Mapping 139 million kilometers positions it as a data layer for autonomous vehicles and urban planning, ripe for partnerships. If Solana’s ecosystem value climbs past $3.25 billion, Hivemapper could double its contributor base, pushing revenue beyond 2025’s $114,000 YTD.

Key Drivers Propelling Solana DePIN Forward

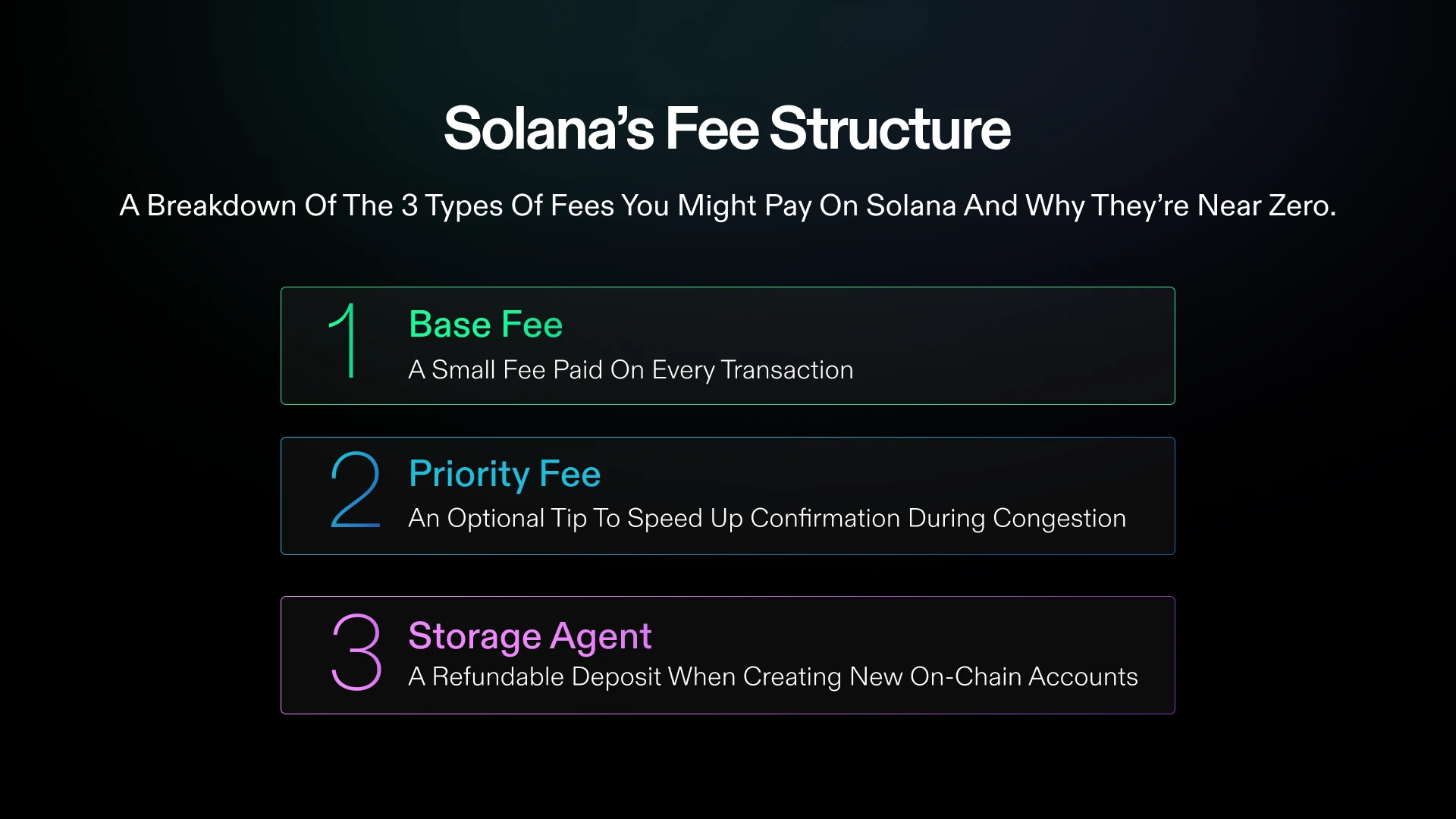

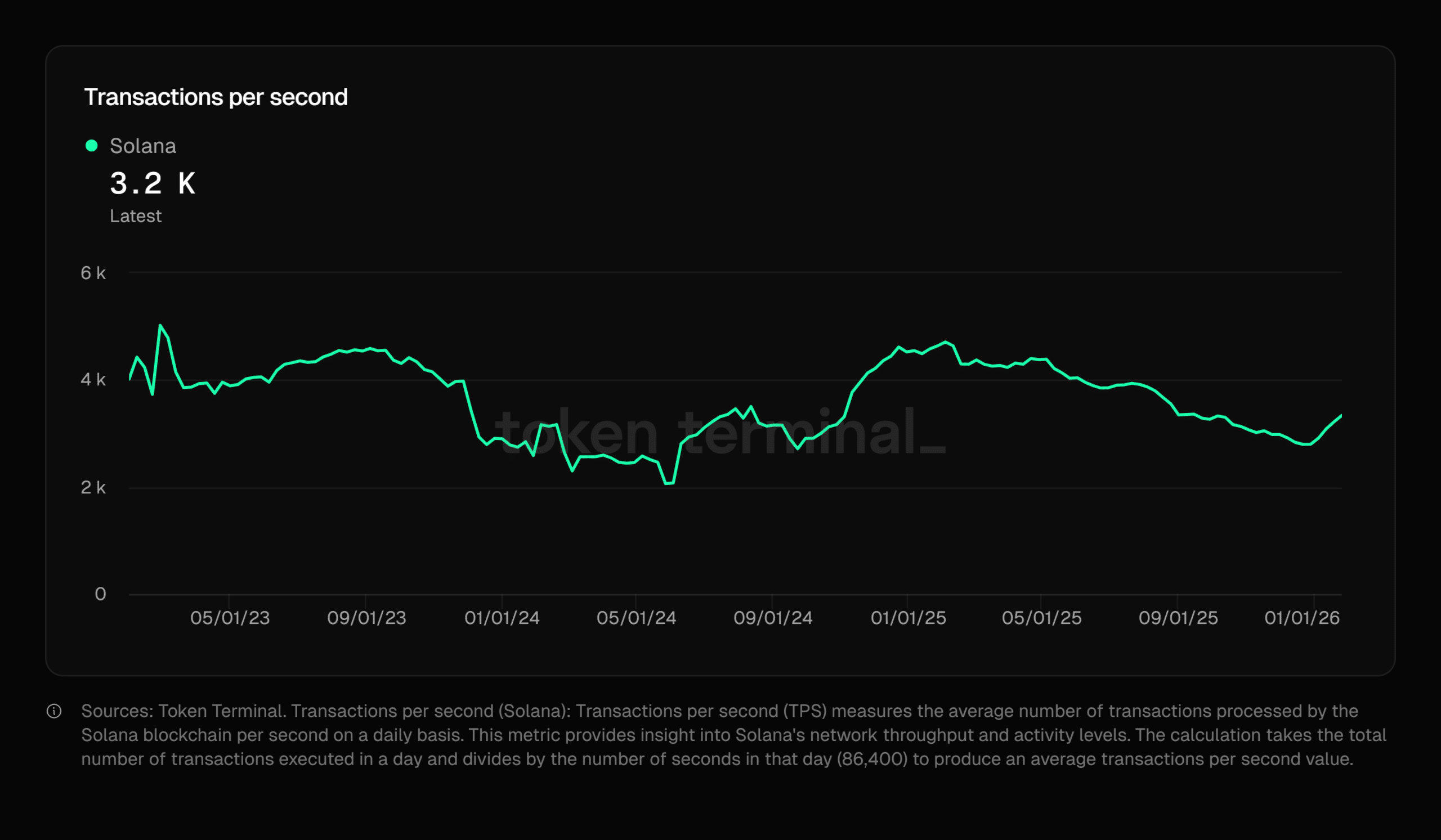

Solana’s DePIN dominance stems from its unmatched throughput, processing thousands of transactions per second at sub-cent fees. This suits DePIN’s bursty, data-heavy workloads far better than Ethereum alternatives. Wireless networks like Helium thrive on real-time settlements, while mapping apps like Hivemapper demand persistent storage without bottlenecks. The result? 30 protocols spanning verticals, from compute via Render to energy plays, all interoperating seamlessly.

Top Solana DePIN Drivers for 2026

-

Ultra-Low Fees: Solana transaction fees average under $0.00025, enabling cost-effective, high-volume DePIN data flows like Helium’s coverage proofs.

-

High TPS: Solana delivers up to 65,000 TPS theoretically and thousands in practice, powering scalable DePIN networks amid $17M 2025 revenue.

-

Helium Mobile DAUs: Reached 2.5M DAUs in late Dec 2025 (Syndica), a 10X YoY surge fueling real-world wireless adoption and 787% revenue growth to $2M+ monthly.

-

Hivemapper Mapping Scale: Over 139M km mapped by 6,000 monthly contributors as of Oct 2025 (SolanaReport), driving 800% revenue growth.

-

Token Burn Mechanics: Hivemapper’s 81% burn rate increase and Helium’s deflationary models reduce supply, supporting value accrual amid DePIN expansion.

-

Ecosystem Synergies: 30 active DePINs (Helium, Hivemapper, Render, Geodnet) across wireless, mapping, compute foster collaborations, with $3.25B market value by Apr 2025.

Consider the flywheel: users earn tokens for contributing hardware, which funds network expansion, attracting more users. Helium Mobile exemplifies this with its helium mobile data offload turning smartphones into mini-hotspots. Hivemapper does the same for dashcams, crowdsourcing fresher data than incumbents at a fraction of the cost. For investors, this means accruing tokens tied to physical utility, not just speculation.

Yet maturity brings challenges. Regulatory scrutiny on wireless spectrum could test Helium, while mapping data privacy demands robust compliance. Competition heats up too, with rivals eyeing Solana’s playbook. Still, as a 14-year veteran in digital assets, I see these as surmountable. Solana’s DePIN projects like Helium, Hivemapper, and Render are pioneering resilient infrastructure, much like early internet protocols.

Looking to 2026, watch for cross-protocol integrations. Imagine Helium hotspots feeding location data to Hivemapper maps, enabling precise IoT deployments. Revenue diversification into enterprise deals could accelerate growth, with Solana’s price potentially validating the thesis at $215 minimum. HNT at $0.9058 offers an entry amid consolidation, rewarding patience as networks compound.

Solana DePIN isn’t chasing memes; it’s building the backbone of tomorrow’s internet. Helium and Hivemapper’s 800% surge is the proof, with 2026 poised to deliver multiples on revenue and adoption. Stake your research here, and let the infrastructure revolution unfold.