In the volatile landscape of Solana DePIN projects 2026, where bandwidth and compute scarcity define value capture, dTelecom stands out as a calculated bet on decentralized real-time voice video Solana infrastructure. Built on Solana’s high-throughput blockchain, this dRTC network promises low-latency voice, video, and chat services fused with AI agents, all while handing data sovereignty back to users. With SOL trading at $80.36 amid a 1.93% dip over the past 24 hours, investors eye dTelecom’s pre-TGE positioning for asymmetric upside, tempered by execution risks in node economics and token vesting.

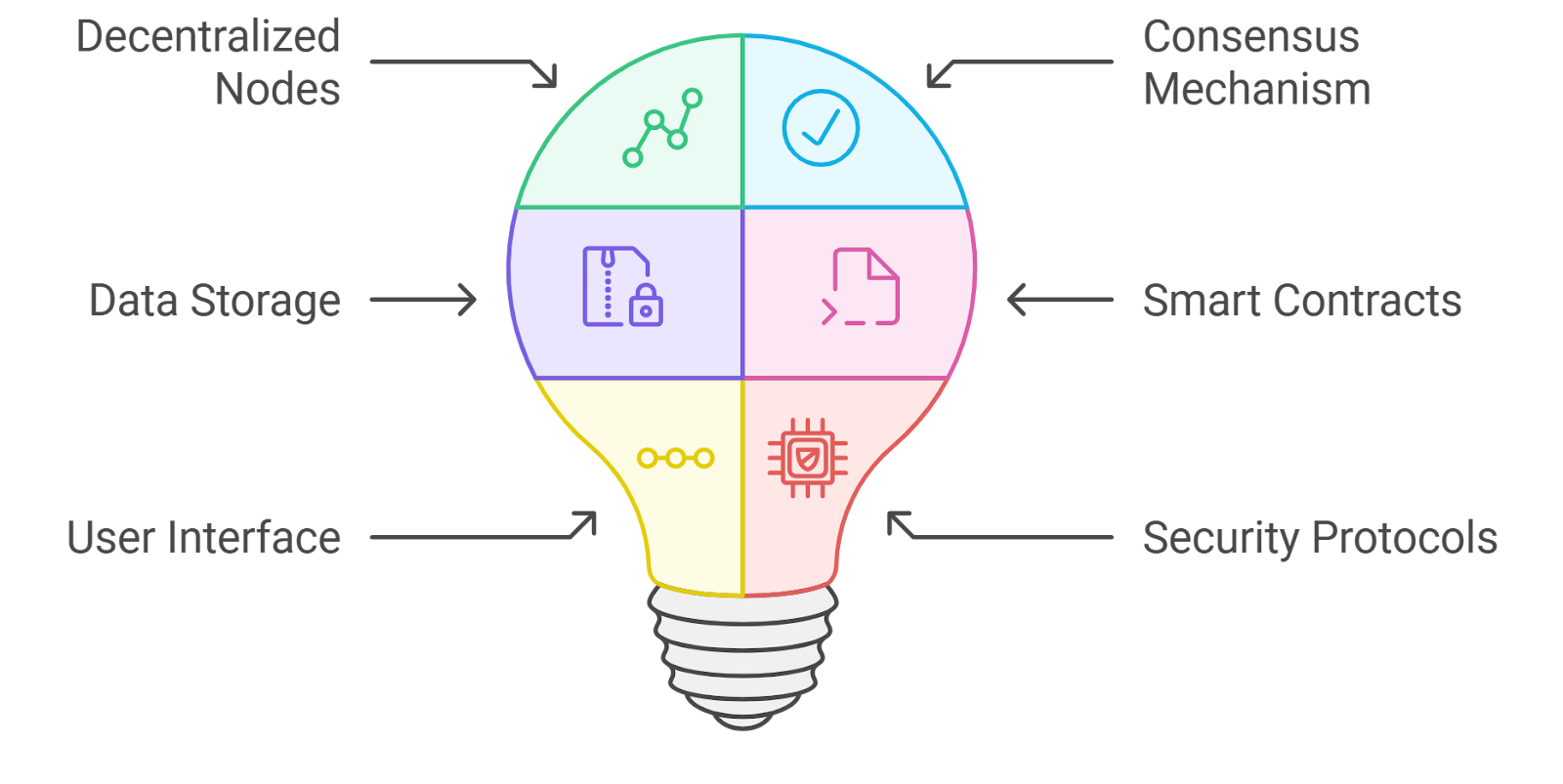

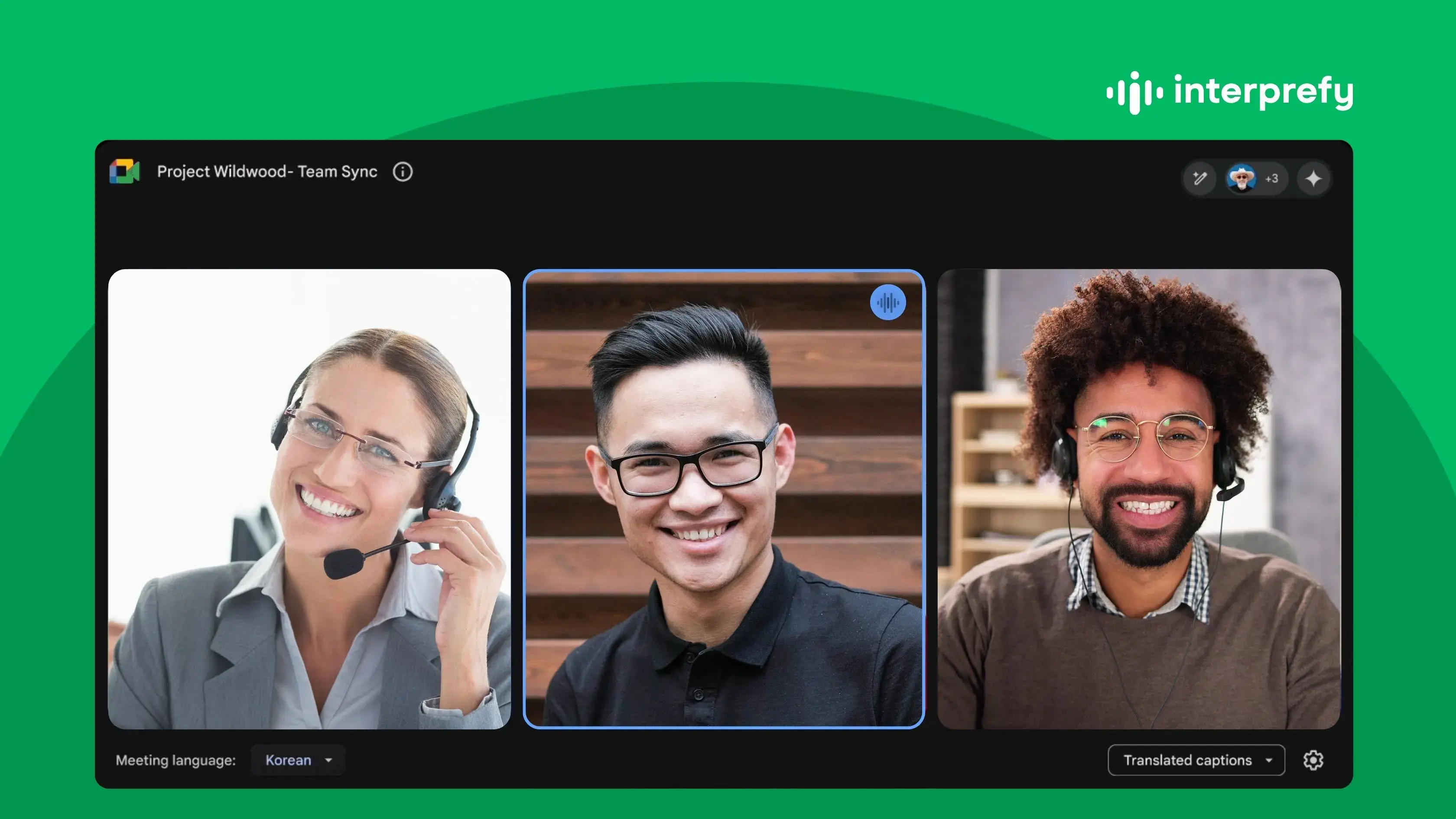

dTelecom’s architecture leverages Solana’s sub-second finality to deliver scalable real-time communication without the bottlenecks of centralized providers. Developers tap into SDKs and APIs for seamless integration, embedding features like AI-driven speech-to-text, voice enhancement, and real-time translation across 30 and languages. Applications such as dMeet, a browser-native video conferencing tool, and censorship-resistant livestreaming already showcase practical utility, enabling creators to monetize global audiences directly.

DePIN Mechanics: Nodes, Bandwidth, and $DTEL Rewards

The core of dtelecom Solana lies in its DePIN model, where individuals deploy nodes to contribute bandwidth and processing power, earning $DTEL tokens as incentives. This community-sourced infrastructure sidesteps the single points of failure in Web2 telecom giants, fostering resilience through geographic distribution. Yet, as a risk manager, I caution that node profitability hinges on sustained demand for dRTC services; low utilization could erode rewards faster than SOL’s current $80.36 price volatility.

Strategic partnerships, such as the April 2025 tie-up with MagicBlock, bolster this setup by injecting real-time engine optimizations for Solana apps. Enhanced speed and security position dTelecom for enterprise adoption in telehealth, remote work, and metaverse interactions, but competition from established Solana DePIN telecom players like Roam and Grass demands vigilant portfolio hedging.

AI Agents Elevating Real-Time Interactions

What sets dTelecom apart in 2026 is its aggressive push into AI agents for communication. Real-time content moderation, intelligent transcription, and adaptive translation agents transform passive calls into proactive experiences. Imagine AI agents handling multilingual negotiations or moderating decentralized streams autonomously; this isn’t hype, it’s a defensible moat in the solana depin projects 2026 race.

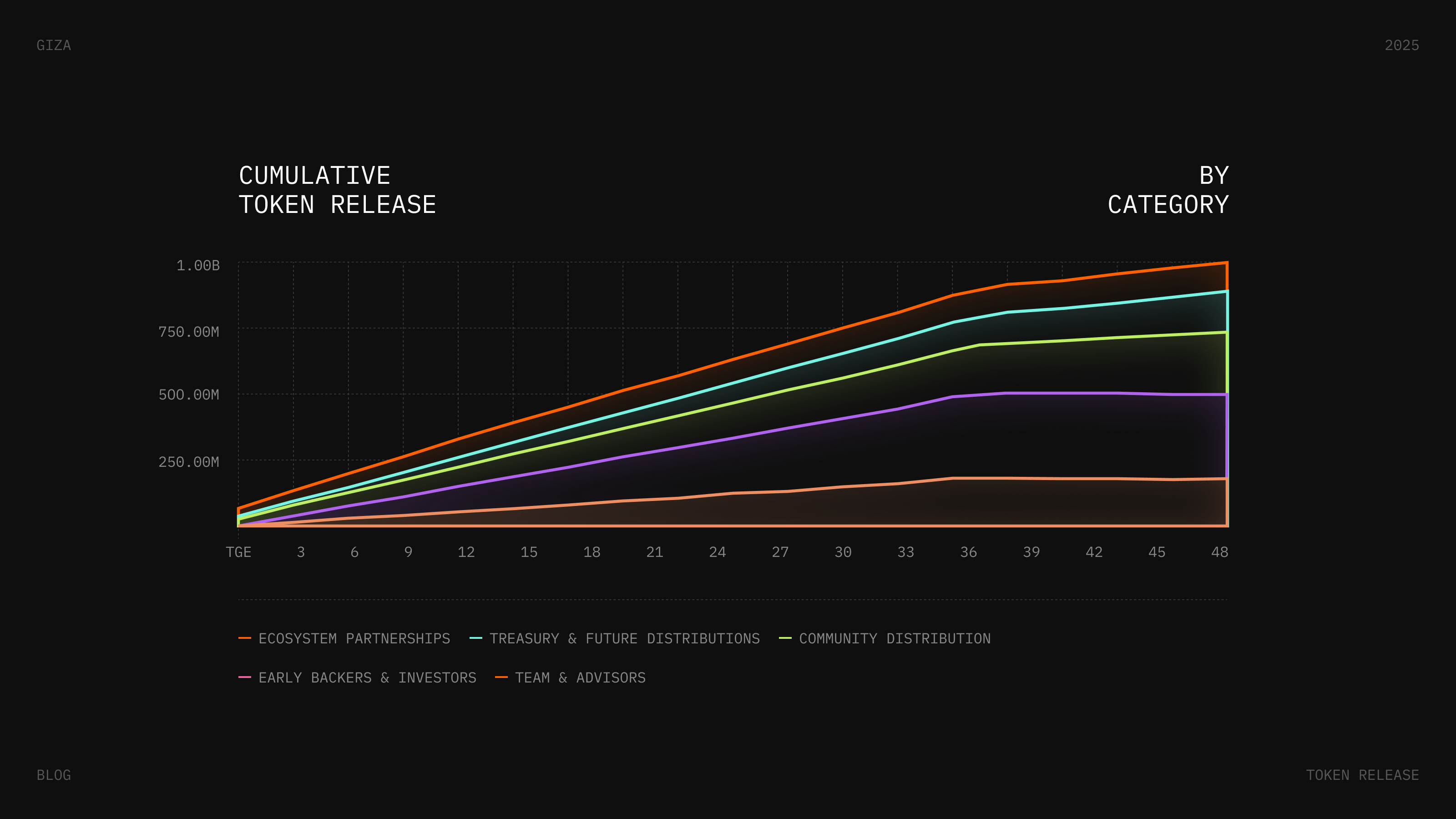

dtelecom (DTEL) Price Prediction 2027-2032

Post-TGE forecasts from 2026 baseline (Bear $0.03, Base $0.08, Bull $0.15), factoring DePIN adoption on Solana, airdrop dilution, AI integration, and market cycles with SOL at $80.36

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $0.04 | $0.12 | $0.30 | +50% |

| 2028 | $0.10 | $0.25 | $0.70 | +108% |

| 2029 | $0.06 | $0.18 | $0.45 | -28% |

| 2030 | $0.12 | $0.32 | $1.00 | +78% |

| 2031 | $0.20 | $0.50 | $1.50 | +56% |

| 2032 | $0.30 | $0.75 | $2.00 | +50% |

Price Prediction Summary

dtelecom (DTEL) shows strong long-term potential in Solana’s DePIN ecosystem with AI-driven real-time communication. Base case average price grows from $0.08 (2026) to $0.75 by 2032, reflecting adoption cycles, bull peaks around 2028, corrections, and recovery amid tech advancements.

Key Factors Affecting dtelecom Price

- Solana DePIN ecosystem growth and network effects

- Airdrop dilution from points program and 24-month unlocks ($2.5M pool)

- AI integrations (speech-to-text, translation) boosting use cases

- Partnerships like MagicBlock enhancing scalability

- SOL price correlation (current $80.36) and broader market cycles

- Regulatory risks for DePIN/telecom and competition from Grass, Roam, Helium

- Tokenomics, node rewards, and community-driven infrastructure expansion

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Privacy remains paramount, with end-to-end encryption ensuring data ownership amid rising regulatory scrutiny. For developers, the API layer simplifies embedding these agents, potentially accelerating dApp growth. However, AI compute demands introduce risks; off-chain dependencies could inflate costs if Solana’s ecosystem fees spike alongside SOL’s $80.36 stabilization.

dTelecom Airdrop and Points Program: Strategic Allocation Choices

Eligibility for the $2.5 million dtelecom airdrop hinges on the points program, a multi-phase campaign culminating at TGE in 2026. Participants accumulate points via node operation, app usage, and referrals, with conversion options posing classic risk-reward trade-offs: cash out all now and forfeit 50%, or vest 75% over 24 months for full value. In a market where SOL hovers at $80.36, immediate liquidity tempts, but long-term vesting aligns with network growth.

The points system’s transparency, akin to Grass or Datagram testnets, rewards early commitment, yet dilution from 400 million TGE allocations mirrors Roam tokenomics pitfalls. Astute allocators diversify, treating airdrops as options premiums rather than free lotteries, mindful of post-TGE dumps that could pressure $DTEL below breakeven node yields.

Navigating the dtelecom points program requires a risk-first mindset, balancing immediate gratification against compounded network effects. With SOL at $80.36 reflecting broader market caution, vesting 75% over 24 months hedges against short-term dumps while capturing upside from AI agent adoption and DePIN scaling.

Maximizing Rewards: Node Strategies and Points Accumulation

Running a dTelecom node demands upfront capital for hardware and bandwidth, but yields stack through multi-layered incentives. Early participants in the testnet mirror Datagram’s model, farming points via uptime, traffic relayed, and AI task completions. Profitability calculators project breakeven at moderate utilization, yet geographic arbitrage favors high-density urban deployments where decentralized voice video Solana demand surges.

Maximize dTelecom Points Strategies

-

Run dedicated nodes in high-demand regions: Leverage DePIN model on Solana to contribute bandwidth and earn points. Requires stable hardware/internet; target areas with high RTC demand per dtelecom.org. Risks: operational costs.

-

Integrate dMeet for passive earning: Deploy browser-based video conferencing with AI translation (30+ languages) to generate points. Passive via ecosystem participation; see docs.dmeet.org. Risks: usage volatility.

-

Leverage referrals for bonus multipliers: Use program referrals to amplify points before 2026 TGE airdrop ($2.5M pool). Track multipliers carefully; eligibility via points system. Risks: referral validity rules.

-

Monitor vesting cliffs strategically: Opt for 25% immediate conversion, rest over 24 months vs. 50% forfeit all-in. Align with $DTEL TGE; assess Solana market risks (SOL at $80.36).

This approach transforms passive holders into active stakeholders, but over-reliance on subsidized rewards risks stranded assets if $DTEL underperforms post-TGE. Pair node exposure with SOL puts at $80.36 strikes to cap downside, preserving capital for diversified Solana DePIN projects 2026.

Competitive Edges and Hedging in Solana DePIN Telecom

Against peers like Roam, which Solana endorsed for WiFi unification, dTelecom carves a niche in voice-video-AI fusion. Roam’s 1 billion token supply with 40% TGE allocation echoes dilution concerns, while Grass’s AI-DePIN pivot competes on compute but lags in real-time comms. dTelecom’s browser-native dMeet and 30-language translation outpace Helium Mobile’s coverage plays, yet execution lags could cede ground.

Solana Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:SOLUSDT | Interval: 1D | Drawings: 6

Technical Analysis Summary

To annotate this SOLUSDT chart in my balanced technical style, start by drawing a prominent downtrend line connecting the December 2026 peak at approximately 260 to the recent February 2026 lows around 80, using ‘trend_line’ for the primary bearish channel. Add horizontal lines at key support 78.26 (24h low) and resistance 82.79 (24h high), plus major levels like 100 and 120. Use fib_retracement from the peak to recent low for potential retracement zones. Mark entry zones with short_position at 82 resistance and long at 78 support. Highlight the recent consolidation range with rectangle from late Jan to Feb at 78-100. Add arrow_mark_down on MACD bearish cross and callout on declining volume. Vertical lines for potential DePIN airdrop news impacts around mid-Jan 2026. Text notes for risk: medium due to volatility.

Risk Assessment: medium

Analysis: Bearish structure with support nearby at 78.26; DePIN catalysts add volatility but technicals dominate short-term

Market Analyst’s Recommendation: Scale short above 82 with stops at 85, monitor for airdrop-driven reversal; stay balanced, no hero trades

Key Support & Resistance Levels

📈 Support Levels:

-

$78.26 – 24h low and chart recent bottom, strong psychological support

strong -

$100 – Prior swing low from Jan, moderate hold

moderate

📉 Resistance Levels:

-

$82.79 – 24h high, immediate overhead resistance

strong -

$120 – Mid-Jan consolidation high, key barrier

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$82 – Short entry on resistance rejection, bearish MACD confirmation

medium risk -

$78 – Long entry on support bounce, volume pickup needed

medium risk

🚪 Exit Zones:

-

$70 – Stop loss below key support for shorts

🛡️ stop loss -

$100 – Profit target at resistance for longs

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: declining

Volume fading on downside moves, suggesting weakening momentum but potential exhaustion

📈 MACD Analysis:

Signal: bearish crossover

MACD line below signal with histogram contracting negative, confirming downtrend

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Market Analyst is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Investors structure positions via covered calls on SOL exposure, layering dTelecom points as convex payoff generators. At current SOL levels, this setup targets 2-3x multiples by end-2026, assuming 20% DePIN market share capture.

Risk Mitigation: From Regulatory Headwinds to Tech Dependencies

Regulatory fog around DePIN telecom, including data privacy mandates, looms large. dTelecom’s encryption fortifies against breaches, but AI moderation invites scrutiny if biases emerge. Technical risks compound with Solana congestion episodes, potentially inflating latency beyond sub-second ideals. Mitigate via staged entry: allocate 10% to points farming, 20% to node pilots, and hedge 70% in liquid SOL at $80.36.

Forward thinkers position dTelecom as the connective tissue for Solana’s DePIN explosion, where real-time AI agents unlock trillion-dollar telecom TAM. With disciplined vesting and hedges, early movers compound advantages in this bandwidth arms race, eyes fixed on $DTEL’s post-TGE trajectory amid SOL’s steady $80.36 base.