In the high-stakes arena of Solana DePIN projects 2026, dtelecom Solana stands out with over 35 million minutes of communication processed and more than 50,000 users onboarded. This decentralized telecom powerhouse leverages Solana’s blistering speed to deliver real-time voice, video, and AI-driven services, all while SOL trades at $86.72, underscoring the ecosystem’s resilience amid and $6.97 daily gains. As user growth accelerates, dtelecom rewards early participants through a robust points system, positioning it as a frontrunner in decentralized communication Solana infrastructure.

Pioneering dRTC: AI-Enhanced Telecom on Solana’s Backbone

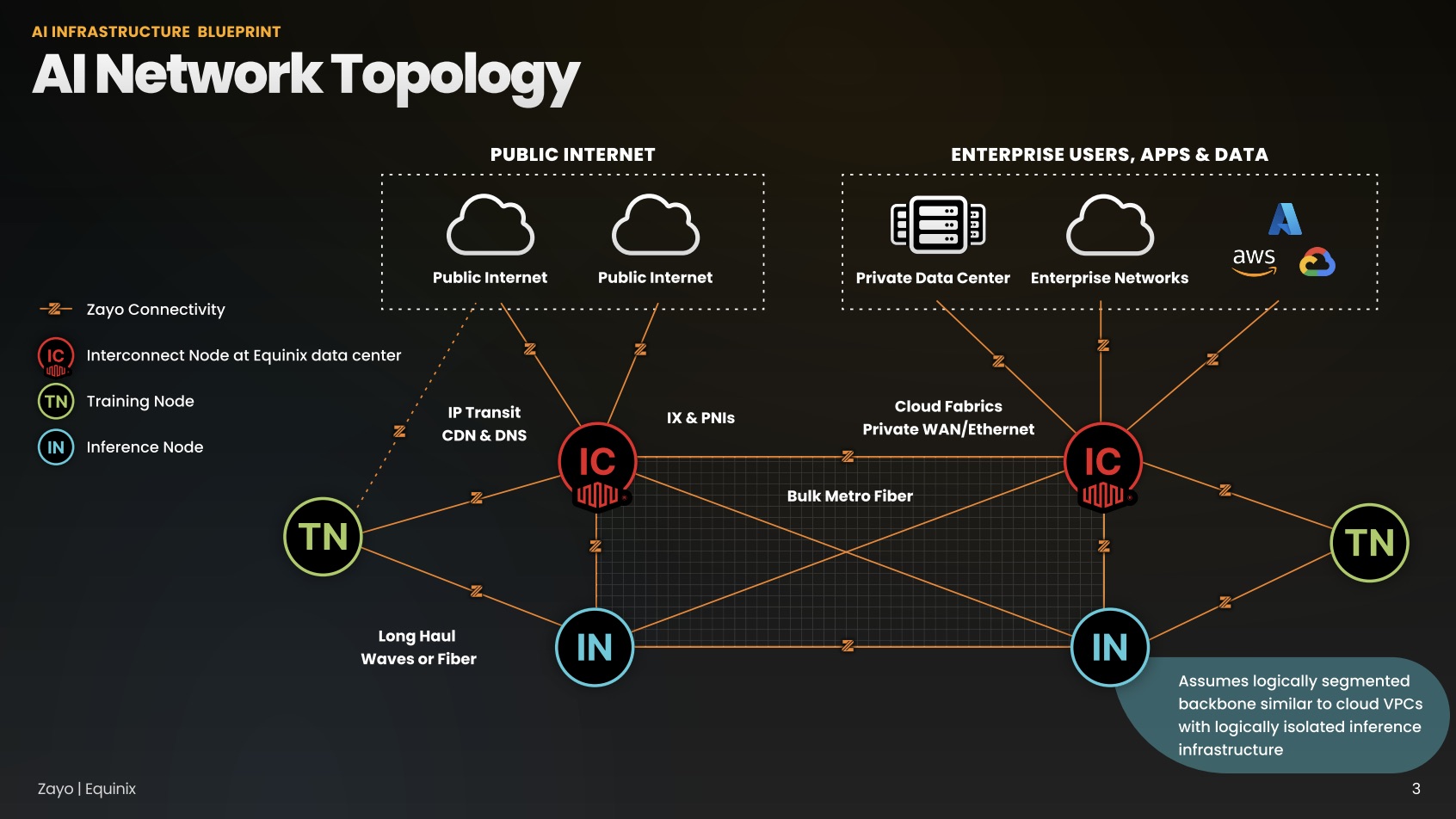

dTelecom redefines telecom by building a decentralized real-time communication (dRTC) network directly on Solana. Developers gain secure, scalable tools for voice, video, and chat integrations, bypassing centralized chokepoints that plague traditional providers. Backed by heavyweights like the Solana Foundation, Google, and peaq, this solana depin telecom initiative fuses blockchain efficiency with AI smarts. Real-time speech-to-text clocks in at a mere $0.005 per minute, enabling seamless AI agent transactions settled in USDC. Such precision pricing democratizes access, but investors must weigh Solana’s network congestion risks, even as SOL holds steady at $86.72.

The architecture shines in high-volume scenarios. Nodes contribute server bandwidth to earn $DTEL tokens, fostering a self-sustaining economy. Unlike legacy Web2 giants, dtelecom solana distributes control, slashing latency while enhancing privacy. Yet, strategic minds note the volatility inherent in nascent DePIN tokens; diversification remains key before DTEL token launch hype peaks.

35 Million Minutes Milestone: User Metrics Signal Explosive Traction

February 2026 marks a inflection point: dTelecom’s 35M and minutes and 50K users reflect viral adoption in decentralized communication Solana. This surge mirrors patterns in peers like Helium Mobile and Hivemapper, where engagement loops propel token value. Daily active users spike via intuitive apps, driving organic growth without heavy marketing spends. Picture this: everyday bandwidth sharing turns idle servers into revenue streams, rewarding node operators handsomely.

Strategic insight: While metrics dazzle, risk-aware portfolios hedge against adoption plateaus. SOL’s 24h high of $87.21 hints at bullish tailwinds, but dips to $79.75 remind us volatility lurks.

Leaderboard chasers climb through consistent usage, amplifying network effects. As dtelecom rewards deepen engagement, expect compounded returns for patient holders, provided Solana’s throughput scales flawlessly.

$2.6 Million Airdrop Ignites dTelecom Rewards and Node Incentives

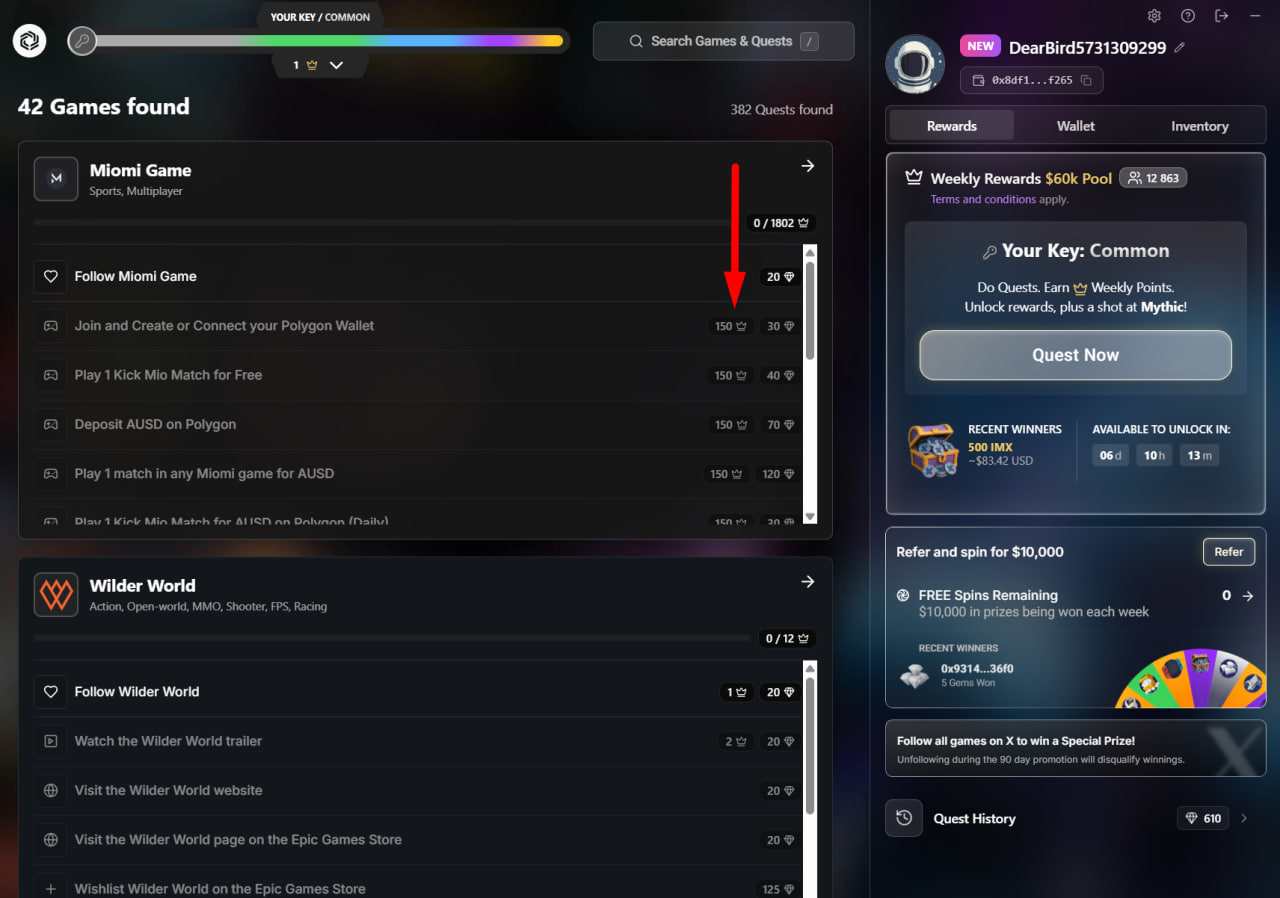

dTelecom’s confirmed $2.6 million DTEL airdrop supercharges participation. Users rack up points via app usage, referrals, and social tasks, redeemable for tokens and perks. This loyalty program, live now, echoes successful Solana DePIN playbooks, blending gamification with tangible utility. Node operators stake servers meeting specs, earning $DTEL for bandwidth provision; it’s a low-barrier entry to passive income in solana depin telecom.

$DTEL powers staking, governance, and premium unlocks, creating layered incentives. Early birds via airdrop gain outsized exposure, but prudent strategists cap allocations at 5-10% amid unproven tokenomics. With SOL at $86.72 buoying sentiment, this drop could catalyze further user influx, solidifying dtelecom solana’s edge.

dtelecom (DTEL) Price Prediction 2027-2032

Forecast incorporating user growth (50K+ users, 35M+ minutes), $2.6M airdrop impact, Solana DePIN trends, and market cycles

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $0.02 | $0.08 | $0.25 |

| 2028 | $0.05 | $0.30 | $1.20 |

| 2029 | $0.10 | $0.50 | $2.00 |

| 2030 | $0.25 | $0.90 | $3.50 |

| 2031 | $0.40 | $1.50 | $5.00 |

| 2032 | $0.70 | $2.20 | $6.50 |

Price Prediction Summary

dtelecom (DTEL) shows strong potential for growth as a leading Solana DePIN project in decentralized real-time communication. With 50K+ users and 35M+ minutes already processed in 2026, alongside partnerships (Solana Foundation, Google, peaq) and a $2.6M airdrop, bullish scenarios project up to $6.50 by 2032 amid adoption waves and Solana ecosystem expansion. Conservative estimates account for market corrections and competition, with average prices rising progressively from $0.08 in 2027.

Key Factors Affecting dtelecom Price

- Explosive user growth and network usage (35M+ minutes, 50K+ users) driving token demand

- Airdrop incentives boosting early adoption and liquidity

- Solana’s high-throughput blockchain enabling scalable DePIN expansion

- AI-powered features (speech-to-text at $0.005/min) and USDC integrations attracting developers

- Market cycles: Bullish peaks in 2028/2032 aligned with Bitcoin halving effects

- Regulatory progress for DePIN and telecom infrastructure

- Competition from Helium/Hivemapper and macro factors like SOL price recovery from $86 baseline

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Early airdrop hunters complete tasks like social shares and app trials, stacking points toward $DTEL allocations. This mechanism not only bootstraps liquidity but also filters committed users, a hallmark of sustainable Solana DePIN projects 2026. Yet, with SOL’s 24h low scraping $79.75, timing entries demands precision; options overlays on SOL could shield downside while capturing upside.

Node Economics: Bandwidth Sharing in dtelecom Solana DePIN

Core to dtelecom rewards lies node participation. Anyone with a qualifying server contributes bandwidth, earning $DTEL proportional to uptime and throughput. This democratizes infrastructure, mirroring Helium’s hotspot model but tuned for real-time comms on Solana’s rails. Minimum specs keep barriers low, inviting retail operators into solana depin telecom without enterprise overhead.

Risk calculus favors diversified node exposure. High uptime yields steady accruals, but electricity costs and hardware depreciation erode margins if $DTEL falters post-launch. At SOL’s current $86.72 perch, network fees stay nominal, aiding profitability. Strategists might pair node yields with short-dated SOL calls, hedging token launch volatility.

dTelecom Node Rewards Breakdown: Uptime Tiers, $DTEL Earnings per TB, Costs vs Benefits

| Uptime Tier | Est. $DTEL Earnings per TB Bandwidth (Monthly) | Est. Costs per TB (Monthly) | Costs vs Benefits |

|---|---|---|---|

| 🥉 Bronze (<90%) | 50 $DTEL | $25 | Moderate: Entry-level rewards, higher relative costs |

| 🥈 Silver (90-95%) | 120 $DTEL | $20 | Good: Balanced earnings growth vs efficiency gains |

| 🥇 Gold (95-99%) | 250 $DTEL | $12 | High: Strong rewards, optimized operations |

| 🏆 Platinum (99%+) | 400 $DTEL | $8 | Excellent: Max $DTEL potential, low costs, ideal for 50K+ user network |

AI integrations elevate the pitch. Speech-to-text at $0.005/min fuels agent economies, settling in USDC for stability. Developers embed dRTC APIs effortlessly, scaling apps without vendor lock-in. Backing from Solana Foundation and Google lends credibility, though execution risks persist in crowded DePIN fields.

Comparative Edge: dTelecom vs Peers in Decentralized Communication Solana

Against Helium Mobile’s coverage focus or Hivemapper’s mapping, dtelecom solana carves voice/video niches. 50K users dwarf early rivals, with 35M minutes proving demand. Tokenomics align incentives: $DTEL staking secures governance votes, node ops get burn mechanisms for scarcity. User growth loops, much like those inflating peer tokens, promise DTEL appreciation if adoption holds.

Strategic overlay: Allocate via structured products. FRM principles dictate 2-5% portfolio tilts toward high-conviction DePIN like this, collateralized by SOL at $86.72. Volatility skews premiums rich; selling puts funds entries below $79.75 lows.

Steps to Maximize dTelecom Rewards

-

1. Use dTelecom Apps DailyEarn points through voice, video, and AI services on the dRTC network; over 35M minutes processed by 50K+ users.

-

2. Complete Airdrop TasksParticipate in the $2.6M DTEL airdrop via simple social and loyalty program tasks for points redeemable for tokens.

-

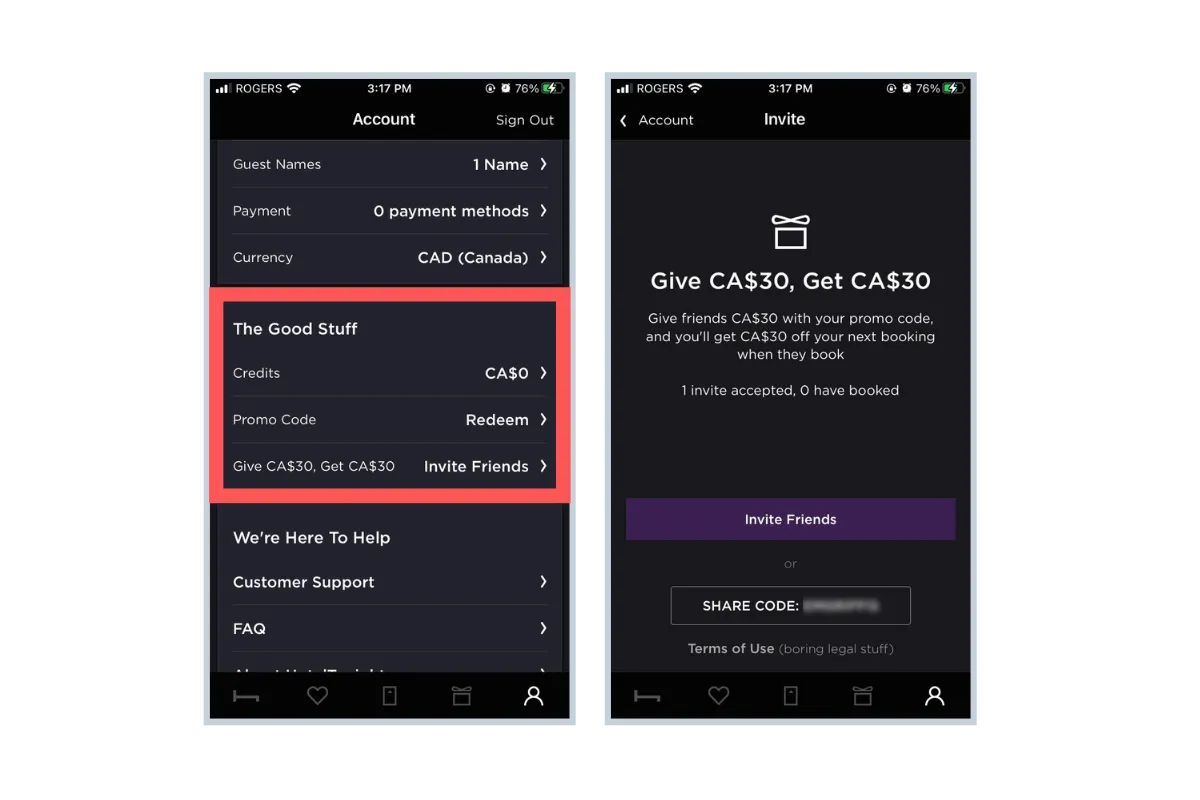

3. Refer FriendsInvite others to join and earn bonus points; drives network growth like other Solana DePIN projects.

-

4. Set Up a NodeRun a server meeting specs to provide bandwidth and earn $DTEL; backed by Solana Foundation.

-

5. Stake DTEL Post-LaunchAfter DTEL launch, stake for governance, incentives; note crypto volatility risks (SOL at $86.72).

peaq collaboration unlocks DePIN synergies, porting tools across chains while Solana anchors speed. This hybridity mitigates single-chain risks, a nod to multichain prudence. As 2026 unfolds, dtelecom rewards could anchor portfolios seeking asymmetric bets in solana depin projects 2026.

Opinion: dTelecom’s metrics scream momentum, but unlaunched DTEL demands caution. Hedge aggressively; returns follow risk containment.

Risk-Managed Playbook: Entering dTelecom Ahead of DTEL Token Launch

Positioning starts with points farming: daily tasks yield multipliers, referrals compound virality. Node runners audit costs against projected $DTEL flows, targeting 20% and ROI post-fees. For pure plays, await exchange listings, layering in SOL-correlated options to navigate pre-launch fog.

Solana’s ecosystem tailwinds, with SOL up $6.97 daily to $86.72, amplify leverage. Yet, congestion spikes or macro headwinds could stall. Diversify across DePIN baskets; dtelecom solana slots as high-beta conviction amid decentralized communication Solana evolution.

Patient capital thrives here. 35M minutes cement traction; 50K users signal escape velocity. As bandwidth economies mature, dtelecom rewards position early movers for outsized gains, balanced by disciplined risk frameworks. Solana DePIN telecom ascends, and dTelecom leads the charge.

dTelecom (DTEL) vs Helium Mobile (HNT) vs Hivemapper (HONEY): DePIN Comparison 📊

| 📊 Metric | 🌐 dTelecom (DTEL) | 📡 Helium Mobile (HNT) | 🗺️ Hivemapper (HONEY) |

|---|---|---|---|

| 👥 Active Users | 50,000+ | 200,000+ | 50,000+ |

| ⏱️ Key Usage Metric | 35M+ Minutes of Communication | 1M+ Hotspots Deployed | 100M+ KM Mapped |

| 🔗 Solana Ecosystem Integration | Native on Solana Backed by Solana Foundation 🟢 |

Migrated to Solana 🟡 | Native on Solana 🟢 |

| 💰 User Incentives | $2.6M DTEL Airdrop Live 🎁 Points for Tasks & Referrals |

HNT Staking & Rewards | HONEY Drive-to-Earn Rewards |

| 🚀 Growth Highlights | AI-Powered dRTC 35M+ Mins, Rapid Adoption |

Subscription Model User-Driven Token Growth |

Popular Mapping Network DePIN Leader |