In the evolving landscape of Solana DePIN projects, Sallar emerges as a compelling opportunity for everyday users to tap into AI compute rewards by running mobile miners on their smartphones. With Solana’s Binance-Peg SOL trading at $86.22, down -0.0203% over the last 24 hours from a high of $91.08 and low of $85.01, the ecosystem remains resilient amid broader market fluctuations. Sallar leverages this high-speed blockchain to decentralize computing power, allowing Android and iOS devices to contribute idle processing capacity to demanding tasks like AI model training and cryptographic computations.

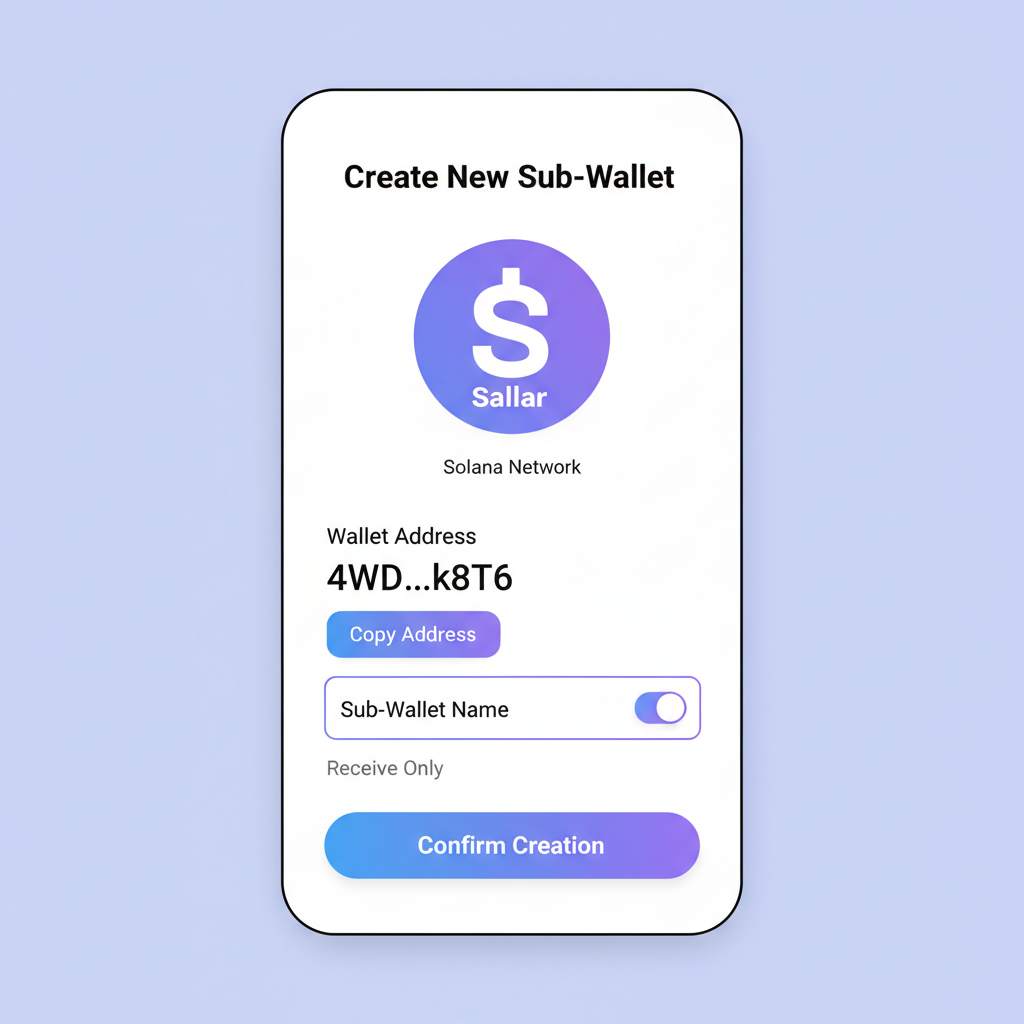

Sallar’s model flips the script on traditional cloud computing monopolies. Participants download the app, receive a Solana sub-wallet for seamless deposits and withdrawals, and start earning $ALL tokens proportional to their device’s contributions. Holding $ALL in the app unlocks staking bonuses, amplifying returns in a system designed for sustained participation. This Solana mobile miner approach democratizes access to DePIN AI compute on Solana, sidestepping the high barriers of GPU rigs or validator setups.

Smartphones as Computational Nodes in Sallar’s Network

What sets Sallar apart in the Sallar Solana DePIN space is its focus on ubiquitous hardware. Unlike projects demanding specialized equipment, Sallar transforms billions of smartphones into a distributed supercomputer. Users contribute to real-world applications – from big data analytics to scientific simulations – verified through Solana’s efficient proof-of-contribution mechanisms. The network’s capped supply of 12 billion $ALL tokens, with 78% earmarked for contributors, creates scarcity-driven value accrual. Audited by Hacken for security, Sallar ensures trust in an ecosystem that generated $17 million in revenue across Solana DePIN protocols by December 2025.

This setup aligns incentives perfectly: more compute power supplied meets surging demand for decentralized AI infrastructure. As Solana’s low fees and high throughput enable micro-transactions for rewards, even casual users can accumulate meaningful $ALL holdings without prohibitive costs.

Staking Mechanics and Earnings Optimization

Earning Sallar $ALL tokens isn’t just passive; strategic holding elevates profitability. The sub-wallet staking feature compounds rewards, rewarding long-term commitment in this DePIN AI compute Solana play. For instance, baseline earnings from run Sallar miner phone scale with uptime and device specs, but staked $ALL multipliers can boost yields significantly. Solana’s DePIN quickstart primitives – minting tokens, staking, and logging – underpin these operations, ensuring transparent rewards distribution.

Consider the economics: with SOL at a steady $86.22, Sallar’s integration of mobile compute positions it for explosive growth in 2026. Early adopters benefit from network effects as more nodes join, stabilizing compute supply for enterprise clients.

Strategic Partnerships Amplifying Sallar’s Reach

Sallar’s collaboration with Nosana marks a pivotal Nosana Sallar partnership, blending mobile CPU power with GPU-heavy workloads. Nosana operators earn $NOS by sharing idle GPUs, and now Sallar nodes feed into this hybrid model, exploring deeper integrations for comprehensive decentralized compute. This synergy addresses GPU bottlenecks in AI, where mobile fleets handle preprocessing and lighter inference tasks.

Details on launching your own node are covered in our step-by-step guide, making entry straightforward. As Solana DePIN surges – check the broader trends here – Sallar’s mobile-first strategy could capture substantial market share.

Sallar (ALL) Price Prediction 2027-2032

Forecasts based on DePIN growth, mobile adoption, Solana ecosystem expansion, and AI compute demand

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | Est. YoY Growth (Avg) |

|---|---|---|---|---|

| 2027 | $0.025 | $0.065 | $0.140 | +44% (from 2026 est. $0.045) |

| 2028 | $0.040 | $0.110 | $0.250 | +69% |

| 2029 | $0.070 | $0.200 | $0.450 | +82% |

| 2030 | $0.120 | $0.350 | $0.800 | +75% |

| 2031 | $0.180 | $0.550 | $1.300 | +57% |

| 2032 | $0.300 | $0.850 | $2.200 | +55% |

Price Prediction Summary

Sallar (ALL) shows strong growth potential from 2027-2032, driven by DePIN trends and Solana’s ecosystem. Conservative minimums reflect bearish market cycles or competition, while maximums assume bullish adoption of mobile AI compute mining. Average prices could rise from $0.065 to $0.850, implying a market cap expansion to ~$10B at full circulation, realistic for leading DePIN tokens amid regulatory clarity and tech advancements.

Key Factors Affecting Sallar Price

- DePIN sector expansion on Solana ($17M revenue in 2025)

- Widespread mobile mining adoption via Sallar app

- Integrations like Nosana for decentralized GPU/AI compute

- Favorable tokenomics: 12B cap, 78% rewards allocation, staking bonuses

- Rising demand for edge computing in AI, data, and research

- Solana’s scalability and low-cost advantages

- Market cycles, regulatory developments, and competition from other DePINs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Looking ahead, Sallar’s trajectory hinges on scaling mobile adoption amid Solana’s DePIN momentum. With Binance-Peg SOL holding at $86.22 despite a 24-hour dip of -0.0203%, the blockchain’s stability supports micro-reward payouts essential for mobile nodes. Projections suggest $ALL could appreciate as contributor rewards tighten supply, especially with 78% of the 12 billion token cap funneled to active participants.

Navigating Risks in Mobile DePIN Mining

While the allure of run Sallar miner phone is strong, participants must weigh practical challenges. Battery drain and heat generation on smartphones demand mindful usage – run nodes during charging or idle periods to mitigate wear. Network uptime directly correlates to earnings, so unreliable connectivity curbs yields. Sallar counters these with optimized algorithms that throttle compute during low battery states, preserving device health.

Regulatory scrutiny on DePIN compute looms as AI demand intensifies, but Solana’s compliant infrastructure and Hacken audits position Sallar favorably. Token volatility mirrors broader crypto markets; $ALL’s value ties to network utility, not speculation alone. Diversify holdings and stake judiciously to manage downside, echoing disciplined execution in volatile sectors.

Competition from GPU-centric peers like Nosana adds pressure, yet the Nosana Sallar partnership fosters complementarity. Mobile nodes excel in distributed, low-latency tasks, freeing premium hardware for heavy lifting. This division of labor enhances overall ecosystem efficiency.

Earnings Potential and Real-World Benchmarks

Quantifying returns requires context. Entry-level Android devices might net 50-100 $ALL daily under optimal conditions, scaling with flagship specs and staking multipliers. At current dynamics, this translates to supplemental income for power users, with enterprise demand projected to lift rates in 2026. Solana’s sub-second finality ensures timely payouts, unlike slower chains bogged down by congestion.

Historical Solana DePIN revenue – $17 million by late 2025 – underscores commercial viability. Sallar’s slice grows as AI firms seek cost-effective alternatives to AWS or Google Cloud, where centralized providers charge premiums for idle capacity that mobile DePIN repurposes for free.

Tokenomics favor holders: staking bonuses compound via sub-wallet integration, creating flywheels of retention. Withdrawals remain fluid, bridging to Solana DEXs for liquidity. This frictionless design lowers barriers, inviting retail influx.

Daily $ALL Earnings Estimates by Device Tier (USD Equivalent)

| Device Tier | Estimated Daily Earnings |

|---|---|

| Budget Android 📱 | $0.50 |

| Mid-range 📱📱 | $1.20 |

| Flagship 📱📱📱 | $2.50 (enhanced with staking) |

Future Outlook for Sallar in 2026

By mid-2026, anticipate Sallar nodes surpassing 1 million as smartphone penetration hits 7 billion globally. Integrations like token-gating via Helius APIs could premiumize access, rewarding high-performers with exclusive compute jobs. Solana Mobile’s Saga ecosystem amplifies this, blending hardware incentives with software rewards.

The Solana mobile miner paradigm redefines participation, shifting DePIN from niche validators to mass-market engagement. With SOL anchored at $86.22, fiscal prudence guides allocation – view Sallar as a high-conviction bet on decentralized AI infrastructure.

Sallar exemplifies Solana’s edge in scalable DePIN, turning idle phones into revenue streams. As compute hunger escalates, early movers secure prime positioning in this unfolding cycle.