In the volatile world of Solana DePIN projects, Sallar stands out with its $ALL token trading at $0.000350, down 12.97% over the last 24 hours from a high of $0.000369. This dip, while sharp, reflects broader market pressures rather than fundamental flaws in a network that’s bootstrapped its way to 10,000 phone miners without a dime from venture capitalists. As an options strategist, I see Sallar’s community-driven model as a high-risk, high-reward play in decentralized computing on Solana, where idle smartphone power fuels AI and big data workloads.

Sallar reimagines cloud computing by tapping into billions of underutilized smartphones. Users download the Sallar. io app, connect their devices, and share processing power for $ALL rewards distributed via audited smart contracts. This setup sidesteps the energy-hungry data centers dominating traditional infrastructure, offering an eco-friendly alternative that’s already powering cryptography and scientific research. At current levels around $0.000350, early participants face volatility risks, but the network’s organic expansion signals resilience.

Harnessing Solana Phone Miners for Decentralized Computing

Sollar’s core innovation lies in its Solana phone miners DePIN approach. Founded in 2023, the project turns everyday devices into nodes contributing computational resources. Unlike GPU-heavy rivals, Sallar democratizes access; anyone with a smartphone can mine $ALL tokens based on contributed power, governed by Proof of Benchmark mechanisms. This levels the playing field, mitigating centralization risks that plague VC-funded DePINs.

Strategic investors should note the token’s deflationary pressures from network burns, echoing io. net’s model but tailored for mobile efficiency. With $ALL at $0.000350, downside protection comes from hedging via Solana options, while upside leverages growing demand for decentralized AI compute.

10K Phone Miners: Proof of Community Traction

By February 2026, Sallar boasts 10,000 active phone miners, a milestone achieved purely through grassroots momentum. No VC backing means no diluted tokenomics or misaligned incentives; instead, rewards flow directly to contributors. This purity reduces rug-pull risks, a common pitfall in crypto, but introduces execution dependencies on volunteer nodes.

The Sallar roadmap outlines robust tokenomics, user-friendly apps, and NFT-based computing power allocations, positioning it as a leader in Solana DePIN. Recent launches like Sallar and expand $ALL utility into Web3 growth vectors, enhancing holder value amid a 24-hour low of $0.000305. Risk-aware positioning here involves scaling in on dips, with stops below recent lows to manage drawdowns.

- Key Growth Drivers: App-driven onboarding, benchmarked rewards, audited contracts.

- Risk Mitigants: No VC overhang, community governance, Solana’s high throughput.

- Market Context: $ALL at $0.000350 trails peers but offers asymmetric upside.

$ALL Tokenomics: Sustainable Incentives Without Inflation Overhang

Sallar’s tokenomics prioritize sustainability, rewarding miners proportionally to compute shared. Total supply details in FAQs emphasize scarcity, with burns regulating circulation much like io. net’s 20-year plan. At $0.000350, $ALL’s fully diluted value suggests room for multiples if adoption scales to millions of devices.

Investors must weigh liquidity risks; trading volume remains modest per CoinGecko data. Yet, the absence of VC dumps fosters stability. For hedged exposure, pair $ALL calls with Solana puts, aligning with my ‘risk first’ mantra. Sallar’s decentralized computing on Solana Sallar ecosystem promises longevity, but only if node uptime holds amid mobile constraints.

Sallar ($ALL) Price Prediction 2027-2032

Community-Driven DePIN on Solana: Projections Based on Network Growth, Adoption Trends, and Market Cycles

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $0.000300 | $0.000700 | $0.001200 |

| 2028 | $0.000500 | $0.001500 | $0.003500 |

| 2029 | $0.001000 | $0.003000 | $0.006000 |

| 2030 | $0.001500 | $0.005000 | $0.010000 |

| 2031 | $0.002500 | $0.008000 | $0.015000 |

| 2032 | $0.004000 | $0.012000 | $0.025000 |

Price Prediction Summary

Sallar ($ALL), currently at $0.000350, is positioned for significant upside as a pioneering community-driven DePIN on Solana with 10K phone miners. Projections account for DePIN sector growth, AI computing demand, and crypto market cycles, with average prices potentially rising over 34x to $0.012 by 2032 in the base scenario amid bullish adoption, tempered by bearish mins during corrections.

Key Factors Affecting Sallar Price

- Rapid network expansion beyond 10K miners via smartphone app adoption

- Rising demand for decentralized computing in AI, big data, and cryptography

- Solana’s scalability and low-cost ecosystem advantages

- Sustainable tokenomics rewarding contributors without VC dilution

- Proof of Benchmark and NFT integrations enhancing utility

- Regulatory clarity boosting DePIN legitimacy

- Competition from io.net and other DePIN projects

- Broader crypto bull/bear cycles and market cap growth potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Getting started requires minimal friction: launch a node via the app. For detailed setup, check our step-by-step guide. This hands-on involvement underscores Sallar’s appeal in the Sallar $ALL token narrative.

Sallar Roadmap: From Tokenomics to AI-Enhanced DePIN

Sallar’s trajectory hinges on executing its roadmap, which prioritizes tokenomics refinement alongside app enhancements and innovative features like Proof of Benchmark. This mechanism verifies device capabilities before rewarding $ALL at $0.000350, ensuring fair distribution without wasteful computation. Sallar and initiatives further integrate AI workloads, boosting $ALL utility in Web3 ecosystems and countering the recent 12.97% dip to $0.000305 lows.

These steps position decentralized computing Solana Sallar as a contender against centralized giants, but mobile hardware limits uptime. Strategic allocation: 20% portfolio in $ALL spot, hedged with out-of-the-money puts at $0.000300 to cap losses amid volatility.

Community Signals: Farcaster and Twitter Buzz

Organic hype on Farcaster underscores Sallar Solana DePIN’s traction, with developers praising its lightweight mining protocol. No VC narratives eliminate dump risks, yet bootstrap funding demands vigilant monitoring of node retention rates.

For Solana phone miners DePIN enthusiasts, the Sallar. io app review reveals seamless onboarding: install, benchmark, mine. Rewards accrue in real-time via Solana’s speed, but battery drain poses user friction. My risk-adjusted view favors gradual accumulation below $0.000350, targeting resistance at $0.000369 highs.

Strategic Positioning in $ALL: Hedged Plays for DePIN Volatility

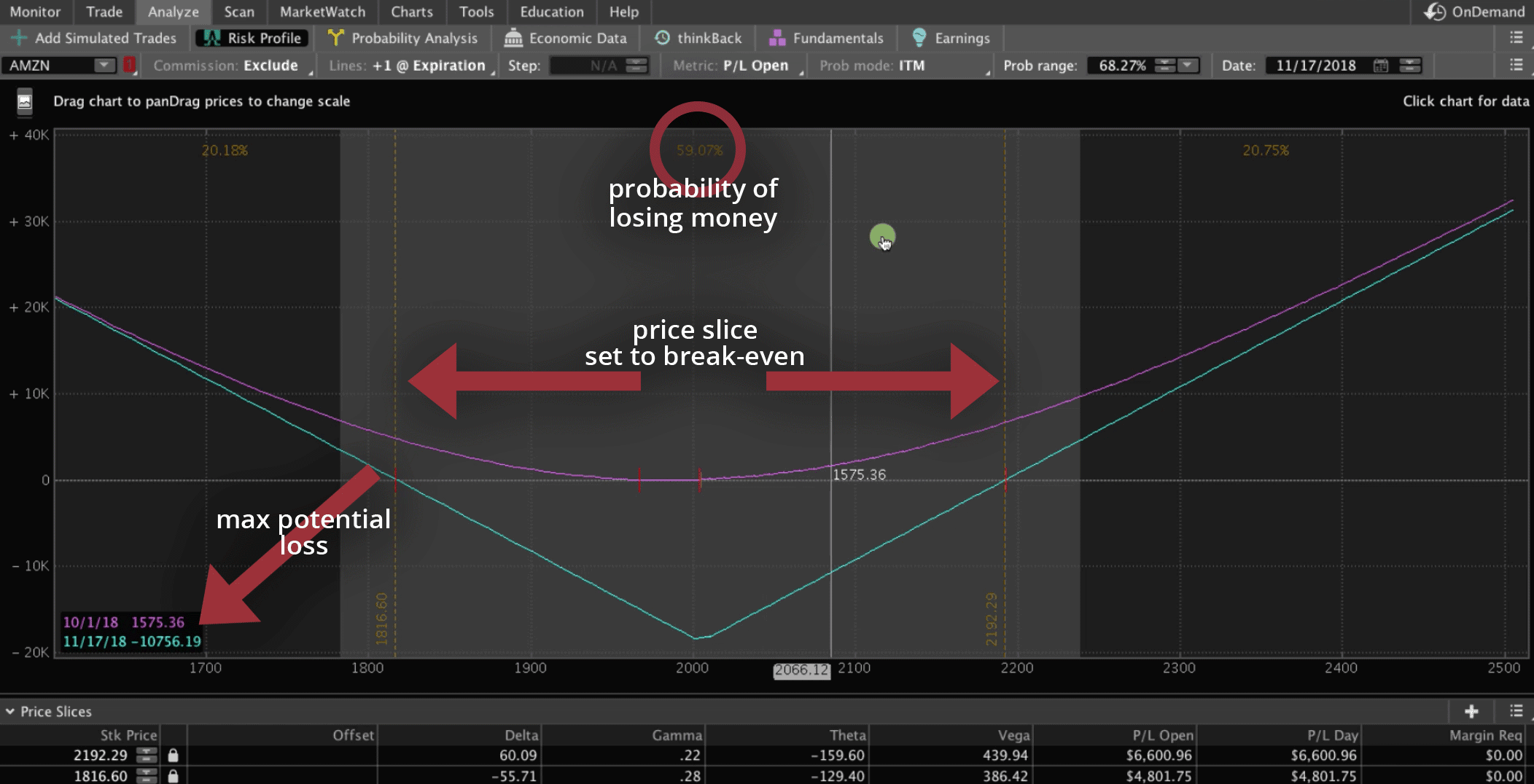

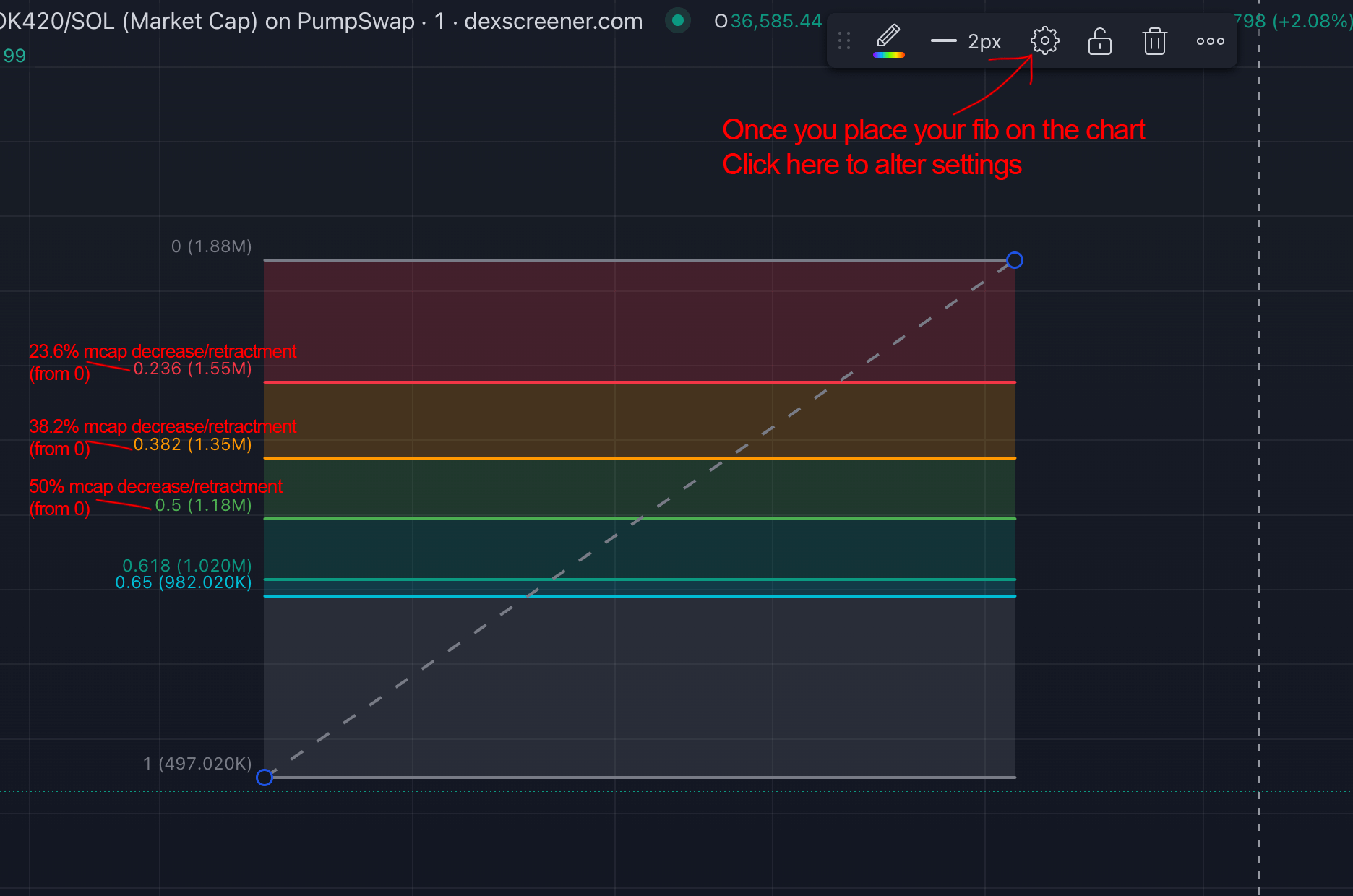

As $ALL hovers at $0.000350, options overlays shine. Construct a strangle: buy $0.000300 puts for downside insurance, sell $0.000400 calls to fund premiums, netting theta decay in range-bound action. This setup yields 15-20% annualized if network stabilizes at 10K miners, scaling to 50K via viral app shares.

$ALL Hedging Strategies

-

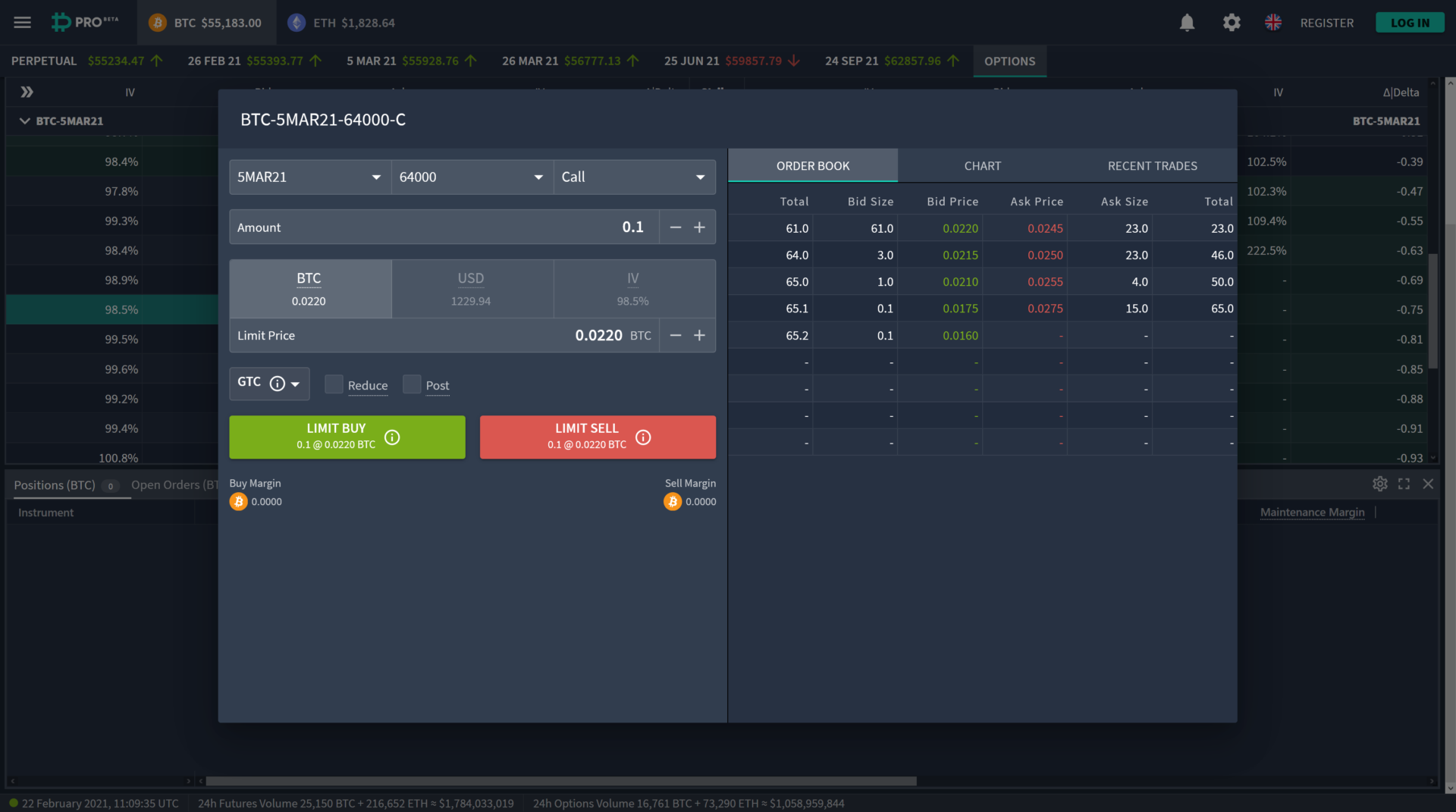

Strangle Setup: Buy OTM call + put on correlated assets like SOL (Deribit) to capture $ALL volatility. Risk: Time decay erodes premiums; limited $ALL options availability.

-

Spot Accumulation on Dips: DCA $ALL below $0.000305 (24h low) at current $0.000350 (-12.97%). Use Raydium. Risk: Further downside if support breaks.

-

Pair with SOL Puts: Long $ALL spot, hedge Solana risk with SOL puts on Deribit. Protects against chain-wide drops. Risk: Basis risk if $ALL-SOL decouples.

-

Node Uptime Checklist:• Run Sallar app continuously (sallar.io).• Stable Wi-Fi/mobile data.• Battery >20%, avoid overheating.• Update app, monitor $ALL rewards. Risk: Downtime forfeits mining yields.

Compare to io. net: both burn tokens for scarcity, but Sallar’s mobile focus slashes entry barriers, trading at a discount despite parallel tokenomics. Fully diluted valuation implies 5-10x potential if AI demand surges, balanced by execution hurdles like iOS/Android fragmentation.

FAQ insights from sallar. io clarify supply caps and network ops, reinforcing transparency. Contributors hold $ALL long-term or trade on DEXs, with burns amplifying scarcity post-mining. At current $0.000350 levels, this creates a convexity profile ideal for convexity-seeking portfolios.

DePIN purists will appreciate Sallar’s ethos: power the future without gatekeepers. Download the app, join 10K miners, and stake your claim in Solana’s compute revolution. Volatility persists, but risk-managed entries transform dips into deployment zones.