In the vast $3.5 trillion telecom landscape, where giants like Zoom and Twilio dominate with centralized servers, dTelecom emerges as a Solana DePIN contender reshaping real-time voice, video, and AI interactions. This decentralized Real-Time Communication (dRTC) network lets developers embed low-latency voice/video/chat into apps while users retain data ownership and earn from shared bandwidth. Built on Solana’s high-throughput blockchain, dTelecom targets enterprise-grade scalability without single points of failure, a move backed by grants from the Solana Foundation, Google, and Peaq.

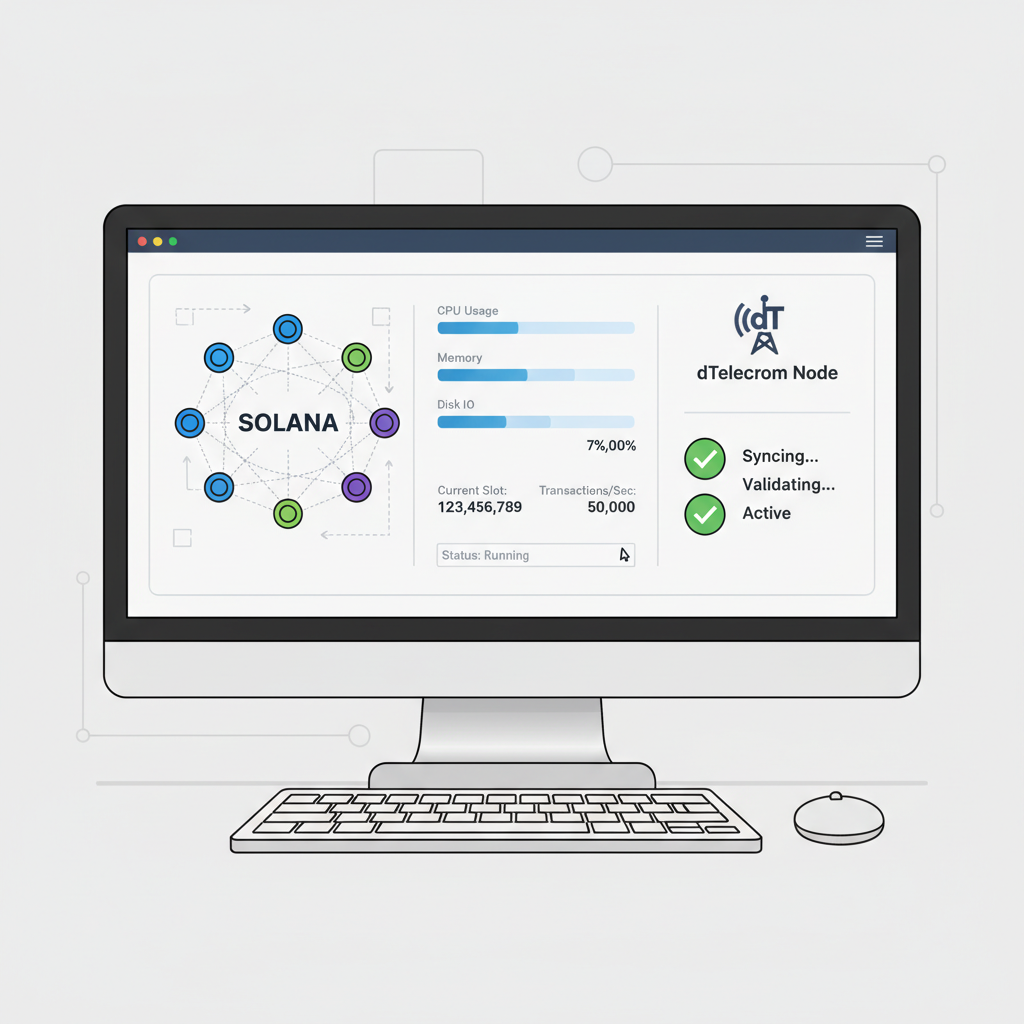

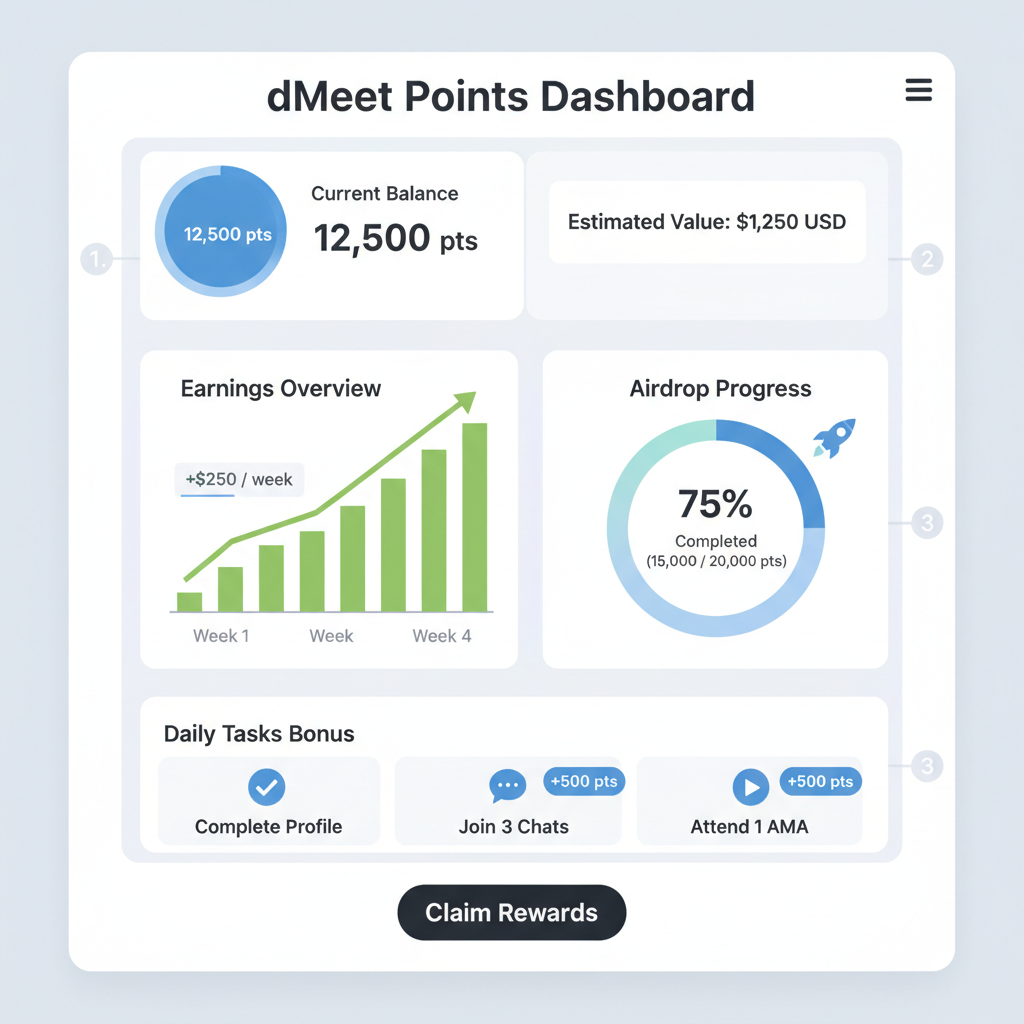

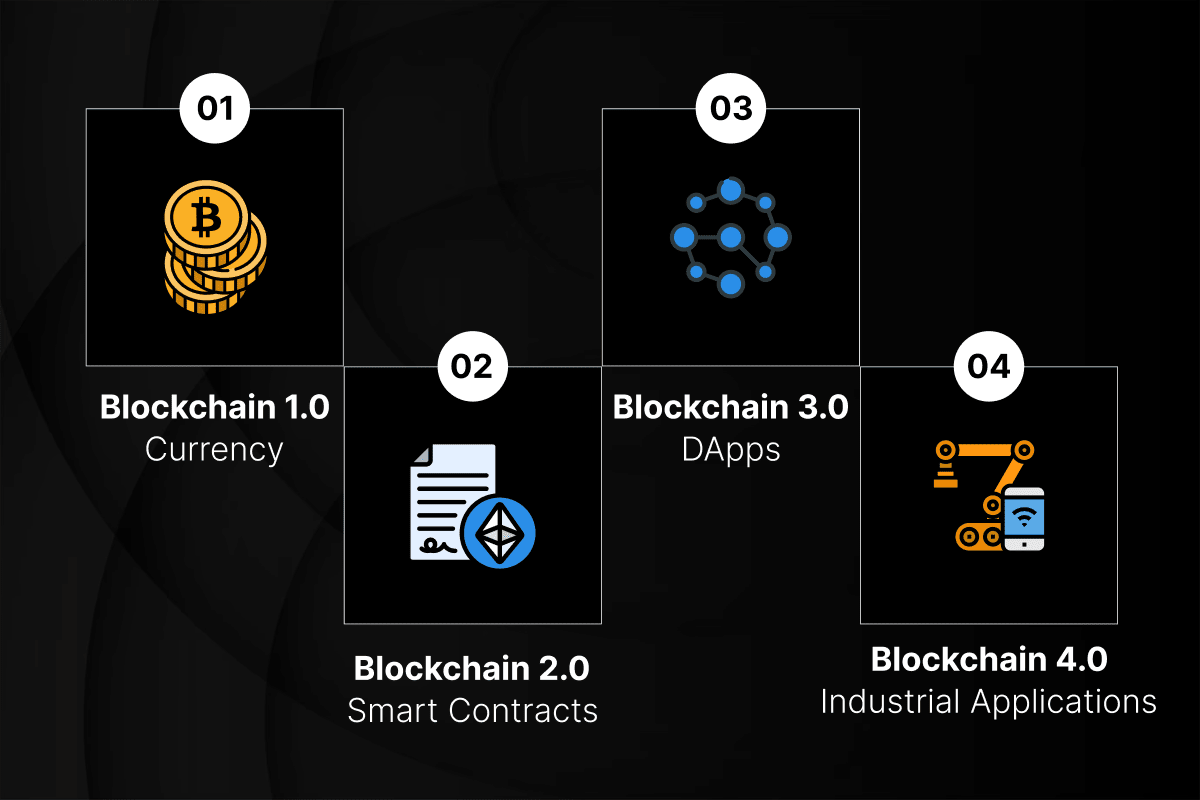

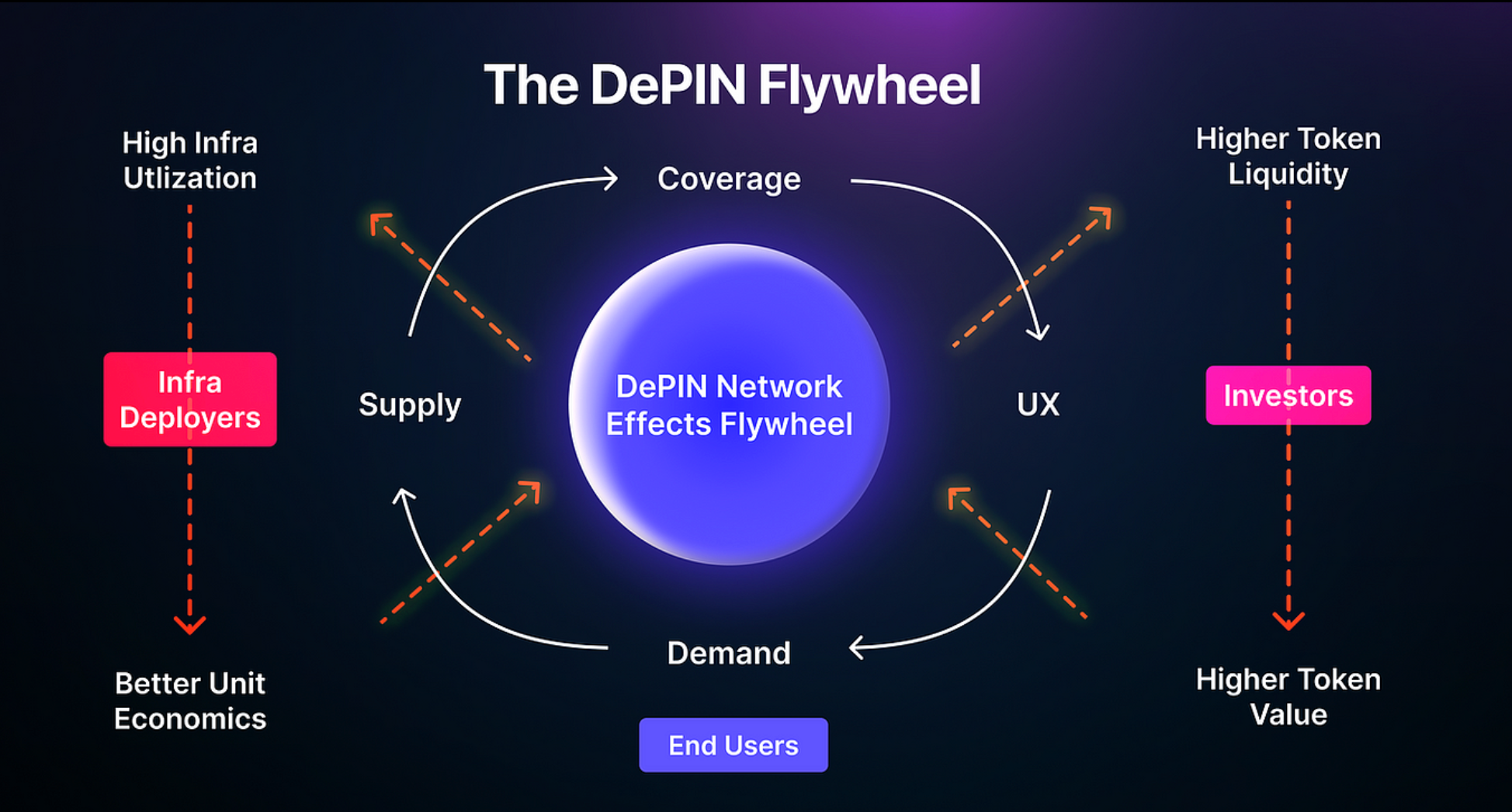

At its core, dTelecom flips the script on traditional telecom stacks. Instead of renting cloud resources, node operators contribute compute and bandwidth to a permissionless network. This DePIN model aligns incentives: providers get rewarded in upcoming $DTEL tokens, while end-users benefit from censorship-resistant comms. With Solana’s speed handling millions of transactions per second, dTelecom achieves sub-100ms latencies crucial for video calls and AI agents. Current momentum includes a $2.6 million Phase 2 Airdrop, converting usage points from dMeet app, livestreams, and AI voice agents into tokens ahead of the 2026 TGE.

dTelecom’s DePIN Stack: From Infra to Coordination

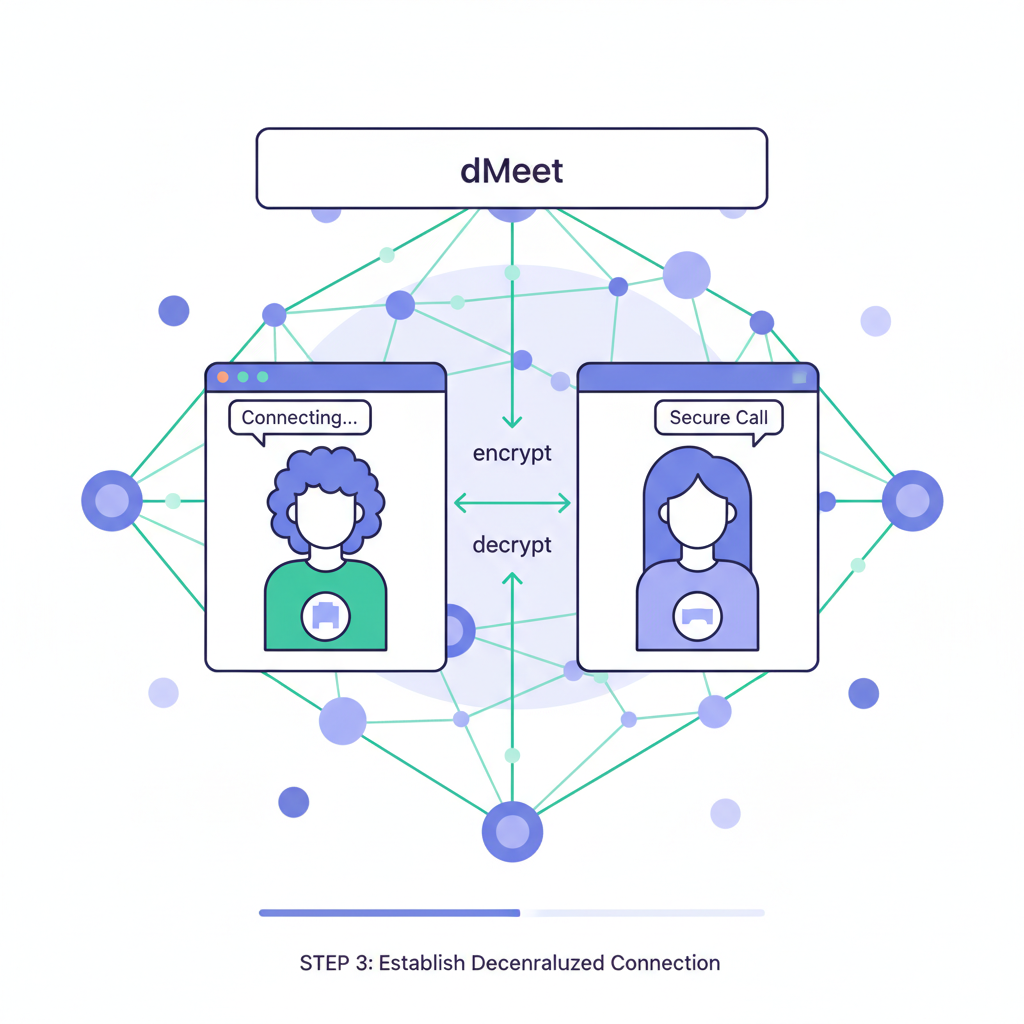

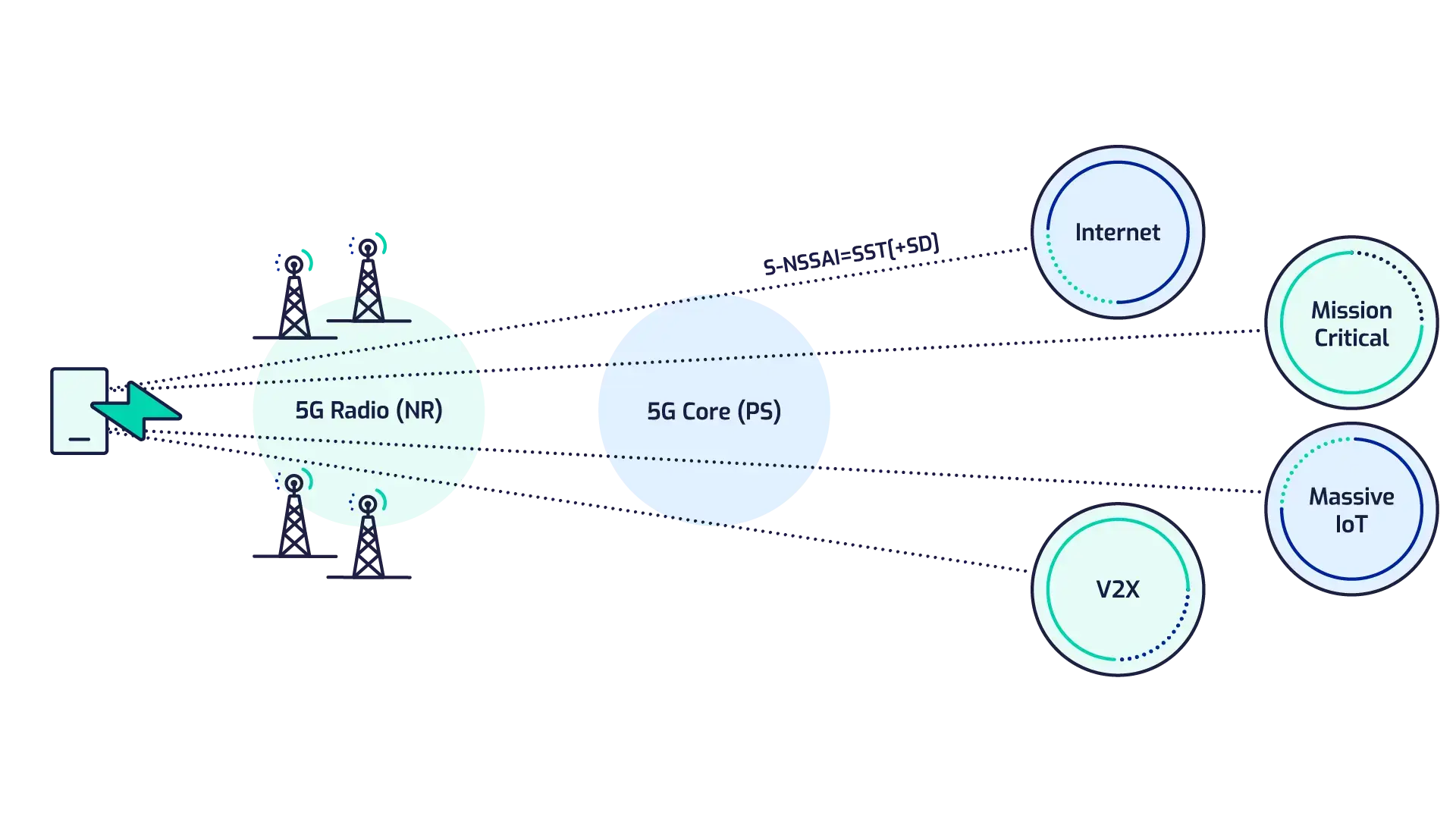

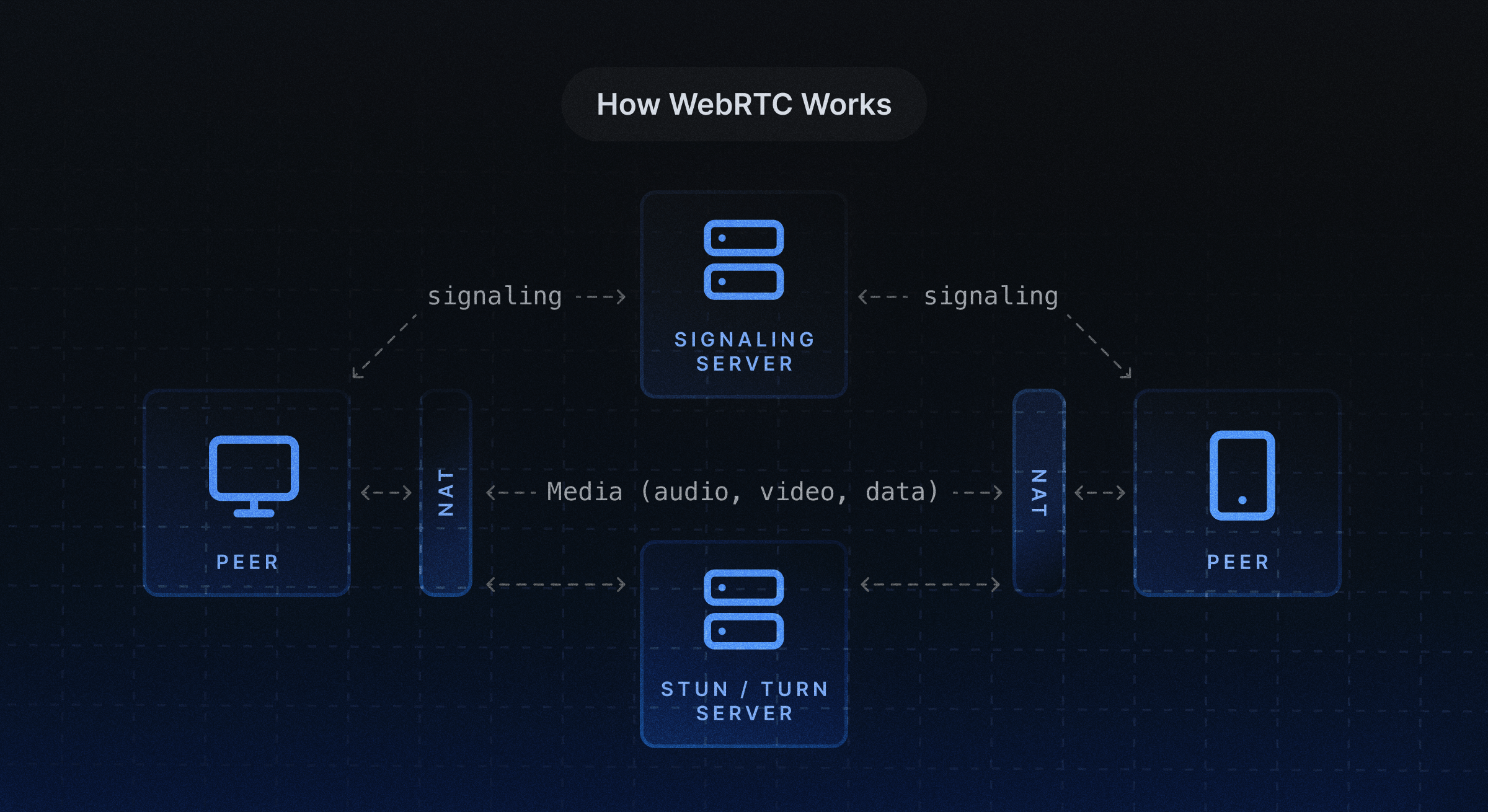

dTelecom’s architecture stands out in the Solana DePIN telecom space. The base layer provides decentralized infrastructure for voice, video, livestreaming, and AI agents. Coordination happens via apps like dMeet, enabling seamless peer-to-peer sessions. Developers access a full SDK and API suite, integrating features like real-time speech-to-text powered by x402 protocols – a first in decentralized setups.

They’re decentralizing real-time voice, video, and AI communication, targeting a $3.5T centralized market. Backed by Solana Foundation, Google.

This stack addresses pain points in centralized systems: data silos, surveillance risks, and escalating costs. By tokenizing bandwidth, dTelecom creates a marketplace where supply meets demand dynamically. Early adopters testing spatial environments or AI-LLM chats report smooth performance, hinting at viability for Web3 social apps and metaverses. As Solana’s ecosystem matures – with SOL steady at $85.25 after a 24-hour gain of and $1.96 – projects like this gain traction for their real-world utility.

AI-Native Features Powering Solana Decentralized Telecom

What elevates dTelecom in the DePIN voice video Solana niche are its AI integrations. Beyond basic RTC, it supports user-LLM voice chats, real-time translation, voice enhancement, and content moderation – all on-chain verifiable. Imagine AI agents handling customer support calls without Big Tech intermediaries; that’s the vision here.

- Real-time STT/TTS: x402-powered, decentralized speech processing.

- Low-latency video: WebRTC optimized for Solana’s throughput.

- Monetized bandwidth: Nodes earn for relaying traffic.

From a risk-managed investment lens, these features position dTelecom favorably. Telecom’s trillion-dollar scale offers asymmetric upside, yet DePIN execution risks loom – like node reliability under peak loads. Still, grants signal validator confidence, and the airdrop incentivizes organic growth. Participants racking points via dMeet usage stand to claim $DTEL early, blending utility with speculation.

Navigating dTel Rewards Airdrop in the Solana DePIN Ecosystem

dTelecom’s $2.6 million Phase 2 Airdrop underscores its community-first strategy. Users earn points through active engagement: hosting calls on dMeet, running livestreams, deploying AI voice agents, or exploring spatial audio. These accrue toward Stage 3 token claims pre-TGE in 2026. It’s a smart play to bootstrap network effects, mirroring Helium’s success in wireless DePIN but for multimedia comms.

With SOL at $85.25 – dipping from a 24-hour high of $85.51 yet up overall – capital efficiency matters. dTelecom leverages Solana’s sub-cent fees for micro-payments in sessions, making AI telecom viable at scale. For developers, GitHub repos reveal SDKs ready for integration, promising quick wins in dApps needing voice/video. Investors eyeing solana depin telecom should watch node growth; sustained activity could catalyze $DTEL value post-launch.

dTelecom (DTEL) Price Prediction 2027-2032

Post-TGE Projections Based on DePIN Adoption, Airdrop Momentum, and $3.5T Telecom Market Potential

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $0.03 | $0.12 | $0.35 | +20% (from 2026 baseline $0.10) |

| 2028 | $0.08 | $0.25 | $0.80 | +108% |

| 2029 | $0.15 | $0.50 | $1.50 | +100% |

| 2030 | $0.30 | $1.00 | $3.00 | +100% |

| 2031 | $0.60 | $2.00 | $6.00 | +100% |

| 2032 | $1.20 | $4.00 | $12.00 | +100% |

Price Prediction Summary

DTEL is positioned for substantial growth as a leading DePIN project on Solana, disrupting the $3.5T telecom industry with decentralized real-time voice, video, and AI communication. Predictions account for market cycles, with conservative mins in bear scenarios, realistic avgs driven by adoption, and bullish maxs from AI/DePIN hype and partnerships. Steady appreciation expected, potentially reaching $4 avg by 2032 in base case.

Key Factors Affecting dTelecom Price

- Solana ecosystem expansion and low-cost scalability

- DePIN adoption in real-time comms and AI agents

- Airdrop momentum and community engagement

- Backed by Solana Foundation, Google, and grants

- Regulatory progress in decentralized telecom

- Competition from centralized giants and other DePINs

- Technological advancements in dRTC, STT/TTS, and low-latency AI

- Broader crypto market cycles post-2026 TGE

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Balancing hype with fundamentals, dTelecom’s progress merits attention. Its blend of DePIN incentives and AI tooling could disrupt beyond crypto, into enterprise VoIP and telehealth. As Solana solidifies as DePIN hub, this project’s trajectory hinges on delivery – but early signals are compelling.

Node operators play a pivotal role in dTelecom’s Solana DePIN telecom ecosystem, supplying the bandwidth and compute that power its dRTC capabilities. This permissionless setup lowers barriers compared to legacy providers, where upfront capital ties up resources. Early metrics suggest healthy participation, fueled by the airdrop’s point system that rewards consistent uptime and traffic relay. As SOL holds at $85.25, reflecting a modest 24-hour increase of $1.96, such projects underscore Solana’s appeal for high-velocity DePIN applications.

For developers eyeing solana decentralized telecom integrations, the process mirrors standard WebRTC adoption but with blockchain primitives. GitHub documentation outlines SDK setup, emphasizing Solana’s low fees for session micropayments. This could redefine dApps in gaming, social, and enterprise spaces, where voice commands drive AI interactions seamlessly.

Developer Tools and Ecosystem Integration

dTelecom’s toolkit extends beyond core RTC, incorporating x402 for decentralized STT that rivals cloud services in accuracy. Voice enhancement filters out noise in real-time, while translation layers support global adoption. These aren’t gimmicks; they’re engineered for enterprise VoIP replacement, potentially capturing slices of the $3.5 trillion market through cost savings alone.

dTelecom SDK Benefits for Solana Devs

-

Low-Latency AI Features: Integrate real-time speech-to-text (STT), text-to-speech (TTS), voice enhancement, translation, and AI moderation for seamless voice/video/AI interactions.

-

Data Ownership: Users retain full control over their data in a decentralized network, eliminating centralized intermediaries.

-

Bandwidth Monetization: Developers and users can earn by contributing bandwidth to the DePIN network.

-

Easy WebRTC Integration: SDK simplifies adding voice, video, and chat via WebRTC into Solana apps with minimal setup.

From an investment strategist viewpoint, dTelecom balances speculative allure with grounded utility. Node economics must prove sustainable post-airdrop, as free rewards can inflate supply. Yet, backing from Solana Foundation and Google lends credibility, mitigating some execution doubts. Watch for metrics like active nodes and daily sessions; scaling past 10,000 concurrent users would validate the thesis.

Solana’s ecosystem thrives on projects like dTelecom that bridge physical infra with digital incentives. With SOL’s 24-hour range from $81.84 to $85.51 culminating at $85.25, market stability aids deployment focus. Bandwidth providers stand to gain most in a tokenized economy, where idle resources yield returns. Developers and users alike find empowerment here, sidestepping centralized gatekeepers.

Risks, Resilience, and Road Ahead

DePIN telecom on Solana isn’t without hurdles. Latency spikes during congestion or regulatory scrutiny on data flows could challenge growth. Competition from established players adapting blockchain looms large. Still, dTelecom’s AI-native edge – verifiable moderation and agentic comms – carves a defensible moat. Grants fuel iteration, and community traction via dMeet signals product-market fit.

Stakeholders should allocate modestly, prioritizing diversified Solana DePIN exposure. dTelecom’s momentum, paired with ecosystem tailwinds, positions it as a watchlist staple for those betting on decentralized infrastructure’s maturation. As adoption compounds, the network’s value accrues to early participants, rewarding patience in volatile markets.