Picture this: the massive $3.5 trillion telecom industry, long dominated by centralized giants prone to outages and sky-high costs, finally getting a blockchain overhaul. Enter dTelecom on Solana, a DePIN powerhouse delivering decentralized real-time voice, video, and AI communication. With node operators pocketing 75% of customer payments and apps like dMeet slashing infrastructure expenses by 95%, this isn’t just hype; it’s a practical revolution for developers, users, and earners in the Solana DePIN ecosystem.

Solana’s blistering speed makes it perfect for low-latency comms, and dTelecom leverages that to build a censorship-resistant network. No more relying on Big Telecom servers that fail during peak times or censor content. Instead, thousands of independent nodes distribute bandwidth, compute, and connectivity, dodging mass outages like those plaguing traditional infra. Backed by Solana Foundation, Google, ElevenLabs, and peaq, dTelecom positions itself as the go-to for DePIN telecom on Solana, powering everything from AI agent chats to seamless video calls.

Why dTelecom Stands Out in Solana DePIN Projects

In a sea of Solana DePIN projects, dTelecom shines with its vertical integration. It’s not just about nodes; it’s a full-stack decentralized Real-Time Communication (dRTC) network infused with AI. Developers plug in voice, video, and chat features effortlessly, all while enjoying borderless, private connectivity. Solana’s high throughput handles the real-time demands that choke other chains, ensuring sub-second latency critical for calls and AI interactions.

The buzz is real. Social feeds light up with talk of how dTelecom builds rails for AI agents, letting them converse fluidly without centralized bottlenecks. And with Solana at $83.05 today, down 3.71% in 24 hours, the ecosystem remains resilient, drawing sharp traders like me to momentum plays here. Vertical integration from infra to apps means scalability; it’s what DePIN needs to challenge telecom titans head-on.

Node Rewards: 75% Payouts Fuel Network Growth

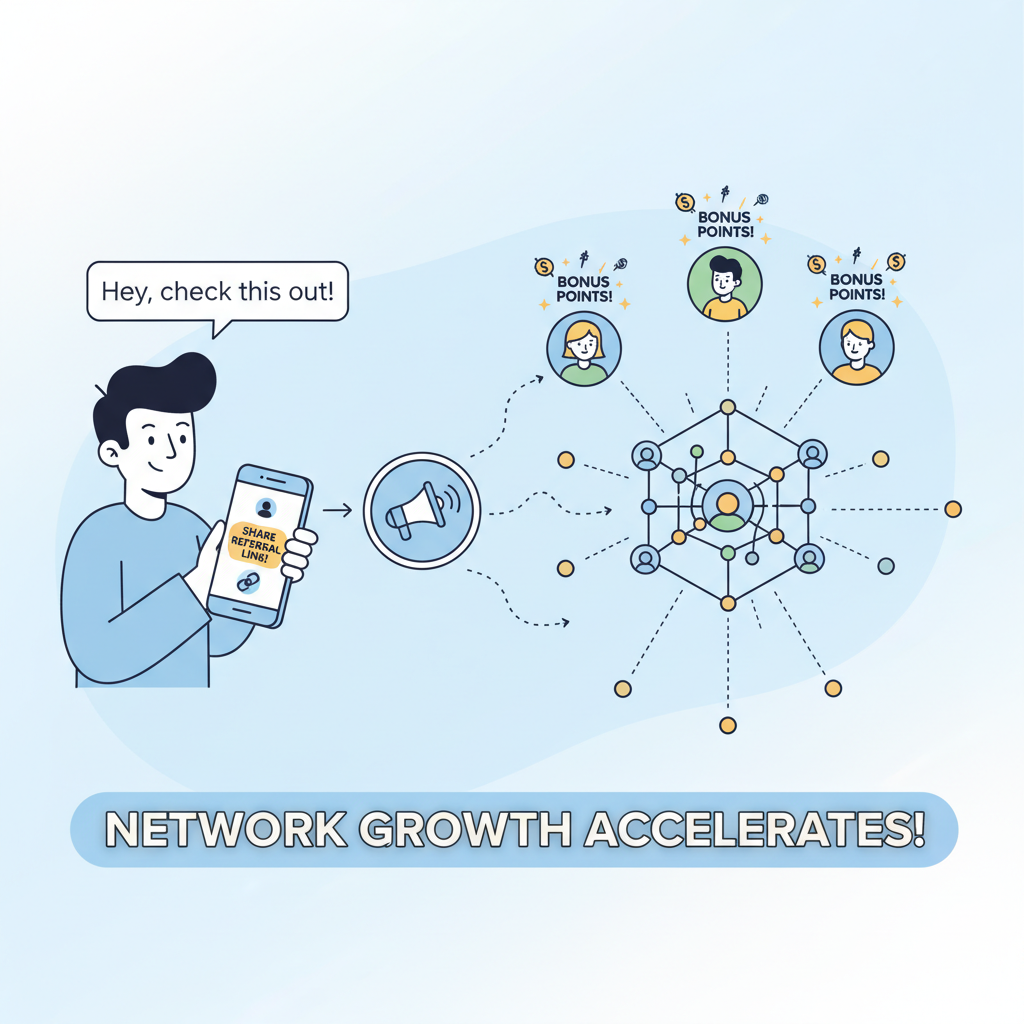

Here’s where it gets juicy for participants: run a dTelecom node, contribute bandwidth, and earn 75% of every customer payment routed through it. That’s right; operators keep the lion’s share, incentivizing a robust, global mesh of nodes. Whether you’re a home user with spare upload speed or a data center pro, jumping in means real DTEL token rewards potential ahead of the 2026 TGE.

Community incentives extend beyond nodes. Early programs reward usage, referrals, and quests in the ongoing $2.5 million airdrop. Points stack via app interactions and leaderboards, with heavier allocations for top performers. I’ve seen similar setups explode post-snapshot; savvy operators position now to ride that wave. Manage risk by starting small, scale as demand surges. This model turns users into owners, aligning incentives in true DePIN fashion.

dtelecom (DTEL) Price Prediction 2027-2032

Post-2026 TGE Projections Based on DePIN Adoption, Node Rewards, Airdrop Incentives, and Telecom Market Disruption Potential

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Est. YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $0.05 | $0.15 | $0.40 | +50% (from est. 2026 $0.10) |

| 2028 | $0.10 | $0.30 | $0.80 | +100% |

| 2029 | $0.20 | $0.60 | $1.50 | +100% |

| 2030 | $0.40 | $1.20 | $3.00 | +100% |

| 2031 | $0.80 | $2.50 | $6.00 | +108% |

| 2032 | $1.50 | $5.00 | $12.00 | +100% |

Price Prediction Summary

dtelecom (DTEL) shows strong long-term potential as a Solana-based DePIN project disrupting the $3.5T telecom industry with 95% cost reductions, node rewards (75% to operators), and AI-integrated real-time voice/video comms. Projections assume progressive adoption, crypto bull cycles in 2029-2032, and partnerships with Solana Foundation/Google/peaq. Average price could hit $5.00 by 2032 (50x from 2026 baseline) in bullish scenarios, with mins reflecting bear markets/regulatory risks.

Key Factors Affecting dtelecom Price

- Rapid DePIN node growth and rewards distribution driving token demand

- Solana ecosystem expansion and SOL price correlation ($83 baseline)

- Airdrop/TGE momentum and community incentives post-2026

- Telecom industry disruption via low-latency, censorship-resistant infra

- AI communication integrations boosting real-world utility

- Regulatory clarity for DePIN/telecom vs. potential crackdowns

- Competition from centralized providers and other DePIN projects

- Macro crypto cycles: bears in 2027-28, bulls in 2029+

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

95% Cheaper Decentralized Voice and Video Infra

The proof is in the pudding, or rather, in dMeet. This video conferencing app on dTelecom infrastructure cut costs by up to 95% versus legacy providers. No massive server farms; just peer-to-peer efficiency via DePIN nodes. For decentralized voice on Solana, it’s a game-changer, especially as AI demands real-time rails that don’t break the bank.

Traditional telecom funnels billions into centralized hardware, vulnerable to failures and monopolies. dTelecom flips the script: distributed nodes mean resilience and savings passed to users. Developers build without vendor lock-in, companies scale globally without borders. On Solana, where SOL holds at $83.05 amid minor dips, this efficiency could spark the next DePIN rally.

Imagine deploying video calls for thousands without the ballooning AWS bills. dTelecom’s DePIN model makes that reality, empowering Solana node DePIN operators worldwide to share the wealth. As SOL trades at $83.05 with a 3.71% dip over 24 hours, this cost edge sharpens the appeal for momentum traders eyeing DePIN breakouts.

Partnership Power: Solana Foundation to Google Backing DePIN Telecom

Prestige matters in crypto, and dTelecom packs it. Grants from Solana Foundation validate the tech, while Google and ElevenLabs add AI muscle for smarter comms. peaq’s involvement bridges DePIN ecosystems, amplifying reach. This isn’t fly-by-night; it’s battle-tested infrastructure ready to scale. For dtelecom Solana watchers, these ties signal longevity amid volatile markets.

Solana’s edge shines here: high-speed blocks handle real-time data floods that sideline slower chains. AI agents chatting seamlessly? dTelecom builds those rails, decentralized and owned by node contributors. As DePIN telecom on Solana matures, expect integrations with wallets, DAOs, and metaverses craving low-latency voice.

Running a Node: Practical Steps for Passive Income

Node operation demystified: anyone with decent bandwidth can contribute, earning 75% of routed payments. Start small on home setups, upgrade to VPS for volume. Monitor uptime, optimize latency, watch $DTEL flow in. Risks? Minimal with Solana’s reliability; rewards scale with adoption. In my swing trading playbook, this beats pure speculation, blending yield with ecosystem bets.

DePIN’s promise peaks in resilience. Centralized outages cripple events; dTelecom’s node swarm laughs them off. For developers eyeing decentralized voice Solana, SDKs make integration plug-and-play, unlocking apps from telehealth to virtual events.

dTelecom isn’t chasing gimmicks; it’s rebuilding telecom’s core on Solana’s rails. With SOL at $83.05 proving ecosystem grit, node runners and airdrop hunters gear up for telecom’s on-chain pivot. Vertical stacks, fat rewards, slashed costs: this DePIN contender rides high, pulling savvy players along. Spot the momentum, stake your node, claim those points; the $3.5 trillion prize awaits the prepared.