Solana’s DePIN ecosystem has solidified its position as a revenue powerhouse in 2025 and early 2026, with projects collectively surpassing key milestones like $3 million in monthly revenue at peaks. Among the top performers by revenue, Render Network, io. net, GEODNET, Nosana, and Sallar stand out for their real-world utility and economic traction. These networks leverage Solana’s high-throughput blockchain to deliver decentralized GPU rendering, cloud compute, geospatial data, AI DevOps, and edge compute solutions, respectively. Investors eyeing solana depin projects revenue should note how these protocols have outpaced broader crypto trends, driven by surging demand for physical infrastructure in AI and mapping applications.

Render Network (RNDR), trading at $1.92, exemplifies this momentum. By late 2024, it posted over $200,000 in revenue for two straight months, scaling to roughly $2.65 million total by April 2025. This growth stems from enterprises tapping its decentralized GPU resources for rendering tasks in film, gaming, and AI model training. Render’s migration to Solana amplified its efficiency, slashing costs while boosting node participation. As demand for GPU compute explodes, Render’s revenue trajectory suggests it’s not just riding the AI wave but steering it within DePIN.

io. net: Fueling Decentralized Cloud Compute

io. net has emerged as a compute juggernaut, doubling monthly revenue to $2.5 million by mid-2025. This Solana-based platform aggregates idle GPUs worldwide, offering a cheaper alternative to AWS or Google Cloud for machine learning workloads. Its revenue spike correlates with a 33% year-over-year ecosystem growth, underscoring io. net solana revenue as a bellwether for DePIN scalability. What sets io. net apart is its focus on accessibility; developers access vast compute without upfront hardware investments, fostering rapid adoption in AI startups.

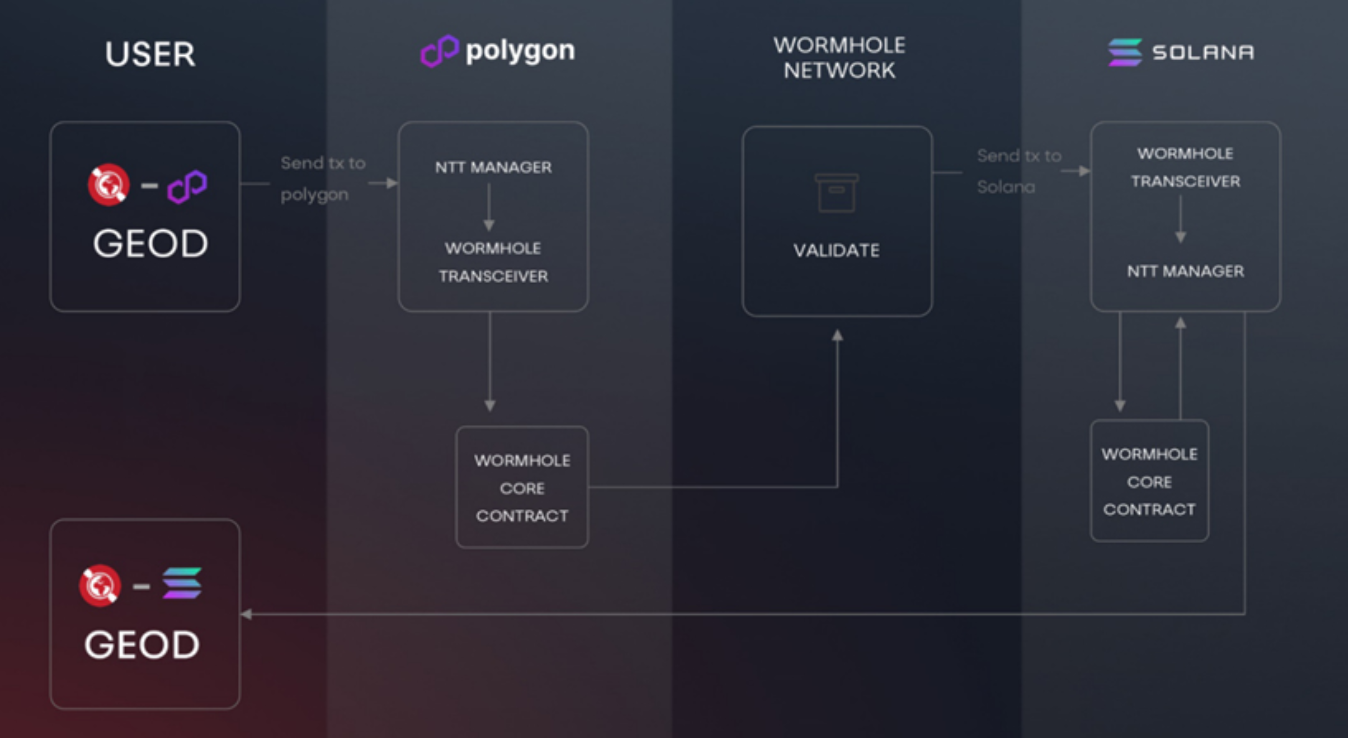

GEODNET: Geospatial Precision at Scale

GEODNET’s decentralized GNSS base stations deliver centimeter-level location data, powering applications from autonomous vehicles to precision agriculture. While exact revenue figures remain aggregated in ecosystem reports, its contributions propelled Solana DePIN past $1.6 million monthly in late 2024. GEODNET Solana thrives on real-time data needs, with expanding station deployments signaling sustained revenue potential. In a world increasingly reliant on accurate geospatial intel, GEODNET’s model rewards contributors while serving industries hungry for trustworthy, tamper-proof positioning.

Render (RNDR) Price Prediction 2027-2032

Long-term forecasts based on Solana DePIN revenue growth, market cycles, and adoption trends amid strong ecosystem performance

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $1.20 | $3.50 | $6.00 |

| 2028 | $2.50 | $7.00 | $12.00 |

| 2029 | $4.00 | $10.50 | $18.00 |

| 2030 | $5.50 | $15.00 | $25.00 |

| 2031 | $8.00 | $20.00 | $35.00 |

| 2032 | $10.00 | $28.00 | $45.00 |

Price Prediction Summary

Render (RNDR), a top Solana DePIN project with over $2.65M in cumulative revenue by 2025, is projected to experience substantial growth from its current $1.92 price. Average prices could rise 14x by 2032 in bullish scenarios driven by GPU demand, while minimums account for bear markets. Bullish max reflects 20x+ potential from AI/rendering adoption; bearish mins assume regulatory hurdles or competition. Comparable growth expected for io.net (IO), GEODNET (GEOD), and Nosana (NOS) in the thriving DePIN sector.

Key Factors Affecting Render Price

- Explosive DePIN revenue growth on Solana (e.g., Render’s $200K+ monthly peaks)

- Increasing demand for decentralized GPU/compute services amid AI boom

- Solana ecosystem expansion with 42.5M active addresses and rising fees

- Market cycles: Expected 2027-2028 bull run post-2026 consolidation

- Regulatory clarity and institutional adoption boosting DePIN legitimacy

- Technological advancements in real-world use cases (mapping, wireless, DevOps)

- Competition from Helium, Hivemapper, but Render’s revenue leadership provides edge

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

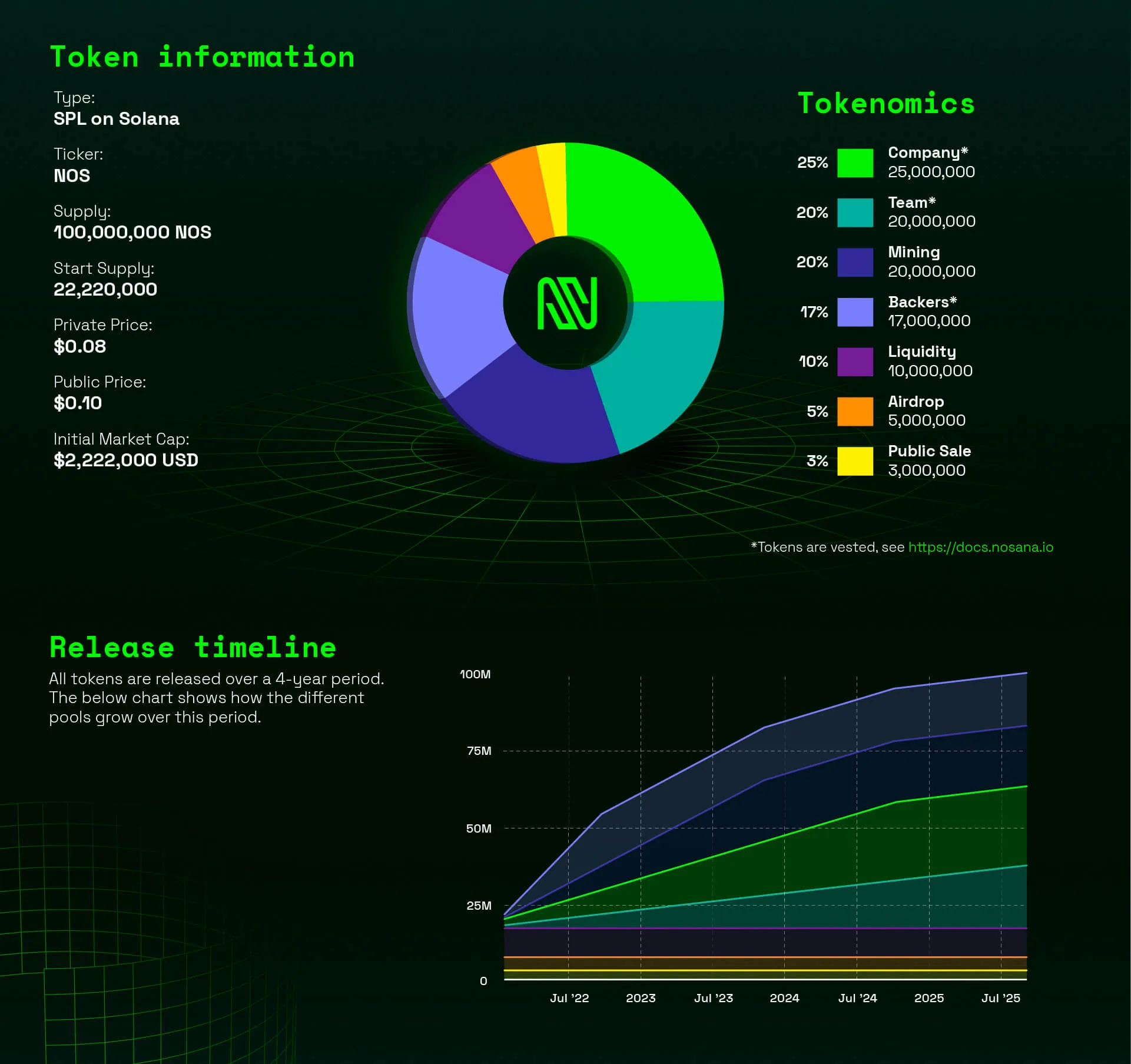

Nosana: AI DevOps on Decentralized Rails

Nosana reimagines CI/CD pipelines through distributed GPU grids tailored for AI workflows. April 2025 saw contributor numbers surge over 100%, a proxy for revenue acceleration as more developers integrate its Nosana AI DePIN services. This growth mirrors Solana’s fee revenue up 37.6% to $24.5 million over 30 days, with Nosana capturing a slice via job executions. Its edge lies in blending open-source tools with token incentives, making decentralized DevOps viable for production-scale AI training.

Sallar rounds out this elite group as an edge compute innovator on Solana, optimizing resource sharing for low-latency applications. Though specific metrics are emerging, its alignment with Sallar Solana compute trends positions it for revenue gains amid the physical infrastructure boom. These projects collectively highlight why Solana hosts six of the top 10 DePIN by annual revenue, per recent analyses.

Solana’s DePIN revenue hit record highs, with protocols like these driving over $458,000 monthly in April 2025 alone.

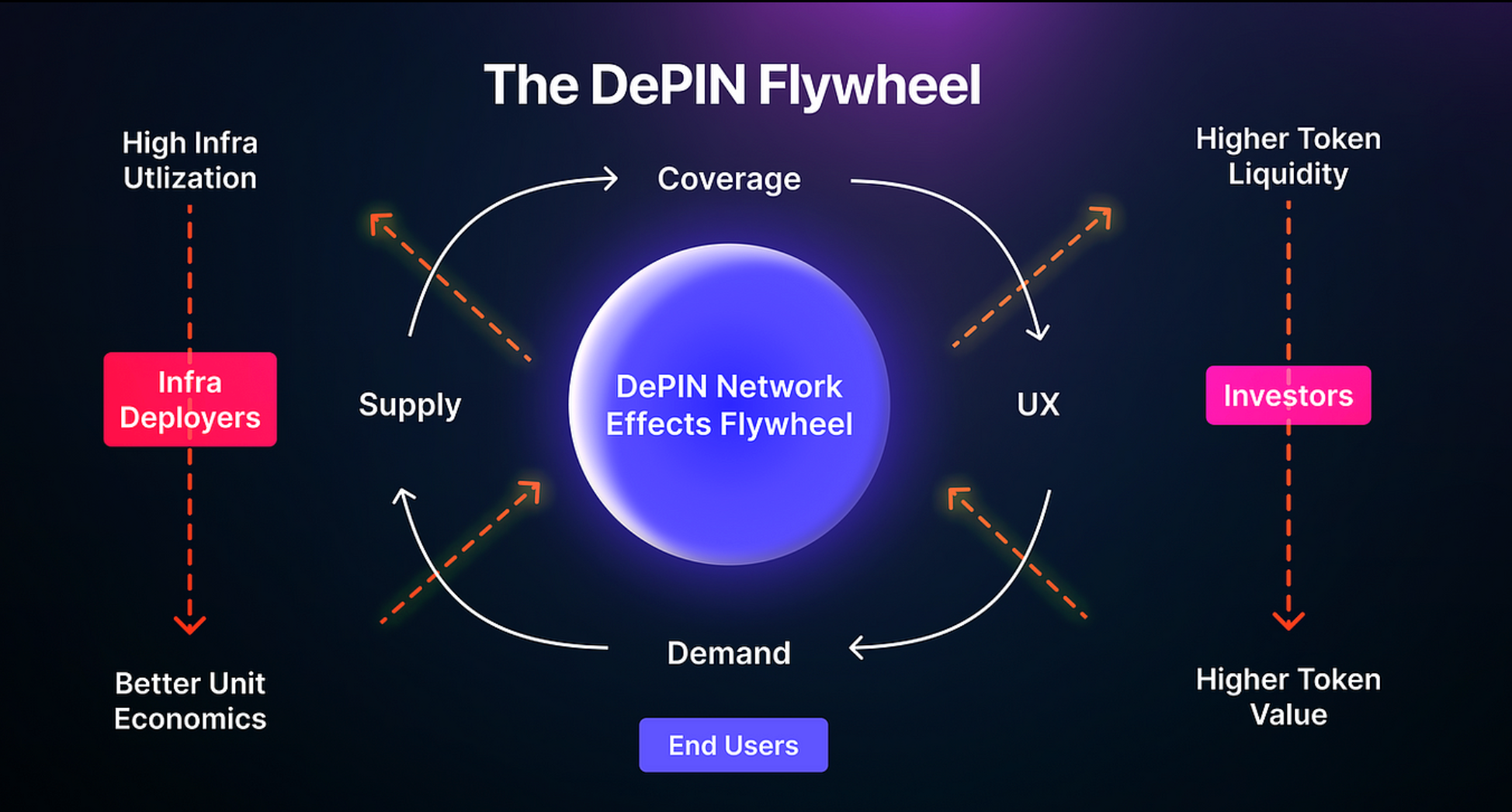

Sallar’s edge compute model taps into distributed devices for processing data closer to the source, ideal for AR/VR and real-time analytics. Its revenue potential builds on Solana’s low-latency strengths, with early traction in mobile edge networks mirroring broader best performing depin solana trends. As enterprises seek alternatives to centralized clouds, Sallar’s tokenomics incentivize device owners, fostering a flywheel of supply and demand.

Top Performing Solana DePIN Projects by Revenue Breakdown

| Rank | Project | Token | Monthly Revenue | Growth & Highlights |

|---|---|---|---|---|

| 1 | io.net | IO | $2.5M | Doubled by mid-2025; dominating compute aggregation 🔥 |

| 2 | Helium Network | HNT | $400K | July 2025; 60% of sector fees; 350K+ subscribers 📡 |

| 3 | Render Network | RNDR ($1.92) | $200K | Late 2024 (2 consecutive months); steady enterprise GPU adoption; $2.65M total by Apr 2025 🚀 |

| 4 | Hivemapper | HONEY | Part of >$1M collective | Dec 2024 peak; 36%+ contributor growth; 29% world roads covered 🗺️ |

| 5 | Nosana | NOS | Part of $1.6M ecosystem | Apr 2025: >100% contributor growth; decentralized DevOps ⚙️ |

| 6 | GEODNET | GEOD | Part of $1.6M ecosystem | Robust GNSS infrastructure; precise geospatial data 🌍 |

| – | Solana DePIN Ecosystem | SOL | $458K (Apr); up to $3M | Fees +37.6% ($24.5M 30d); outperforming Ethereum peers 📊 |

This table illustrates not just raw figures but sustainability. Render’s consistent $200,000 and months reflect enterprise adoption, while io. net’s doubling signals hyperscale potential. GEODNET and Nosana benefit from network effects, with station deployments and contributor surges translating to fee accrual. Sallar, though nascent, aligns with projections for edge compute exploding alongside 5G rollouts.

Beyond numbers, these projects exemplify DePIN’s maturation. Render Network’s Solana integration reduced job settlement times by 90%, boosting throughput and revenue per node. io. net’s supplier rewards have onboarded thousands of GPUs, undercutting traditional clouds by 90% on costs. GEODNET’s base stations now rival centralized GNSS providers in accuracy, commanding premiums in drone logistics. Nosana’s grid handles complex AI jobs that centralized DevOps struggle with at scale, evidenced by its 100% and contributor growth. Sallar complements this by minimizing data travel, critical for bandwidth-constrained environments.

Top 5 Solana DePIN by Revenue

-

Render Network (RNDR): Leading decentralized GPU rendering platform. Achieved >$200K revenue for two consecutive months in late 2024; total ~$2.65M by April 2025. Price: $1.92 (-0.0352% 24h).

-

io.net (IO): Aggregates idle GPUs for decentralized cloud computing. Doubled monthly revenue to $2.5M by mid-2025 amid rising AI demand.

-

GEODNET (GEOD): Decentralized GNSS base stations for precise geospatial data. Strong infrastructure supports Solana DePIN ecosystem growth and real-world utility.

-

Nosana (NOS): Decentralized DevOps for CI/CD pipelines. Over 100% contributor growth in April 2025, boosted by network expansion and token incentives.

-

Sallar: Decentralized physical infrastructure project leveraging Solana’s scalability, real-world utility, token incentives, AI demand, and network expansion for revenue growth.

Investors should weigh tokenomics alongside revenue. Render at $1.92 maintains stability amid volatility, with buybacks from job fees enhancing scarcity. io. net’s IO token captures compute marketplace value, GEODNET’s GEOD funds station incentives, Nosana’s NOS aligns with job volume, and Sallar’s model promises yields from edge utilization. Yet, risks persist: regulatory scrutiny on physical networks, competition from centralized giants, and Solana’s occasional outages. Data-driven diligence reveals these as calculated bets in a sector where revenue correlates strongly with adoption metrics.

Solana’s DePIN surge, detailed in Syndica’s 2025 analysis, positions these projects at the vanguard. As AI and IoT converge, their revenue streams will likely compound, rewarding early positioners with outsized returns. Tracking solana depin projects revenue metrics remains essential for navigating this high-conviction space.