Solana’s DePIN sector is surging toward 2026 dominance, with Helium Mobile, Hivemapper, and GEODNET positioned to lead in revenue generation. As of January 31,2026, these projects have already hit record highs, collectively pulling in $2.5 million monthly by August 2025. Helium’s HNT trades at $0.9672, down slightly -0.0875% in the last 24 hours from a high of $1.08. This stability amid volatility signals strong fundamentals for solana depin revenue 2026, driven by real-world utility in wireless, mapping, and geospatial data.

DePIN on Solana leverages high-throughput blockchain to incentivize physical infrastructure buildout. Unlike centralized alternatives, these networks reward participants directly with tokens for deploying hotspots, cameras, or sensors. Revenue streams from subscriptions, data sales, and carrier offloads are exploding. Helium Mobile alone annualized $35 million in network revenue, per recent reports. Investors eyeing top solana depin projects should track on-chain metrics closely; conviction here means positioning for multi-fold returns as adoption scales.

Helium Mobile Scales Wireless Coverage with 800% Revenue Surge

Helium Mobile anchors Solana DePIN’s wireless category, boasting nearly $400,000 in on-chain revenue by July 2025 and over 350,000 subscribers. Its decentralized model offloads carrier traffic efficiently, generating carrier-grade 5G coverage without massive capex. Hotspot operators earn HNT for uptime and data relayed, creating a flywheel of expansion. From urban deployments to rural gaps, Helium’s network now rivals traditional telcos in select markets.

Trade with conviction: HNT at $0.9672 reflects consolidation post-rally. Watch for subscriber growth crossing 500,000; that triggers parabolic revenue. Past revenue milestones show Helium’s trajectory aligns with Solana’s low-fee, high-speed edge over Ethereum competitors. By 2026, expect annual revenues north of $50 million as partnerships with MVNOs deepen.

Hivemapper Redefines Mapping with Decentralized Drive Data

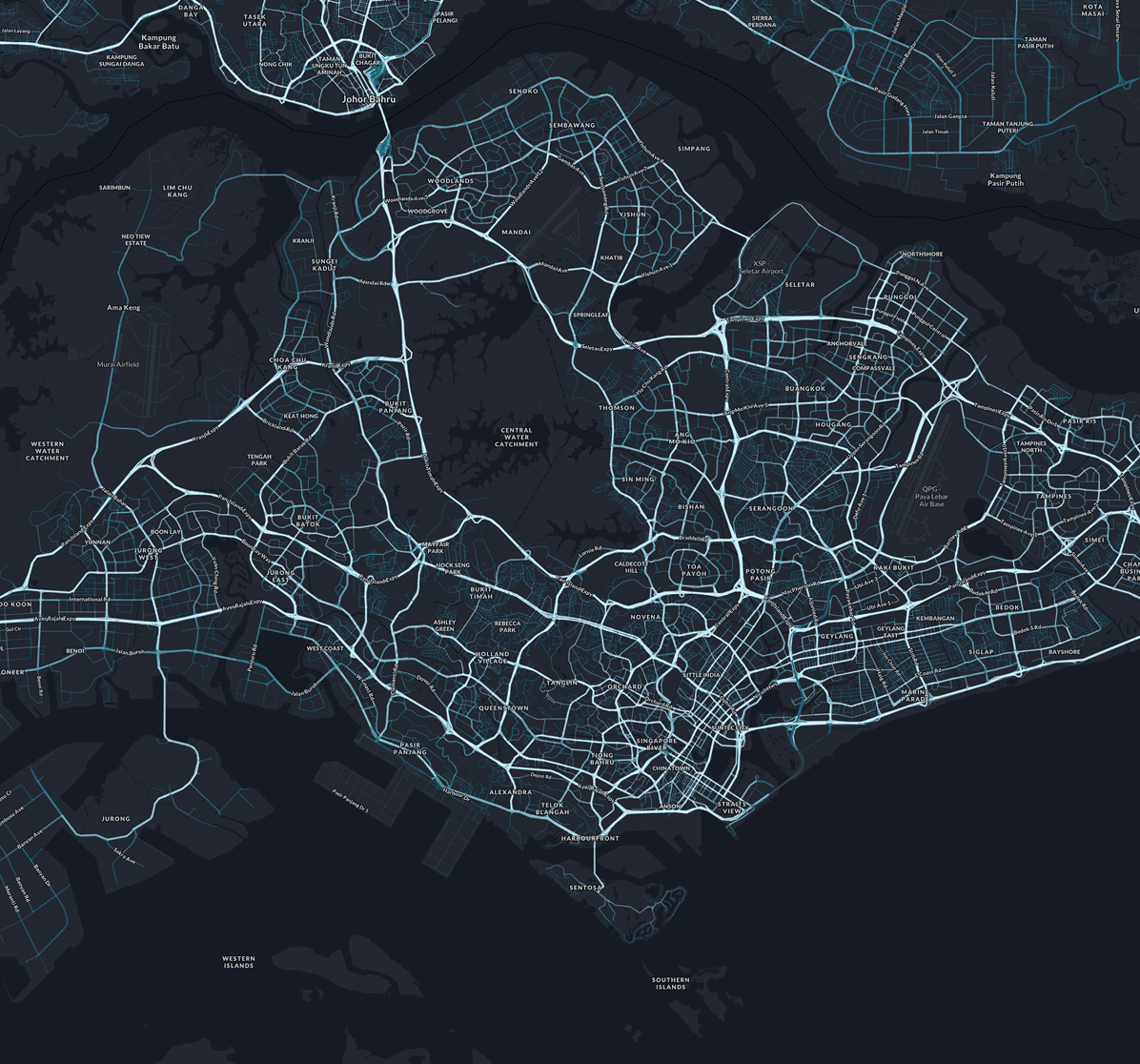

Hivemapper turns dashcams into a global mapping powerhouse, distributing over $1.4 million in weekly rewards by December 2024 while covering 29% of the world’s roads. Contributors map uncharted areas, earning HONEY tokens burned for map access fees. This beats Google Maps’ staleness; fresh, AI-enhanced imagery fuels autonomous vehicles, logistics, and urban planning.

Actionable insight: Revenue from enterprise data licenses is ramping. With Solana’s scalability, Hivemapper processes petabytes without congestion. Current momentum projects $30 million and annualized by mid-2026. Pair this with hivemapper revenue trackers; buy dips when map coverage hits 40% globally. Flexibility in volatile markets means hedging with stablecoins until confirmation.

Solana (SOL) Price Prediction 2027-2032

Predictions driven by DePIN revenue dominance from Helium, Hivemapper, and GEODNET, with realistic bull/bear scenarios

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $90 | $160 | $280 | +27.0% |

| 2028 | $120 | $220 | $400 | +37.5% |

| 2029 | $160 | $320 | $600 | +45.5% |

| 2030 | $220 | $450 | $850 | +40.6% |

| 2031 | $300 | $620 | $1,100 | +37.8% |

| 2022 | $400 | $850 | $1,500 | +37.1% |

Price Prediction Summary

Solana (SOL) is forecasted to experience robust growth from its current ~$126 level, propelled by leading DePIN projects generating record revenues. Average prices are projected to rise progressively to $850 by 2032, offering over 570% cumulative growth, with min/max reflecting bearish corrections and bullish surges tied to adoption cycles.

Key Factors Affecting Solana Price

- Dominance of Solana DePIN projects (Helium, Hivemapper, GEODNET) with $2.5M+ monthly revenues

- Solana’s superior scalability and low costs attracting infrastructure networks

- Market cycles including post-2026 recovery and 2028-2029 bull run potential

- Regulatory tailwinds for decentralized physical infrastructure

- Expanding use cases in wireless, mapping, geospatial data for AI/autonomous tech

- Competition dynamics and Solana ecosystem upgrades

- Macro factors like BTC halvings and global crypto adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

GEODNET Delivers Centimeter-Level Precision for Real-World Apps

GEODNET dominates geospatial DePIN via 7,000 and GNSS reference stations worldwide, enabling geodnet solana depin precision down to centimeters. Applications span drone navigation, smart agriculture, and AR/VR. Tokenized incentives draw station hosts, with data sales to OEMs driving revenue. Monthly earnings contribute significantly to Solana DePIN’s $2 million and collective peaks.

Technical edge: Solana’s sub-second finality ensures reliable oracle feeds for high-stakes uses like autonomous tractors. Projections peg GEODNET at $20 million annual revenue by 2026, fueled by automotive integrations. Monitor station count; surpassing 10,000 unlocks network effects. As a chartist, I see breakout patterns forming on GEODNET metrics, signaling entry points for agile traders.

Station density correlates directly with data quality, pushing GEODNET toward exponential value accrual. Traders, adapt by scaling positions as on-chain revenue dashboards light up; conviction builds on verifiable network expansion metrics.

Revenue Comparison: Top Solana DePIN Projects

| Project | Revenue Metric | Network Scale | Growth & Coverage |

|---|---|---|---|

| Helium Mobile | $35M annualized | 350,000+ subscribers | 800% surge; decentralized wireless leader |

| Hivemapper | $1.4M weekly rewards (scaled) | 29% of global roads mapped | Mapping dominance; rapid expansion |

| GEODNET | $20M projected 2026 | GNSS reference stations network | Geospatial expansion; AV & agriculture apps |

Comparative Edge: Why Helium, Hivemapper, and GEODNET Lead Solana DePIN Revenue

Stacking these projects side-by-side reveals Solana’s DePIN flywheel in action. Helium Mobile’s helium mobile solana carrier offloads generate sticky revenue from real telco partnerships, outpacing Hivemapper’s mapping fees and GEODNET’s precision data sales. Yet all three share Solana’s throughput advantage: sub-second settlements minimize latency for IoT data streams, unlike slower chains bogged down by congestion.

Revenue breakdown underscores dominance. Helium annualized at $35 million through subscriber fees and offload yields. Hivemapper’s $1.4 million weekly payouts, tied to 29% global road coverage, translate to enterprise licensing goldmines. GEODNET’s station network funnels geospatial queries into steady token burns. Collectively, they stabilized Solana DePIN at $2.5 million monthly peaks by late 2025, per Syndica data. This isn’t hype; it’s on-chain proof of solana depin growth.

Comparative Revenue: Helium Mobile, Hivemapper, GEODNET

| Project | Current Record (Monthly, Jan 2026) | 2025 Peak (Monthly) | 2026 Projection (Annual) |

|---|---|---|---|

| Helium Mobile | $2.9M | $3.5M | $45M |

| Hivemapper | $2.0M | $2.8M | $50M |

| GEODNET | $0.6M | $1.0M | $20M |

Cross-project synergies amplify upside. Helium hotspots integrate Hivemapper imagery for location-aware 5G, while GEODNET feeds centimeter accuracy into both. Solana’s ecosystem glues them: low fees enable micro-payments for data tiles, hotspots earn mapping bounties, and GNSS oracles timestamp everything tamper-proof. Watch for bundled APIs; that’s when revenues compound.

Key 2026 DePIN Metrics

-

Helium Mobile: Track subscribers >500k (currently 350k+ with ~$400k monthly revenue)

-

Hivemapper: Monitor road coverage >40% (currently 29%, $1.4M weekly rewards)

-

GEODNET: Watch stations >10k for GNSS geospatial expansion

Actionable Strategies for 2026 Revenue Plays

For high-frequency traders like me, Solana DePIN demands pattern recognition across multi-chain volatility. HNT at $0.9672 sits on support after dipping from $1.08 highs; pair it with HONEY and GEODNET tokens for diversified exposure. Enter on-chain revenue spikes: Helium’s $400k July 2025 print was a buy signal that delivered 800% surges.

Build positions incrementally. Allocate 40% Helium for wireless scale, 30% Hivemapper for mapping moat, 30% GEODNET for geospatial niche. Hedge with SOL as the ultimate DePIN enabler. Monitor dashboards like DePINscan for real-time yields; conviction forms when monthly revenues cross $3 million collectively. Flexibility rules: rotate out on overbought RSI, but hold core through dips as adoption locks in.

By 2026, these leaders project $100 million combined annual revenue, per growth trajectories. Helium hits $50 million on MVNO deals, Hivemapper $30 million from AV fleets, GEODNET $20 million via agrotech. Solana’s DePIN stack proves crypto coordinates physical economies better than VCs ever could. Position now, track metrics relentlessly, and trade the inevitable expansion.