Emerging markets face persistent infrastructure challenges, particularly in logistics and energy. Traditional, centralized systems have struggled to keep pace with population growth, urbanization, and the rising demands of digital economies. In markets like Pakistan, these issues manifest as overburdened power grids and fragmented logistics networks, problems that directly impede economic growth and global competitiveness.

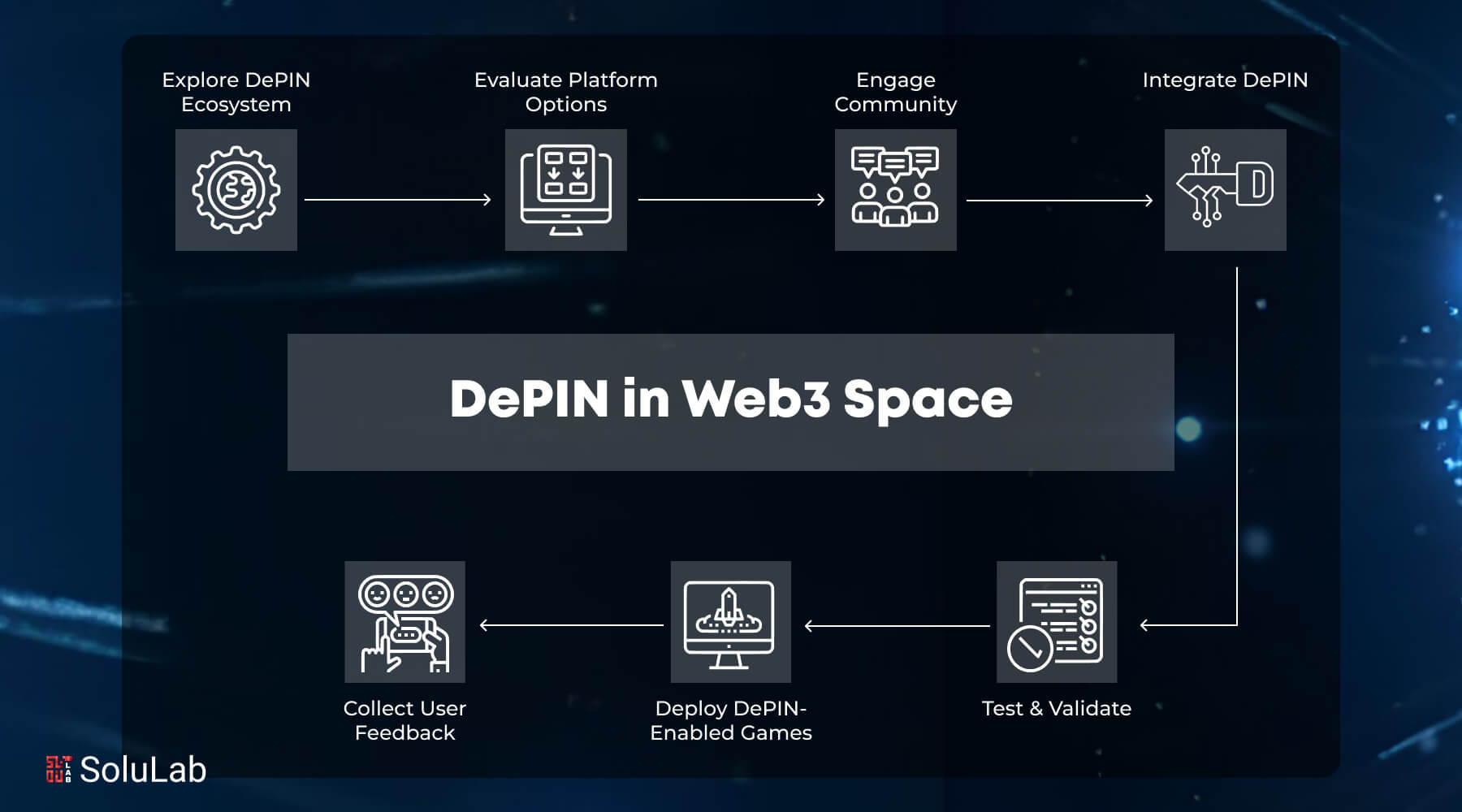

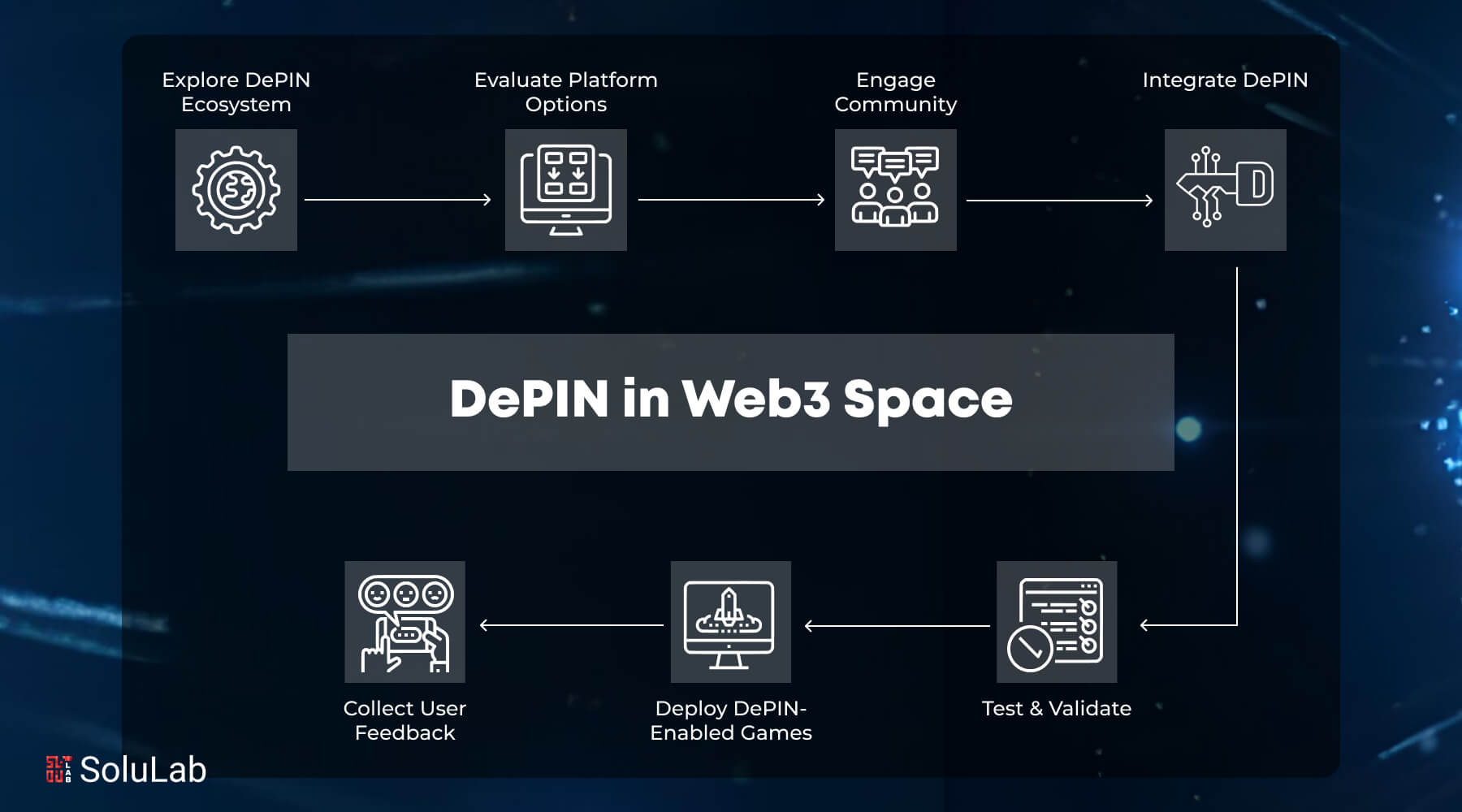

Decentralized Physical Infrastructure Networks (DePIN) are rapidly redefining how these foundational sectors operate. By leveraging blockchain technology, DePIN projects on Solana and other scalable platforms offer decentralized coordination, transparent incentives, and global participation. The result: more resilient infrastructure that adapts to local needs while harnessing global capital and talent.

Why Emerging Markets Need DePIN: The Case for Pakistan

The opportunity for DePIN logistics case study solutions in Pakistan is striking. The country’s centralized energy grid is chronically overloaded, leading to frequent blackouts that disrupt both industry and daily life (see “Roshan Pakistan” case study on DEV Community). Logistics networks are similarly hampered by inefficiencies, delays at ports like Karachi ripple through the national supply chain.

Pioneering platforms such as DePINvest are demonstrating how decentralized models can address these pain points. By connecting sponsors willing to fund hardware deployment with hosts in underserved regions, DePINvest tackles two major hurdles: geographic imbalances and prohibitive upfront costs. This model is especially relevant for emerging markets where capital constraints have historically limited infrastructure upgrades.

The Trillion-Dollar Opportunity in Decentralized Logistics

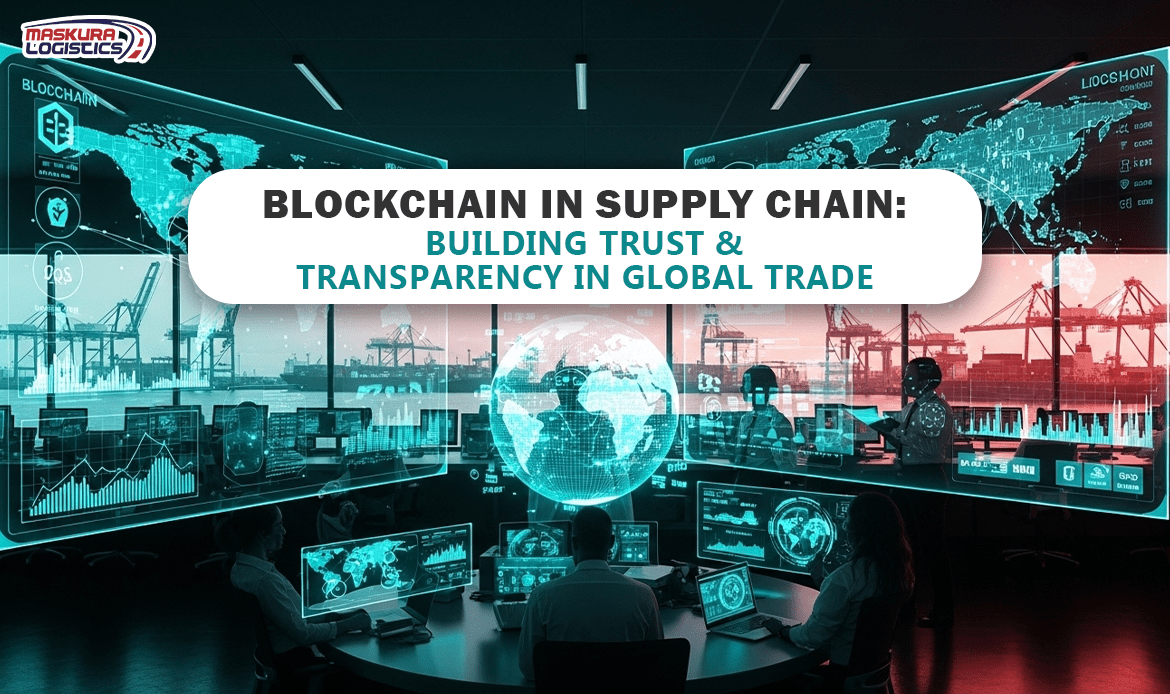

The logistics sector represents a trillion-dollar opportunity for DePIN innovation (crypto.news analysis). Centralized attempts at blockchain-based supply chain management, such as Maersk and IBM’s TradeLens, have failed to scale due to governance bottlenecks and lack of open participation. In contrast, decentralized networks unlock permissionless entry for operators large and small, enabling dynamic routing of goods across borders without single points of failure.

This is particularly transformative for countries like Pakistan with growing export sectors but legacy infrastructure. Imagine a scenario where every trucker or warehouse owner can join a decentralized network like KarachiKargo, earning rewards for real-time data sharing while optimizing delivery routes autonomously via smart contracts on Solana.

Key Benefits of DePIN-Powered Logistics in Emerging Markets

-

Enhanced Efficiency and Scalability: DePIN platforms such as DePINvest enable decentralized deployment of logistics hardware, reducing bottlenecks and enabling rapid scaling across high-impact regions.

-

Lower Costs and Increased Access: By connecting sponsors with hosts, DePIN solutions help overcome hardware cost barriers and geographic imbalances, making advanced logistics infrastructure accessible in underserved areas.

-

Resilience Against Centralized Failures: The collapse of centralized projects like Maersk and IBM’s TradeLens demonstrates the advantage of decentralized logistics networks, which are less prone to single points of failure.

-

Transparency and Trust: Blockchain-powered DePIN networks ensure transparent tracking and verification of goods, building trust among stakeholders and reducing fraud in supply chains.

-

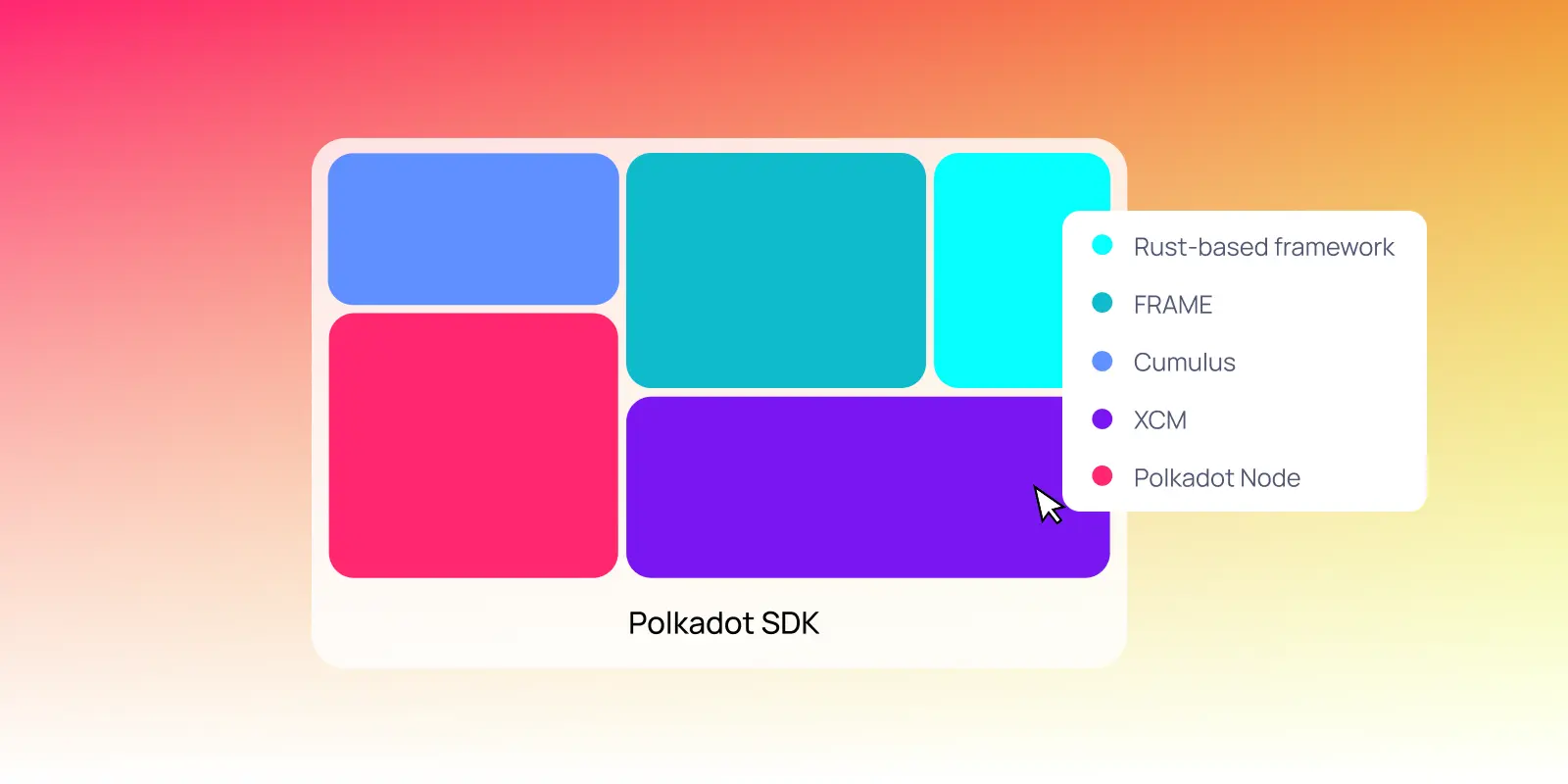

Interoperability and Security: Platforms like Polkadot provide the necessary infrastructure for secure and interoperable logistics solutions, supporting complex supply chain management across diverse systems.

Decentralized Energy Grids: From Sindh SolarShare to Roshan Pakistan

The energy crisis in Pakistan is another area ripe for disruption by DePIN models. Projects such as Sindh SolarShare envision peer-to-peer microgrids where households both produce and trade solar power locally, reducing transmission losses and increasing grid resilience. Research published on arXiv highlights the technical and economic viability of such mobile micro-grids for nomadic communities (arXiv.org study). These decentralized systems consistently outperform traditional setups in terms of cost efficiency, emissions reduction, and reliability.

Solana’s high throughput, low transaction costs, and composability make it an ideal platform for scaling these solutions nationwide. Verification mechanisms built into the blockchain ensure that every kilowatt generated or delivered is transparently accounted for, a critical feature in regions where electricity theft or misreporting has plagued legacy systems (see Medium coverage by Nauman Ali Murad).

In practice, this means rural communities in Sindh or Khyber Pakhtunkhwa can deploy solar panels and IoT meters, connect them to a DePIN protocol, and instantly participate in local energy markets. Homeowners become both producers and consumers, earning tokenized incentives for surplus generation or grid stabilization. The transparency and automation of Solana-based smart contracts eliminate the need for costly intermediaries, while real-time data feeds allow for adaptive pricing that reflects true supply-demand dynamics.

For policy makers and investors, the implications are profound. Instead of top-down capital-intensive projects that often face delays or budget overruns, DePIN networks enable organic, bottom-up growth. Each new participant strengthens the network’s resilience and reach, whether it’s a Karachi warehouse joining a decentralized logistics mesh or a village solar array plugging into Sindh SolarShare. Over time, these micro-contributions aggregate into macro-level infrastructure upgrades that are more robust and equitable than their centralized predecessors.

Strategic Advantages: Scalability, Transparency, and Local Empowerment

The scalability advantage of DePIN is not just technical, it’s social. By providing open access to infrastructure networks, platforms like DePINvest remove barriers to entry for small businesses and individuals who were previously priced out of the market. This democratization unlocks local entrepreneurship while attracting global capital eager to invest in high-growth emerging markets.

Transparency is another critical differentiator. Every transaction, be it an energy trade or a logistics update, is immutably recorded on-chain. This reduces corruption risks and builds trust among participants who may have little recourse under legacy systems. For development agencies and international donors evaluating impact, blockchain-based audit trails provide granular visibility into how funds are deployed and what outcomes are achieved.

Top Reasons Solana DePIN Projects Transform Emerging Markets

-

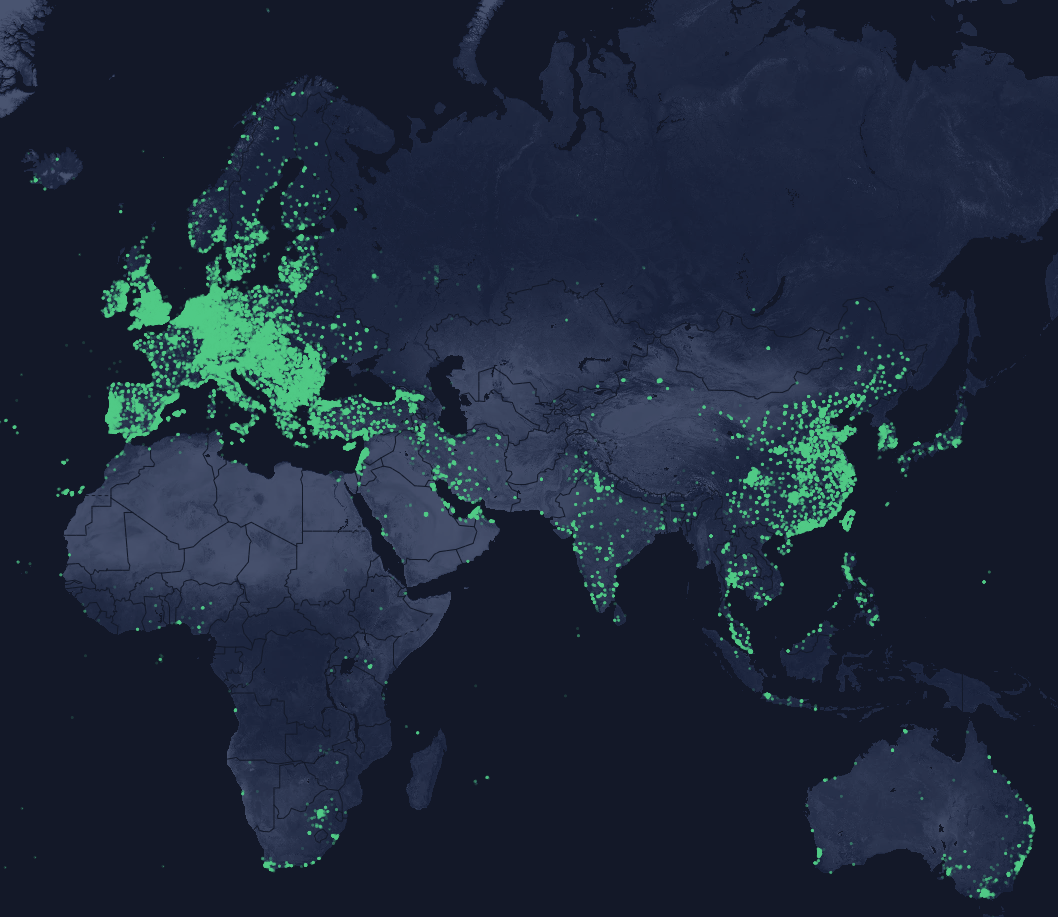

Decentralized Infrastructure Reduces Single Points of Failure: Solana-powered DePIN projects like Helium and Hivemapper create distributed networks for logistics and energy, minimizing risks associated with centralized systems and enhancing resilience in emerging markets.

-

Lower Entry Barriers for Hardware Deployment: Platforms such as DePINvest connect sponsors and hosts, enabling affordable deployment of physical infrastructure in underserved regions by addressing geographic and cost challenges.

-

Efficient, Transparent Supply Chain Management: Solana’s high throughput and low fees support real-time tracking and verification, as seen in decentralized logistics networks that outperform traditional centralized solutions, highlighted by the shortcomings of projects like Maersk and IBM’s TradeLens.

-

Scalable, Flexible Energy Solutions: DePIN enables the creation of mobile micro-grids and decentralized energy networks, exemplified by initiatives like Roshan Pakistan, which provide reliable, cost-effective power to communities with recurring energy shortages.

-

Incentivized Participation and Local Empowerment: DePIN projects reward individuals for contributing resources—such as bandwidth, mapping data, or energy—creating sustainable, community-driven infrastructure growth in emerging markets.

-

Interoperability and Security for Complex Systems: Solana’s robust infrastructure, alongside platforms like Polkadot, ensures secure, scalable, and interoperable solutions for managing intricate logistics and energy networks.

Looking ahead, cross-industry expansion is inevitable. As highlighted by recent coverage on Superteam Earn and AI CERTs® Store, DePIN models are already moving beyond energy and logistics into sectors like healthcare supply chains and telecommunications (see Polkadot’s use case summary). For Pakistan, and similar economies facing infrastructure bottlenecks, the next five years will be defined by how quickly these decentralized approaches can leapfrog traditional limitations.

“DePIN isn’t just a technology play, it’s an opportunity for emerging markets to redefine their growth trajectory on their own terms. ”

Ultimately, the success stories of KarachiKargo and Sindh SolarShare could serve as blueprints for other regions seeking sustainable development without reliance on legacy intermediaries or foreign aid packages. The combination of blockchain transparency, tokenized incentives, and open participation positions DePIN as a catalyst for both economic inclusion and technological sovereignty across the Global South.