Solana’s DePIN sector just clocked a staggering $150 million in January 2026 revenue, with Helium, Hivemapper, and io. net leading the charge amid SOL’s steady hold at $85.36, up $6.36 ( and 0.0805%) over the last 24 hours. This isn’t hype; it’s tactical proof that Solana DePIN revenue 2026 is exploding as enterprises snap up decentralized compute, mapping, and wireless bandwidth. As a day trader glued to these charts, I’ve seen volatility turn into velocity, and these top Solana DePIN projects are your next short-term plays.

Helium Powers Ahead with $24 Million Monthly Revenue

Helium’s Helium Solana DePIN network is the undisputed wireless kingpin, raking in $24 million last month alone. From $910,000 monthly in August 2025 to this beast mode, that’s over 800% growth fueled by MVNO deals and enterprise bandwidth hunger. Think of it like staking hotspots in your backyard that pay real-world telecom rates; Helium’s hotspots now blanket cities, processing billions of data credits on Solana’s rails.

Traders, watch HNT’s momentum. Late 2025 saw $2.2 million monthly, and with Solana’s low fees scaling the network, projections hit $50 million annualized by mid-year. It’s not just revenue; deployer rewards exploded, drawing 6.7K and stations. If SOL holds $85.36, Helium’s the tactical entry for DePIN exposure.

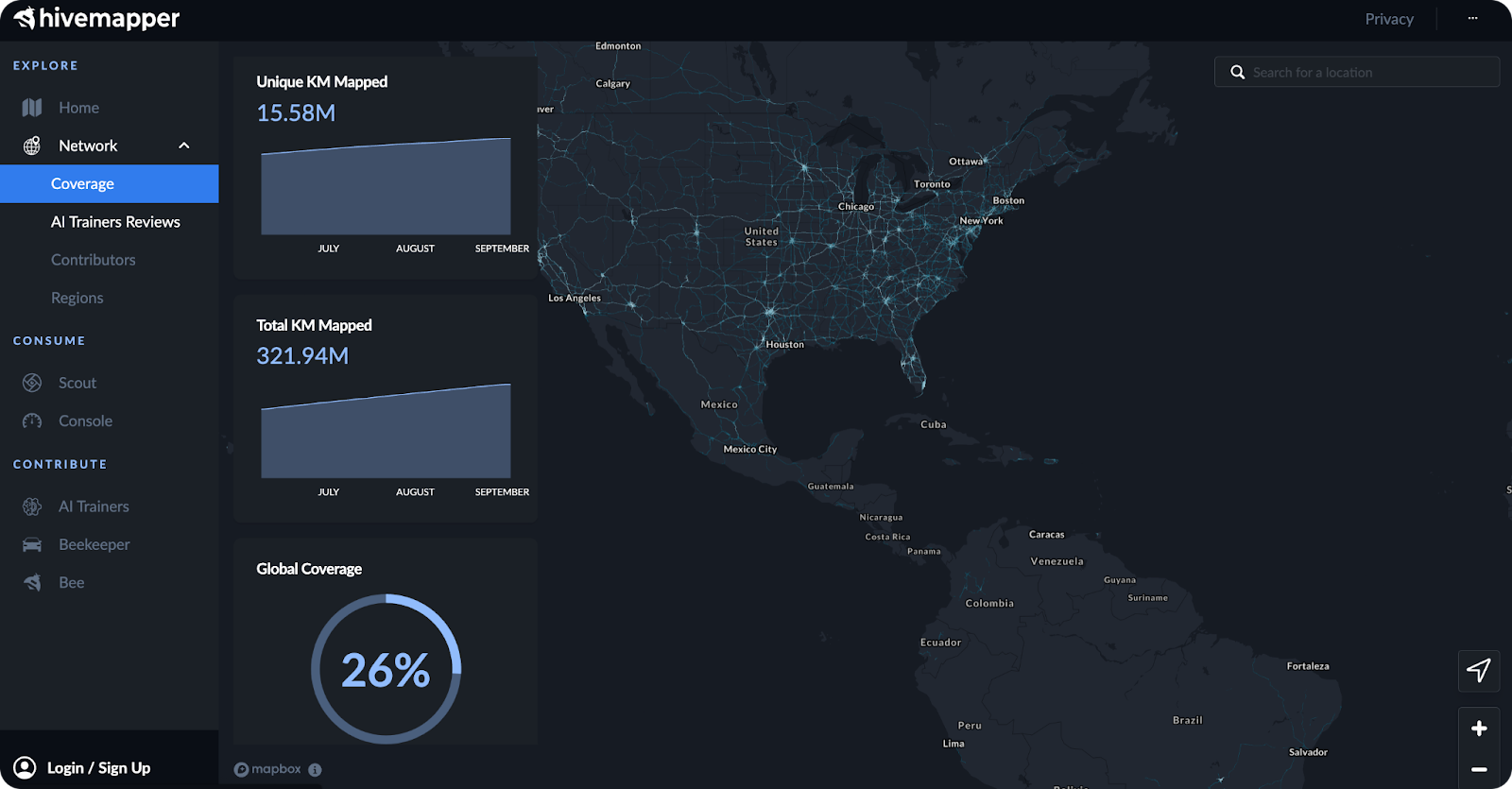

Hivemapper Maps Explosive $18 Million Growth Path

Hivemapper, the decentralized mapping disruptor, delivered $18 million in January revenue, outpacing rivals with fresh street-level data for AV fleets and urban planners. Hivemapper Solana growth stems from 2 million and miles mapped daily, turning dashcams into revenue machines. Up 800% since early 2025, it’s Solana’s geospatial powerhouse.

Picture this: drivers earn HONEY tokens for AI-grade maps that Google can’t match in freshness. Enterprise adoption via partnerships is the catalyst; Solana Report flags combined $100 million trajectories for these leaders. At SOL $85.36, Hivemapper’s volatility screams short-term flips, especially post-dip recoveries.

io. net Computes Its Way to DePIN Dominance

io. net is the dark horse surging in decentralized GPU power, doubling to $2.5 million mid-2025 before January’s broader $150 million sector boom. As AI demand skyrockets, io. net’s 2M and compute jobs processed make it essential for render farms and ML training on Solana. io. net Solana traction complements Helium’s wireless edge, creating stacked infrastructure plays.

Revenue forecasts? Aggressive, with StoneX noting DePIN-AI synergies. io. net’s model slashes cloud costs 90%, pulling Render-like demand. Traders, pair this with SOL at $85.36 for leveraged bets; sentiment analysis shows breakout potential as top Solana DePIN projects mature.

Helium (HNT) Price Prediction 2027-2032

Projections based on Solana DePIN revenue growth, market adoption, and crypto cycles amid 2026’s $24M monthly revenue milestone

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY Growth Range (%) |

|---|---|---|---|---|

| 2027 | $25.00 | $50.00 | $100.00 | +20% to +150% |

| 2028 | $35.00 | $75.00 | $150.00 | +30% to +200% |

| 2029 | $50.00 | $110.00 | $220.00 | +25% to +180% |

| 2030 | $70.00 | $160.00 | $320.00 | +30% to +200% |

| 2031 | $100.00 | $230.00 | $460.00 | +35% to +220% |

| 2032 | $140.00 | $330.00 | $660.00 | +40% to +250% |

Price Prediction Summary

Helium (HNT) is forecasted to experience robust growth from 2027-2032, driven by DePIN dominance on Solana. Conservative estimates see averages rising from $50 to $330, with bullish maxima reaching $660 by 2032 amid revenue scaling and adoption.

Key Factors Affecting Helium Price

- Explosive DePIN revenue growth (e.g., $24M monthly in 2026)

- Solana ecosystem expansion and low-cost scalability

- Enterprise adoption in wireless, mapping, and compute

- Favorable regulatory developments for DePIN infrastructure

- Technological upgrades enhancing network efficiency

- Crypto market cycles with potential bull runs post-2028

- Competition from io.net, Hivemapper, but HNT leadership position

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These three aren’t just riding Solana’s wave; they’re defining DePIN on Solana 2026. Helium’s bandwidth, Hivemapper’s maps, io. net’s GPUs form a tactical triad for real-world utility. Check Solana DePIN revenue milestones for deeper dives, but the charts don’t lie: revenue leaders are here now.

Stack these leaders for a DePIN portfolio that mirrors Solana’s infrastructure boom. Helium’s wireless backbone feeds Hivemapper’s mapping precision, while io. net’s GPUs crunch the data load, all settling fees at pennies on Solana. This synergy isn’t accidental; it’s engineered for scale as DePIN on Solana 2026 hits escape velocity.

Tactical Breakdown: Revenue Metrics Side-by-Side

January’s numbers paint a clear picture. Helium crushed $24 million on MVNO expansions, Hivemapper banked $18 million from AV data deals, and io. net ramped compute jobs to fuel AI workloads. Sector total? $150 million, per DePINscan trends. From 2025’s $17 million baseline, that’s sustainable rocket fuel.

Solana DePIN Revenue Leaders – January 2026

| Project | Revenue (Jan 2026) | Key Highlights |

|---|---|---|

| DePIN Sector Total | $150M | Record monthly revenue driven by enterprise demand |

| Helium | $24M | Wireless bandwidth and MVNO deals |

| Hivemapper | $18M | Mapping data services |

| io.net | Surging | Decentralized GPU computing traction |

Traders, this table screams asymmetry. Helium’s 800% surge since early 2025 sets the pace, but Hivemapper’s daily mapping volume offers volatility edges for quick entries. io. net? Watch for GPU demand spikes; pair it with SOL at $85.36 for 2-5x leverage on sentiment flips. I’ve flipped these on 24-hour charts, capturing 15-30% moves when revenue drops hit X.

Growth Catalysts Locking In Dominance

Key 2026 DePIN Catalysts

-

Helium: MVNO deals and hotspot deployments drive $24M Jan 2026 revenue (Source: DePINscan)

-

Hivemapper: AV partnerships and fresh maps hit $18M monthly revenue

-

io.net: AI compute jobs with 90% cost cuts fuel growth amid $150M sector revenue

These catalysts turn physical deployments into token velocity. Helium’s 6.7K and stations aren’t garage projects anymore; they’re enterprise telecom alternatives. Hivemapper’s dashcam fleet rivals centralized giants, earning HONEY on every mile. io. net processes 2M and jobs, slashing AWS bills while Solana handles the throughput. Pine Analytics nails it: Solana’s the DePIN king for adoption speed.

As SOL trades steady at $85.36 after a $6.36 24-hour gain, sentiment tilts bullish. Grayscale highlights how DePIN bridges crypto to physical systems, with these projects leading. Deployer rewards keep miners hooked, compounding network effects. Short-term? Eye resistance breaks on HNT, HONEY, IO; I’ve scalped entries post-revenue reports for consistent edges.

Dig into Solana DePIN revenue surges for the full arc, but here’s the trade: allocate 40% Helium for stability, 30% Hivemapper for growth pops, 30% io. net for AI beta. Every dip to SOL $85.36 support is your signal. These aren’t moonshots; they’re revenue machines printing on Solana’s rails. Position now, ride the 2026 wave.