Yield farming on Solana is evolving fast, and DePIN projects like Solstice and Sallar (with Neutral Trade in the mix) are at the center of this seismic shift. Forget the wild swings and sleepless nights glued to price charts – delta-neutral vaults are changing the game, promising stable returns regardless of market direction. In a world where volatility is the norm, these new strategies offer a rare sense of calm for DeFi users chasing yield without betting the farm.

Delta-Neutral Vaults: The Antidote to Volatility

Delta-neutral strategies aren’t new in traditional finance, but their on-chain implementation is a breakthrough for Solana DePIN yield strategies. The core idea? Balance long and short exposures so your net position (or “delta”) hovers near zero. This means you can earn yield from trading fees, funding rates, or protocol incentives – without sweating over whether SOL or BTC will moon or dump tomorrow.

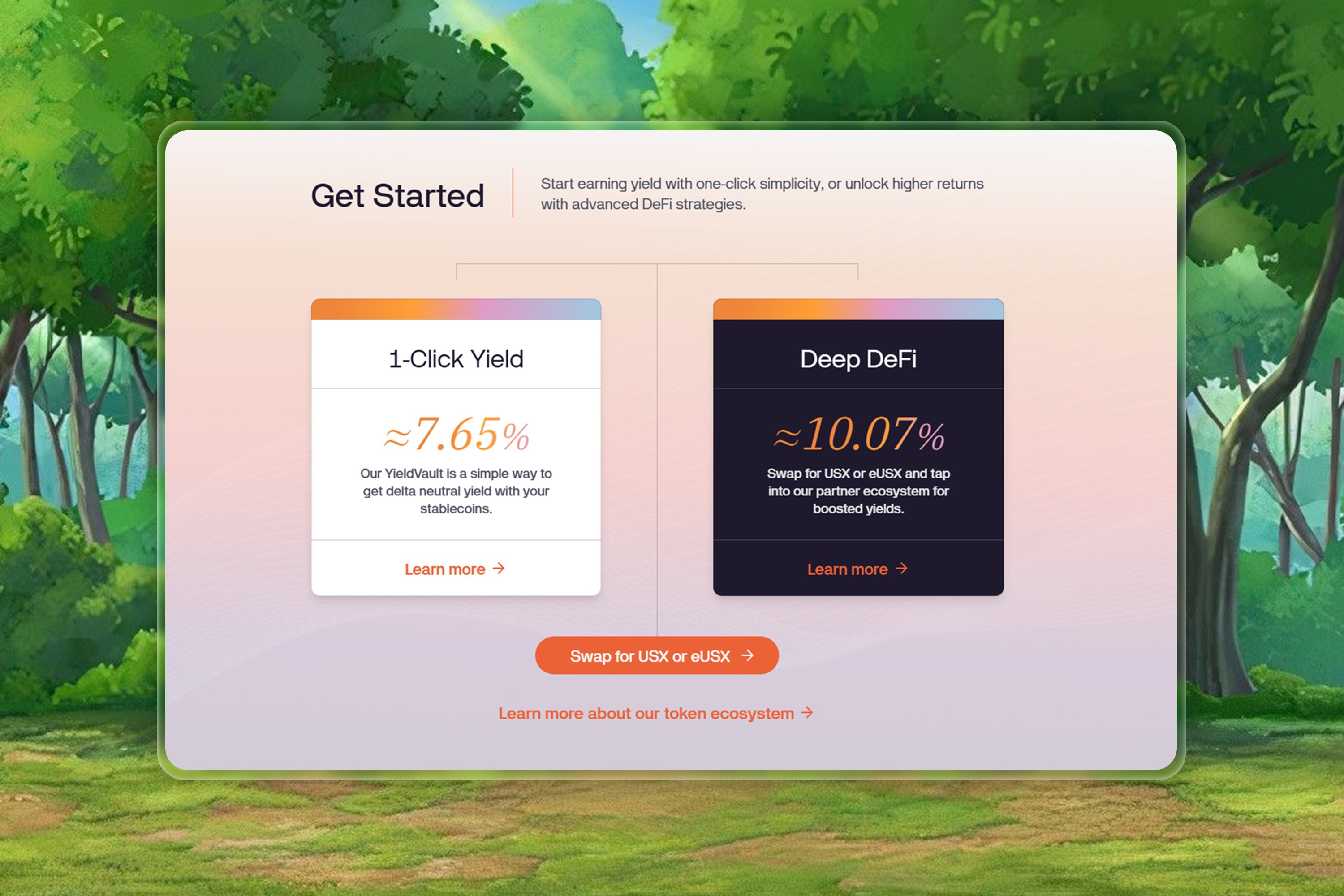

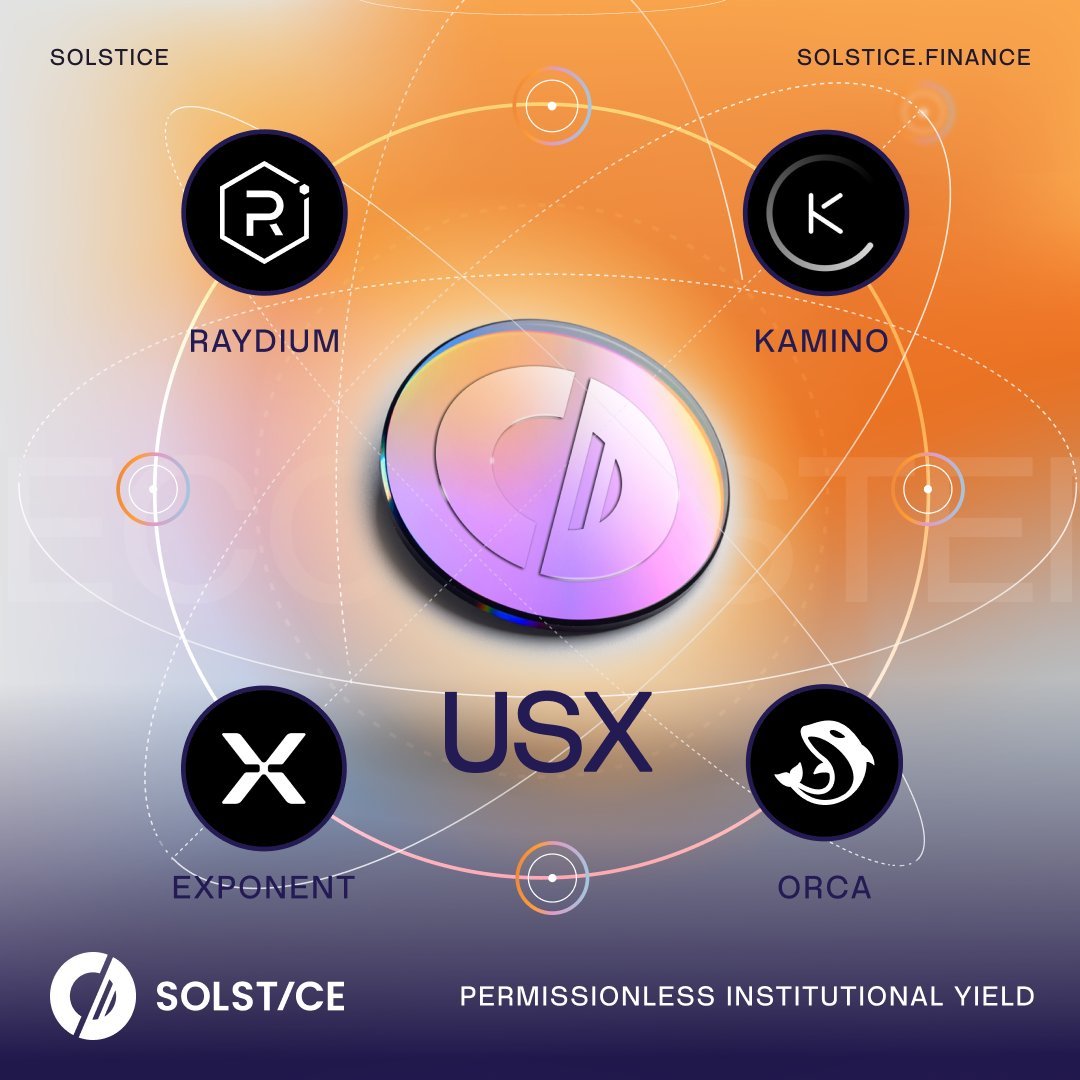

Solstice Finance is leading this charge with its USX stablecoin and YieldVault. Launched in September 2025, USX is fully backed 1: 1 by stable collateral, with real-time proof of reserves via Chainlink for transparency. The innovation here isn’t just another farm token – it’s about bringing institutional-grade returns to everyone on Solana’s open rails.

Solstice’s USX and YieldVault: Institutional Yield for All

The numbers speak volumes. Since inception, Solstice’s YieldVault has delivered a 13.96% net IRR with zero monthly losses, according to DLNews. In 2024 alone, it posted an impressive 21.5% return – all while maintaining a market-neutral stance. That’s not just hype; it’s proof that delta-neutral vaults can deliver real results at scale.

The secret sauce? Users deposit USX into YieldVault, which then deploys capital across multiple delta-neutral strategies. These include basis trades, perpetual hedging, and liquidity provisioning – all designed to firewall your principal from wild market swings. With $200M and TVL and growing, Solstice’s approach is turning heads across DeFi.

Composable Yield: Leveraged Loops and On-Chain Power Plays

The innovation doesn’t stop at basic yield farming. Solstice’s integration with Kamino Finance lets users use their yield-bearing eUSX as collateral to borrow more assets – unlocking advanced leveraged looping strategies for power users. This composability is what sets delta-neutral vaults on Solana apart from legacy platforms.

Key Benefits of Delta-Neutral Vaults for Solana DePIN Investors

-

Stable, Market-Neutral Returns: Delta-neutral vaults like Solstice YieldVault and Neutral Trade offer consistent yields (e.g., Solstice’s 13.96% net IRR, 21.5% annualized in 2024) by neutralizing exposure to price swings, providing peace of mind during volatile market conditions.

-

Institutional-Grade Strategies, Accessible to All: Platforms such as Solstice Finance democratize advanced, institutional-grade yield strategies, making them available to everyday DePIN investors in a permissionless, transparent manner.

-

Enhanced Capital Efficiency: By integrating yield-bearing assets like eUSX as collateral on protocols such as Kamino Finance, users can borrow against their holdings and implement leveraged yield strategies, maximizing returns on their capital.

-

Composability Across the Solana Ecosystem: Delta-neutral vaults are designed to interact seamlessly with other DeFi protocols, enabling complex strategies like leveraged looping and cross-platform hedging for advanced users.

-

Transparent, On-Chain Proof of Reserves: Solstice’s USX stablecoin is fully backed 1:1, with real-time proof of reserves via Chainlink, ensuring investor trust and transparency in collateral management.

-

Diversified Yield Sources: Neutral Trade’s JLP Delta Neutral Vault and SOL Super Staking strategies generate returns from multiple sources, including trading fees and staking rewards, reducing reliance on any single yield stream.

-

Minimized Risk of Impermanent Loss: By hedging exposure to volatile assets (e.g., BTC, SOL, ETH), delta-neutral vaults protect against impermanent loss, a common risk in traditional liquidity provision.

The result? Stable yields in the 8%-21% range (depending on strategy), permissionless access to sophisticated risk management tools, and real-time transparency thanks to Solana’s high-speed infrastructure. No wonder USX is now the fifth-largest stablecoin on Solana by TVL.

Sallar and Neutral Trade: Democratizing Hedge Fund Tactics

While Solstice grabs headlines, Neutral Trade (previously Sallar) is quietly building out its own arsenal of delta-neutral strategies for everyday users. Its JLP Delta Neutral Vault commands nearly two-thirds of its TVL, using spot JLP tokens as collateral and hedging with short perps on Drift Protocol. The effect? Users harvest trading fees and incentives while neutralizing exposure to BTC, SOL, or ETH price swings.

This isn’t just about safety – it’s about unlocking Sallar DePIN rewards that were once reserved for big institutions. Neutral Trade’s SOL Super Staking strategy goes a step further by maintaining full SOL exposure while still hedging out unwanted risks from other assets. That’s how you deliver a 30% APY without rolling the dice every day.

For DeFi veterans and newcomers alike, these delta-neutral vaults are a revelation. You don’t have to be a quant or hedge fund manager to access strategies that used to be the playground of Wall Street. The playbook is open: deposit, let the protocol handle the hedges, and watch your yields stack up without the daily drama of price swings.

What’s especially compelling is the on-chain transparency these protocols offer. Solstice’s live proof-of-reserves, for example, lets anyone verify collateral and track performance in real time. This kind of radical openness turns trust into code, a far cry from the opaque world of CeFi yield products.

Why Delta-Neutral Is Winning: The New Yield Paradigm

The numbers don’t lie: Solana DePIN yield strategies are drawing serious TVL as users flock to stable, market-neutral returns. Neutral Trade’s JLP vault alone represents nearly 64% of its protocol’s TVL, clear evidence that the appetite for delta-neutral is real and growing. Meanwhile, Solstice’s USX vault has scaled to $200M in TVL, delivering consistent returns even as broader crypto markets whipsaw.

For those seeking to maximize capital efficiency, the composability of Solana’s DePIN ecosystem is a game-changer. You can loop yields, stack rewards, and move between protocols with minimal friction. And thanks to Solana’s blazing-fast finality, you’re not waiting around for confirmations or eating high gas fees every time you adjust your strategy.

Top Reasons Investors Are Embracing Delta-Neutral Vaults on Solana DePIN

-

Consistent, Market-Neutral Returns: Delta-neutral vaults like Solstice Finance’s YieldVault have delivered stable yields—such as a 13.96% net IRR with no monthly losses since inception and a 21.5% return in 2024—regardless of market volatility.

-

Institutional-Grade Strategies for All: Platforms like Solstice Finance and Neutral Trade democratize access to sophisticated, institutional-grade yield strategies, making them available to everyday DeFi users on Solana.

-

Enhanced Transparency & Security: USX stablecoin is fully backed 1:1 with real-time proof of reserves via Chainlink, ensuring investor confidence and on-chain transparency.

-

Composable Yield Opportunities: Integration of eUSX as collateral on Kamino Finance enables advanced strategies like leveraged looping, letting users borrow against yield-bearing assets for greater capital efficiency.

-

Advanced Hedging for Volatility: Neutral Trade’s JLP Delta Neutral Vault uses spot JLP tokens and short perpetuals on Drift Protocol to neutralize price risk, allowing users to earn from trading fees without market exposure.

-

High-Yield SOL Exposure: The SOL Super Staking strategy by Neutral Trade delivers up to 30% APY by hedging BTC and ETH exposure and maximizing SOL rewards, appealing to SOL bulls seeking yield without added risk.

-

Proven Scale and Adoption: With USX now the fifth-largest stablecoin on Solana and Neutral Trade’s vaults commanding a significant share of TVL, these strategies have demonstrated robust adoption and reliability.

From a tactical perspective, the rise of delta-neutral vaults is a direct response to the volatility that defines crypto markets. Rather than trying to outguess the next price move, these strategies let you focus on sustainable, risk-adjusted returns. It’s a smarter way to farm, and one that’s finally accessible to everyone.

What’s Next for Yield on Solana?: Scaling DePIN and On-Chain Innovation

As more capital flows into Solana’s DePIN protocols, expect to see further innovation in composable yield products, cross-protocol integrations, and new forms of risk management. The blueprint set by projects like Solstice and Neutral Trade is already inspiring a new wave of builders to push the limits of what’s possible with on-chain yield.

For investors, the signal is clear: delta-neutral vaults are no longer an experiment, they’re fast becoming the backbone of sustainable DeFi yield on Solana. Whether you’re seeking steady passive income or advanced DePIN rewards, these strategies are setting a new standard for what’s possible in decentralized finance.