Solana’s latest leap forward is making headlines for good reason. The Alpenglow upgrade has just landed, and it’s already being hailed as a watershed moment for decentralized physical infrastructure networks (DePIN) on Solana. With over 98% validator approval, this isn’t just another technical patch – it’s a radical reimagining of how the Solana blockchain achieves speed, security, and scalability. If you’re tracking the evolution of DePIN infrastructure or weighing enterprise adoption on Solana, this is the upgrade you can’t afford to ignore.

Solana Alpenglow Upgrade: Speed Meets Decentralization

For years, blockchain networks have faced a trade-off: decentralization versus speed. But with Alpenglow, Solana is rewriting that equation. The upgrade replaces the old Proof-of-History and TowerBFT consensus mechanisms with two new powerhouses: Votor and Rotor. Votor slashes block finality from an average of 12.8 seconds down to a jaw-dropping 100,150 milliseconds. That’s not just fast – it puts Solana in the same league as global payment giants like Visa, all while preserving its decentralized ethos.

The implications are huge for DePIN infrastructure. Near-instant transaction confirmation means real-time data feeds, seamless device coordination, and frictionless payments – all critical for decentralized wireless networks, storage protocols, and IoT applications built on Solana.

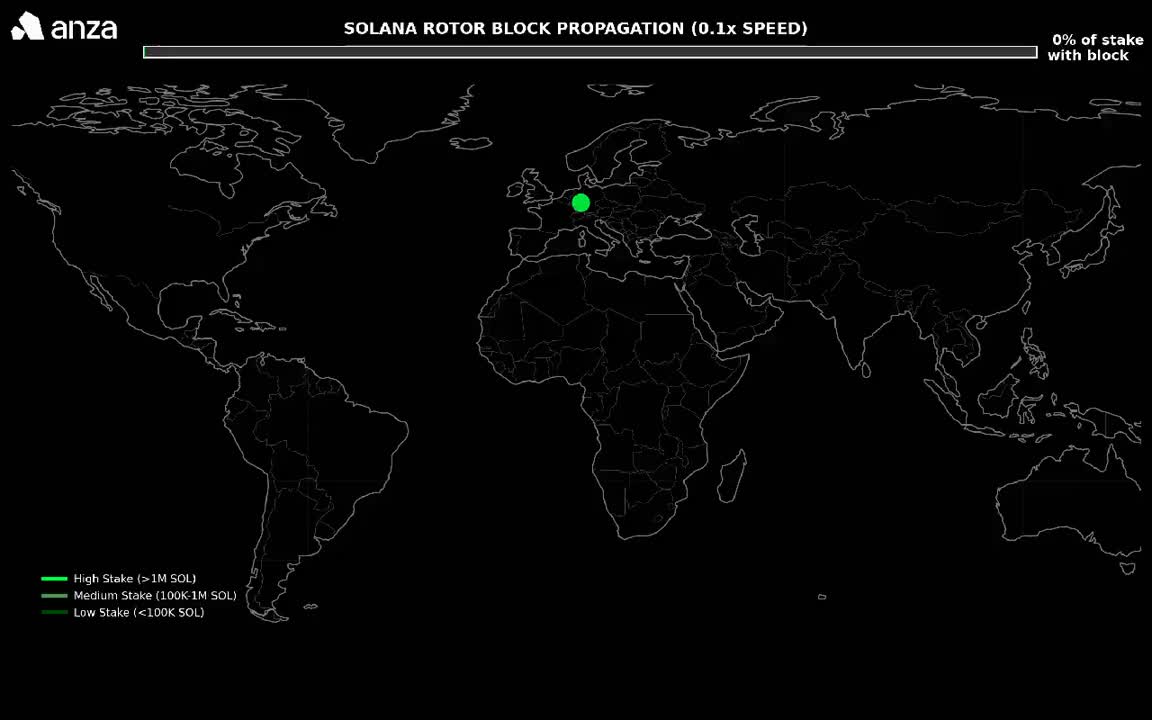

Rotor Protocol: The Engine Behind Network Efficiency

If Votor is the heart of Alpenglow’s consensus innovation, Rotor is its circulatory system. By replacing the multi-hop Turbine protocol with a streamlined single-hop model, Rotor optimizes how data propagates across Solana’s validator network. This not only boosts efficiency but also reduces network congestion and lowers operational costs – a win-win for both validators and DePIN projects alike.

As enterprise adoption ramps up and DePIN use cases multiply, these performance gains are more than just technical bragging rights. They’re foundational to supporting everything from real-time DeFi dapps to next-gen gaming ecosystems that demand split-second responsiveness.

Market Impact: SOL Price Holds Steady at $184.01

The market has taken notice of these advancements in a big way. As of today, Binance-Peg SOL (SOL) trades at $184.01, reflecting investor confidence in Solana’s upgraded capabilities. While short-term price fluctuations are inevitable (with a 24-hour range between $183.55 and $197.32), what stands out is how institutional total value locked (TVL) has surged to $8.6 billion post-upgrade – alongside $1.72 billion in new corporate treasury allocations according to recent reports.

Solana (SOL) Price Prediction Table (2026–2031)

Impact of Alpenglow Upgrade, Rotor Protocol, and DePIN Infrastructure on SOL Price Trajectory

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $160.00 | $210.00 | $285.00 | +14% | Post-upgrade adoption, bullish DeFi/gaming flows |

| 2027 | $190.00 | $260.00 | $335.00 | +24% | Mainstream real-time DeFi, increased institutional TVL |

| 2028 | $230.00 | $315.00 | $410.00 | +21% | Global enterprise adoption, competitive scaling |

| 2029 | $250.00 | $370.00 | $495.00 | +17% | Regulatory headwinds, but strong DePIN growth |

| 2030 | $210.00 | $340.00 | $600.00 | -8.5% | Potential cyclical correction, increased competition |

| 2031 | $270.00 | $405.00 | $720.00 | +19% | New ATHs, real-time finance mainstream, robust dApp ecosystem |

Price Prediction Summary

Solana’s Alpenglow upgrade positions it at the forefront of blockchain infrastructure, enabling near-instant transaction finality and optimizing network throughput. These advancements are likely to drive increased adoption in DeFi, gaming, and enterprise sectors. Price predictions show steady growth through 2029, a possible correction in 2030 as markets cycle, and renewed bullish momentum by 2031 as Solana cements its position as a leader in high-speed, decentralized applications. Minimum and maximum ranges account for both bullish adoption and potential market/regulatory challenges.

Key Factors Affecting Solana Price

- Alpenglow upgrade’s technical impact: 150ms finality and Rotor’s efficient data dissemination.

- Rising institutional adoption: TVL and treasury inflows.

- DePIN infrastructure growth and real-time use cases (DeFi, gaming, payments).

- Regulatory developments and global crypto policy shifts.

- Competition from other high-throughput blockchains (e.g., Ethereum, Sui, Aptos).

- Overall crypto market cycles and macroeconomic conditions.

- Potential for network outages, technical setbacks, or major exploits.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This surge in capital is more than speculative hype; it signals growing faith in Solana as an enterprise-ready blockchain platform tailored for high-throughput applications like DePIN infrastructure.

The New Fault Tolerance Model: Security Without Compromise

No discussion about consensus upgrades would be complete without touching on security enhancements. The new “20 and 20” fault tolerance model introduced by Alpenglow means that even if 20% of validators act maliciously and another 20% go offline simultaneously, the network remains robust against attacks or downtime (source). This resilience is especially crucial for mission-critical DePIN deployments where reliability isn’t optional – it’s essential.

With these security guarantees, DePIN builders and institutional participants can confidently expand their operations on Solana, knowing that both performance and reliability are uncompromised. This is a major differentiator as decentralized infrastructure networks compete with traditional, centralized providers.

Unlocking DePIN Potential: What Comes Next?

The ripple effects of the Alpenglow upgrade and Rotor protocol are already being felt across the Solana ecosystem. DePIN projects now enjoy a foundation that supports real-time sensor networks, decentralized wireless (DeWi), and edge computing applications, all with the kind of speed and uptime previously reserved for Web2 giants. Developers are reporting smoother onboarding, while users benefit from lower fees and near-instant confirmations.

Key Benefits of Alpenglow and Rotor for DePIN Projects

-

Ultra-Fast Transaction Finality: The Alpenglow upgrade reduces Solana’s transaction finality from 12.8 seconds to just 100–150 milliseconds, enabling real-time data and payment flows essential for DePIN (Decentralized Physical Infrastructure Networks) applications.

-

Enhanced Network Efficiency with Rotor: The new Rotor protocol streamlines data dissemination, replacing the old Turbine system with a single-hop model. This minimizes latency and network congestion, supporting large-scale DePIN deployments.

-

Greater Security and Fault Tolerance: Alpenglow introduces a “20+20” fault tolerance model, keeping the network secure even if 20% of validators are malicious and another 20% go offline—crucial for critical infrastructure projects.

-

Scalability for Real-World Applications: The upgrade’s performance boost makes Solana suitable for high-throughput DePIN use cases like IoT networks, smart cities, and decentralized wireless, matching the speed and reliability of centralized systems.

-

Increased Institutional Confidence: With improved speed and reliability, Solana has attracted $8.6B in institutional TVL and $1.72B in corporate treasury allocations, signaling strong support for DePIN projects on the network.

Looking ahead, the combination of Votor and Rotor is expected to drive even greater enterprise adoption. With fee reduction and simplified validator operations, more organizations are exploring Solana for everything from decentralized logistics to smart city infrastructure. The upgrade has also sparked renewed interest among DePIN investors, with new capital flowing into both established and emerging projects.

Community Response: Validators and Builders Weigh In

It’s not just the numbers that tell the story, the Solana community itself has rallied around Alpenglow. Validators have praised the streamlined consensus process, noting improved network stability and reduced hardware requirements. Meanwhile, DePIN builders are already experimenting with new architectures that leverage Rotor’s single-hop data propagation for more resilient and scalable deployments.

Feedback from early adopters suggests that this upgrade is more than a technical milestone, it’s a cultural shift. There’s a palpable sense of momentum as teams push the boundaries of what decentralized infrastructure can achieve on Solana.

What to Watch: The Road Ahead for Solana DePIN

As Solana continues to innovate, keep an eye on how these upgrades reshape the competitive landscape for decentralized physical infrastructure networks. Will we see a wave of new DePIN protocols leveraging ultra-fast finality? Could Solana’s fee reduction and security model set new benchmarks for enterprise adoption?

One thing is clear: with SOL holding steady at $184.01 and validator support at record highs, Solana has positioned itself as a leader in the race to build the next generation of decentralized infrastructure.

Ready to explore or build on Solana’s upgraded DePIN infrastructure? The time to get involved is now, whether you’re an investor, developer, or just curious about what comes next for decentralized networks.