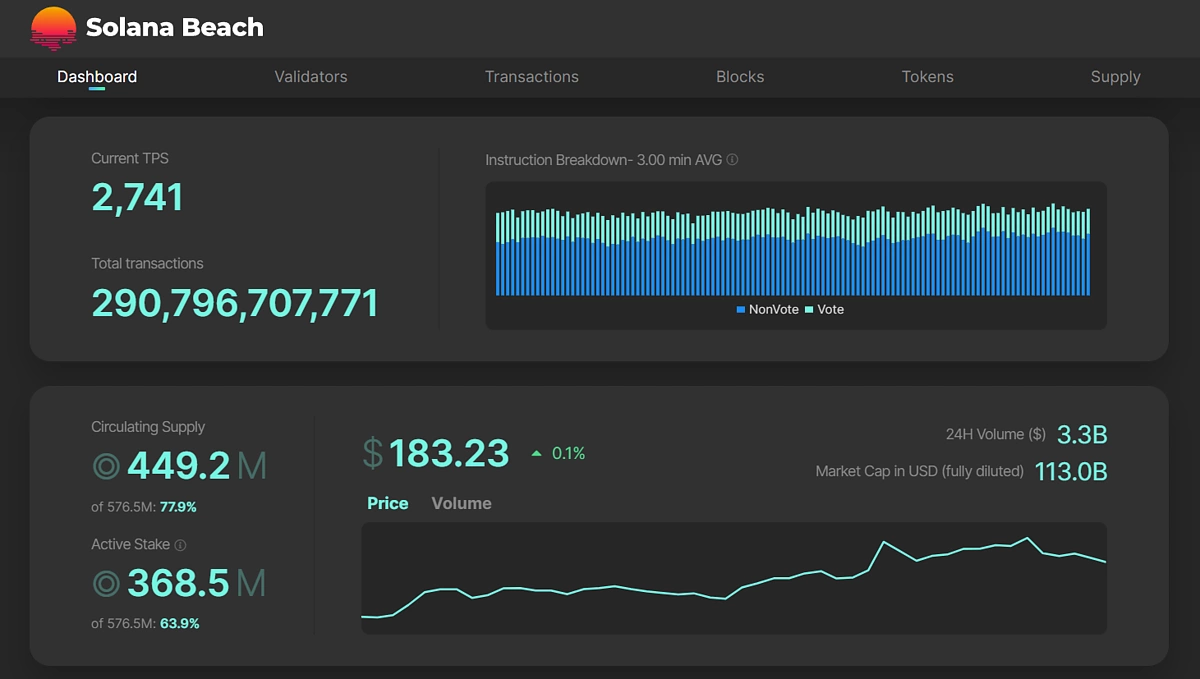

Solana’s Decentralized Physical Infrastructure Network (DePIN) ecosystem is entering a new era of maturity in 2025, with projects that are not only scaling rapidly but also redefining how real-world infrastructure connects to the blockchain. As Solana maintains its strong market position with SOL trading at $181.56 as of October 12,2025, the DePIN sector stands out for its blend of performance, innovation, and community-driven growth. Here’s an in-depth look at the top Solana DePIN projects to watch this year.

Helium Network: Leading Decentralized Wireless Connectivity

Helium Network (HNT, MOBILE, IOT) remains the flagship Solana DePIN project, setting benchmarks for decentralized wireless infrastructure. With over 176,000 subscribers and nearly 70,000 active nodes, Helium has proven its ability to scale beyond early adopter circles. The introduction of a $20 unlimited 5G plan and partnerships with telecom giants like AT and T and Telefónica have fueled user acquisition and network expansion. On-chain revenue now stands at approximately $2.29 million, a testament to robust adoption and sustainable growth. The network’s multi-token approach (HNT for governance, MOBILE for mobile rewards, IOT for IoT device incentives) allows nuanced participation across different verticals.

The strength of Helium lies in its grassroots community deployment model and its seamless migration to Solana’s high-speed chain. This move has unlocked new scalability potential while maintaining the project’s ethos of open access and permissionless participation.

Hivemapper and Render Network: Mapping and Compute Power Redefined

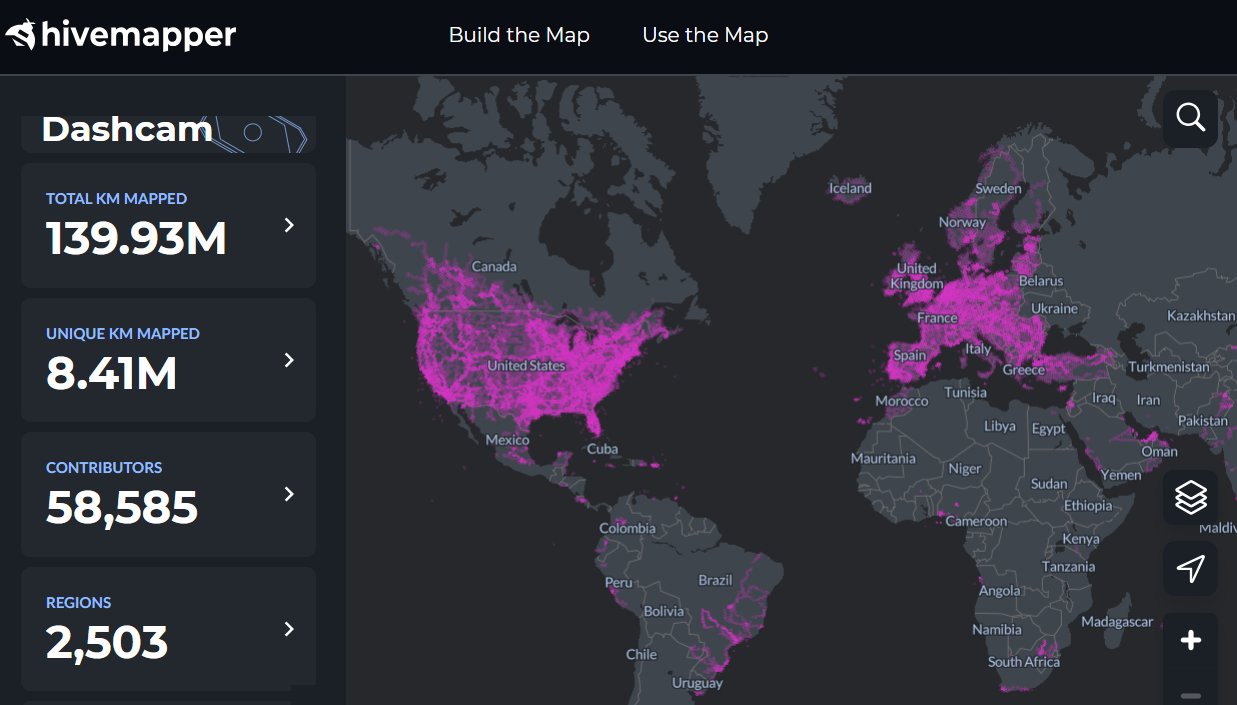

Hivemapper (HONEY) is transforming geospatial data collection by incentivizing drivers globally to map their surroundings using dashcams. By October 2025, Hivemapper contributors have mapped over 139 million kilometers, with approximately 6,000 monthly active contributors. The platform’s tokenomics are designed for sustainability – an 81% increase in token burn rate this year has generated $114,000 YTD revenue from real-world usage (source). Hivemapper exemplifies how decentralized networks can outpace traditional mapping providers in both scale and freshness of data.

Render Network (RNDR) is another heavyweight on Solana’s DePIN roster. With a market cap surpassing $3.6 billion, Render has become synonymous with decentralized GPU computing power. Its integration with industry-standard graphics tools like Blender positions Render as the backbone for distributed rendering tasks across film production, metaverse development, and AI training workloads (source). Over 121 million RNDR tokens burned signals massive demand for compute resources, proof that tokenized infrastructure can deliver both utility and economic value.

Diversifying DePIN: SuiDePIN, Bless DePIN and Brew DePIN Enter the Fray

The next wave of Solana DePIN projects is characterized by specialization, each addressing unique infrastructure needs while leveraging Solana’s composability:

- SuiDePIN ($SUIDEPIN): This project is building modular toolkits for deploying custom physical networks on Solana. By abstracting away technical complexity, SuiDePIN empowers communities to launch decentralized mesh networks or sensor grids tailored to local requirements.

- Bless DePIN ($BLESS): Bless focuses on privacy-centric infrastructure sharing, enabling users to securely monetize idle bandwidth or compute resources without sacrificing confidentiality.

- Brew DePIN ($BREW): Brew aims to decentralize supply chains in food and beverage logistics by tracking provenance data on-chain from farm through distribution.

Top 10 Solana DePIN Projects to Watch in 2025

-

Helium Network (HNT, MOBILE, IOT): The leading decentralized wireless network, Helium has surpassed 176,000 subscribers and nearly 70,000 active nodes. Its $20 unlimited 5G plan and partnerships with AT&T and Telefónica have fueled rapid adoption. On-chain revenue reached $2.29 million as of October 2025, highlighting its robust growth.

-

Hivemapper (HONEY): Hivemapper is transforming geospatial data collection through a decentralized mapping network. By October 2025, it has mapped over 139 million kilometers with around 6,000 monthly active contributors. An 81% increase in token burn rate and $114,000 in year-to-date revenue reflect its expanding ecosystem.

-

Render Network (RNDR): A decentralized GPU computing platform, Render Network boasts a $3.6 billion market cap and integration with industry tools like Blender. Its migration to Solana has improved scalability, and over 121 million RNDR tokens have been burned, indicating strong demand.

-

SuiDePIN ($SUIDEPIN): SuiDePIN focuses on decentralized infrastructure for real-world assets and IoT devices. It leverages Solana’s high throughput to enable scalable, permissionless physical network deployments, supporting a wide range of DePIN use cases.

-

Bless DePIN ($BLESS): Bless DePIN aims to democratize access to decentralized infrastructure by incentivizing resource sharing and network participation. Its tokenomics are designed to reward contributors and foster a collaborative DePIN ecosystem on Solana.

-

Brew DePIN ($BREW): Brew DePIN is building decentralized physical infrastructure for supply chain and logistics. By leveraging Solana’s speed and security, Brew DePIN enhances transparency and efficiency in real-world asset tracking and management.

-

Zebec Network ($ZBCN): Zebec Network offers real-time, programmable money streams and payroll solutions on Solana. Its DePIN initiatives focus on integrating physical payment infrastructure with blockchain for seamless, continuous transactions.

-

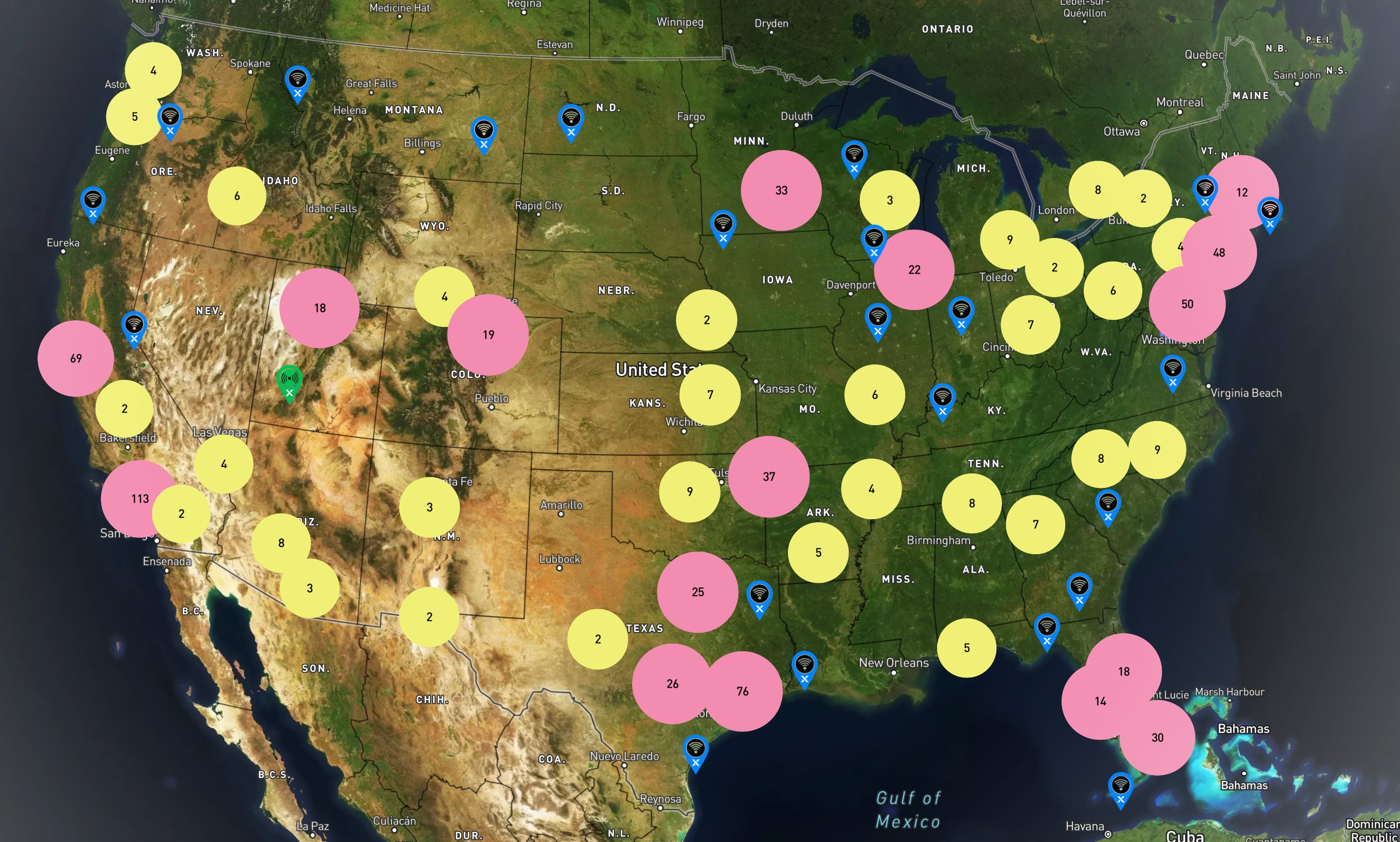

XNET DePIN ($XNET): XNET DePIN is pioneering decentralized wireless connectivity by deploying community-powered network nodes. Its model incentivizes users to expand coverage and bandwidth, supporting the broader Solana DePIN ecosystem.

-

StorAgent ($STORAGENT): StorAgent provides decentralized storage solutions, enabling users to securely share and monetize unused storage capacity. Built on Solana, it ensures fast, low-cost, and censorship-resistant data storage.

-

Upt Protocol ($UPT): Upt Protocol is focused on decentralized uptime monitoring and infrastructure reliability. It leverages Solana’s blockchain to provide transparent, tamper-proof performance data for web services and physical networks.

This diversification signals a maturing ecosystem where not just network size but also vertical expertise drives value creation. Each project brings distinct advantages, whether it’s secure private sharing (Bless), hyper-local deployment (SuiDePIN), or real-world asset tracking (Brew).

Zebec Network and XNET: Expanding Payment Rails and Wireless Coverage

Zebec Network ($ZBCN) continues to innovate in streaming payments, a critical component for automated microtransactions within decentralized infrastructure services. Meanwhile, XNET DePIN ($XNET) focuses on expanding wireless mesh networks into underserved regions by rewarding node operators with native tokens tied directly to bandwidth provisioned.

Solana (SOL) Price Prediction 2026-2031: DePIN Ecosystem Impact

Forecasts based on Solana’s DePIN growth, technical trends, and evolving crypto market conditions.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $140.00 | $200.00 | $270.00 | +10% | Post-2025 consolidation, DePIN adoption grows, but broader market volatility may cap gains. |

| 2027 | $160.00 | $235.00 | $320.00 | +17.5% | Increased DePIN usage, more mainstream partnerships, regulatory clarity improves sentiment. |

| 2028 | $185.00 | $285.00 | $390.00 | +21.3% | Bullish cycle, Solana DePIN projects reach mass adoption, technology upgrades boost scalability. |

| 2029 | $210.00 | $340.00 | $470.00 | +19.3% | Continued DePIN sector expansion, but competition from other L1 blockchains intensifies. |

| 2030 | $185.00 | $310.00 | $480.00 | -8.8% | Potential market correction after strong prior growth, but institutional interest remains. |

| 2031 | $220.00 | $370.00 | $560.00 | +19.4% | Renewed bullish phase, Solana cements position as DePIN leader, global regulatory maturity. |

Price Prediction Summary

Solana (SOL) is positioned for progressive growth through 2031, fueled by the expanding DePIN ecosystem and increasing real-world infrastructure adoption. Price predictions reflect a combination of continued technological innovation, growing user bases, and cycles of market volatility. The average price is expected to rise from $200.00 in 2026 to $370.00 in 2031, with bullish scenarios reaching as high as $560.00 if DePIN adoption accelerates and market sentiment remains positive.

Key Factors Affecting Solana Price

- Growth and adoption of Solana-based DePIN projects (Helium, Render, Hivemapper, Roam, etc.)

- Mainstream and enterprise partnerships driving real-world usage

- Technological improvements in Solana’s scalability and security

- Competition from other L1 blockchains and DePIN networks

- Global regulatory developments impacting crypto markets

- Overall macroeconomic conditions and risk appetite

- Cycles of market sentiment, including corrections and bullish phases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These strategic expansions are not just technical milestones, but also catalysts for broader adoption of Solana DePIN projects in both urban and rural environments. Zebec Network’s programmable payment flows enable real-time compensation for infrastructure contributors, a model that could soon underpin everything from decentralized ride-sharing to edge compute marketplaces. XNET DePIN’s focus on last-mile connectivity is especially relevant as the global demand for affordable, permissionless internet access continues to climb.

StorAgent and Upt Protocol: Data Sovereignty and Interoperability

StorAgent ($STORAGENT) is carving out a niche in decentralized data storage and retrieval. By leveraging Solana’s throughput, StorAgent enables individuals and enterprises to securely store large datasets with verifiable integrity and rapid access times. This is particularly valuable for sectors like healthcare, AI research, and IoT where data privacy and auditability are paramount. StorAgent’s model rewards node operators based on uptime and data retrieval efficiency, aligning incentives with network reliability.

Upt Protocol ($UPT) addresses the growing need for interoperability across DePIN networks. Upt Protocol provides seamless cross-chain communication tools that allow physical infrastructure assets deployed on Solana to interact with other blockchains or legacy systems. This interoperability is critical as enterprises look to bridge existing workflows with new decentralized infrastructure, reducing friction and unlocking new use cases in supply chain management, logistics, and real-time asset tracking.

Community Growth: The Engine Behind DePIN Momentum

The common thread across these top Solana DePIN projects is their vibrant community engagement. Whether it’s Helium’s open deployment model or Hivemapper’s contributor-driven mapping, each project prioritizes user participation as a core growth strategy. In 2025, community governance forums have become increasingly influential in shaping protocol upgrades, reward structures, and partnership decisions, ensuring that value accrues not just to early investors but also to active participants building the network from the ground up.

This surge in grassroots involvement has tangible impacts: token burn rates are rising (as seen with HONEY and RNDR), real-world deployments are accelerating (notably XNET’s rural coverage), and developer activity is at an all-time high across GitHub repositories tied to these protocols.

Strategic Outlook: What Sets Top Solana DePIN Projects Apart?

Performance metrics like active nodes, token burn rates, revenue generation, and user growth provide clear evidence that the best Solana DePIN tokens provides HNT, HONEY, RNDR, ZBCN, XNET, SUIDEPIN, BLESS, BREW, STORAGENT, UPT: are not just speculative assets but productive components of a new digital-physical economy.

- Ecosystem Synergy: Many of these projects interoperate seamlessly or even collaborate on shared infrastructure layers (such as payment rails or wireless mesh backbones).

- Sustainable Tokenomics: Burn-and-earn models incentivize both usage and long-term holding rather than short-term speculation.

- User-Centric Governance: DAO structures empower participants to shape protocol direction based on real-world feedback loops.

- Diverse Applications: From decentralized mapping (Hivemapper) to streaming payments (Zebec) to cross-chain interoperability (Upt Protocol), innovation is happening at every layer of the stack.

The convergence of technical innovation, sustainable tokenomics, robust community governance, and above all, measurable real-world impact, positions these ten projects at the forefront of Solana’s decentralized infrastructure revolution. As institutional interest grows alongside grassroots adoption through 2025 and beyond, expect continued momentum from this cohort as they set new standards for blockchain-powered physical networks worldwide.