In the bustling landscape of blockchain innovation, Solana’s DePIN ecosystem has emerged as a powerhouse by 2026, capturing a significant share of global revenue rankings. Projects leveraging Solana’s high-throughput architecture are not just participating; they are dominating, with six standout networks generating substantial income from real-world utility. This surge in solana depin revenue 2026 underscores the blockchain’s maturity in supporting decentralized physical infrastructure, from wireless connectivity to GPU compute and geospatial mapping. Drawing from analytics platforms like DePINscan and Messari, these top performers highlight why Solana is the execution layer for tangible networks.

Solana’s appeal lies in its ability to handle the data-intensive demands of DePIN applications at scale. Unlike legacy chains bogged down by congestion, Solana processes millions of transactions per second, enabling seamless micropayments for node operators and users alike. Recent data reveals that six out of the top ten DePIN projects by annual revenue are either native to or expanding on Solana, a trend propelled by migrations like Helium’s in 2023. This positions Solana as the go-to for top solana depin projects, where revenue is tied directly to physical hardware deployment and service delivery.

Helium Leads with Wireless Network Monetization

Helium (HNT) tops the charts as the quintessential Solana DePIN success story. Its decentralized wireless network supports IoT devices, 5G, and mobile connectivity, rewarding hotspot owners for coverage provision. Post-migration to Solana, Helium’s efficiency skyrocketed, hitting $1.5 million in on-chain revenue by mid-2025 from data offloading and subscriptions. This figure reflects a network spanning millions of devices worldwide, proving that proof-of-coverage models thrive on Solana’s speed. Investors eyeing helium solana revenue should note Helium’s pivot to sustainable tokenomics, burning fees to reduce supply while expanding into urban 5G hotspots.

What sets Helium apart is its real-world adoption. Enterprises use it for asset tracking and smart cities, generating consistent demand. Node operators earn HNT passively, creating a flywheel effect that boosted active hotspots by over 40% in 2025. For those researching top solana depin projects, Helium exemplifies how DePIN bridges crypto to physical systems, as noted in Grayscale reports.

io. net’s Compute Revolution on Solana

io. net (IO) follows closely, aggregating idle GPUs into a decentralized cloud for AI and machine learning. By tapping Solana for settlements, io. net slashed latency and costs, doubling monthly revenue to $2.5 million in 2025. This growth stems from partnerships with AI firms needing scalable compute without centralized providers like AWS. Users monetize spare hardware securely, with Solana’s sub-second finality ensuring instant payouts.

Diving deeper into io. net solana depin, the platform’s marketplace matches workloads to global nodes, supporting everything from model training to inference. Its 2025 metrics show thousands of active suppliers, with revenue funneled back via token incentives. This model not only democratizes compute but also aligns with Solana’s low-fee environment, making high-volume tasks viable. As AI demand explodes, io. net’s trajectory signals strong solana depin revenue 2026 potential.

Top 6 Solana DePIN Projects Revenue Snapshot

| Rank | Project | Token | Revenue Snapshot |

|---|---|---|---|

| 1 | Helium | HNT | $1.5M on-chain revenue (mid-2025) |

| 2 | Render Network | RNDR | $300k weekly peak (late 2024) |

| 3 | io.net | IO | $2.5M monthly (2025) |

| 4 | Hivemapper | HONEY | $114k YTD (2025) |

| 5 | GEODNET | GEOD | Geospatial leader (GNSS stations) |

| 6 | Nosana | NOS | Node surge in GPU market (2025) |

GEODNET’s Precision in Geospatial Data

GEODNET rounds out the podium with its GNSS station network delivering centimeter-level location accuracy. Operators deploy receivers to earn tokens for real-time data feeds used in agriculture, drones, and autonomous vehicles. On Solana since early inception, GEODNET benefits from robust oracle integrations for data verification, fueling enterprise adoption. While exact 2026 figures evolve, its complementary role to AI, as per StoneX commentary, positions it firmly in revenue leaders.

GEODNET’s strength is granularity: each station contributes to a global mesh far surpassing centralized alternatives in coverage and cost. For geodnet solana enthusiasts, the project’s focus on proof-of-location ensures data integrity, a critical factor in high-stakes applications. As mapping demands grow, GEODNET’s Solana backbone enables micro-transactions per data query, steadily climbing revenue ranks. Check detailed milestones in Solana DePIN revenue analysis.

These frontrunners set the stage for Render Network, Hivemapper, and Nosana, each bringing unique infrastructure plays to Solana’s ecosystem.

Render Network (RNDR) harnesses Solana’s scalability to deliver decentralized GPU rendering, empowering creators and AI developers with on-demand compute. After its migration, Render achieved weekly revenue peaks near $300,000 by late 2024, burning over 121 million RNDR tokens in the process. This burn mechanism tightens supply while funding network growth, attracting thousands of active nodes. Render’s edge comes from handling complex tasks like 3D animation and video effects at fractions of centralized costs, with Solana enabling real-time job distribution and payouts.

For developers, Render’s integration with Solana streamlines workflows previously hampered by Ethereum’s fees. Its revenue model rewards GPU providers proportionally to contributed power, fostering a competitive marketplace. As AI rendering demands intensify, Render solidifies its spot among top solana depin projects, with projections pointing to sustained growth in solana depin revenue 2026. Node operators report consistent earnings, underscoring the project’s maturation into a reliable infrastructure layer.

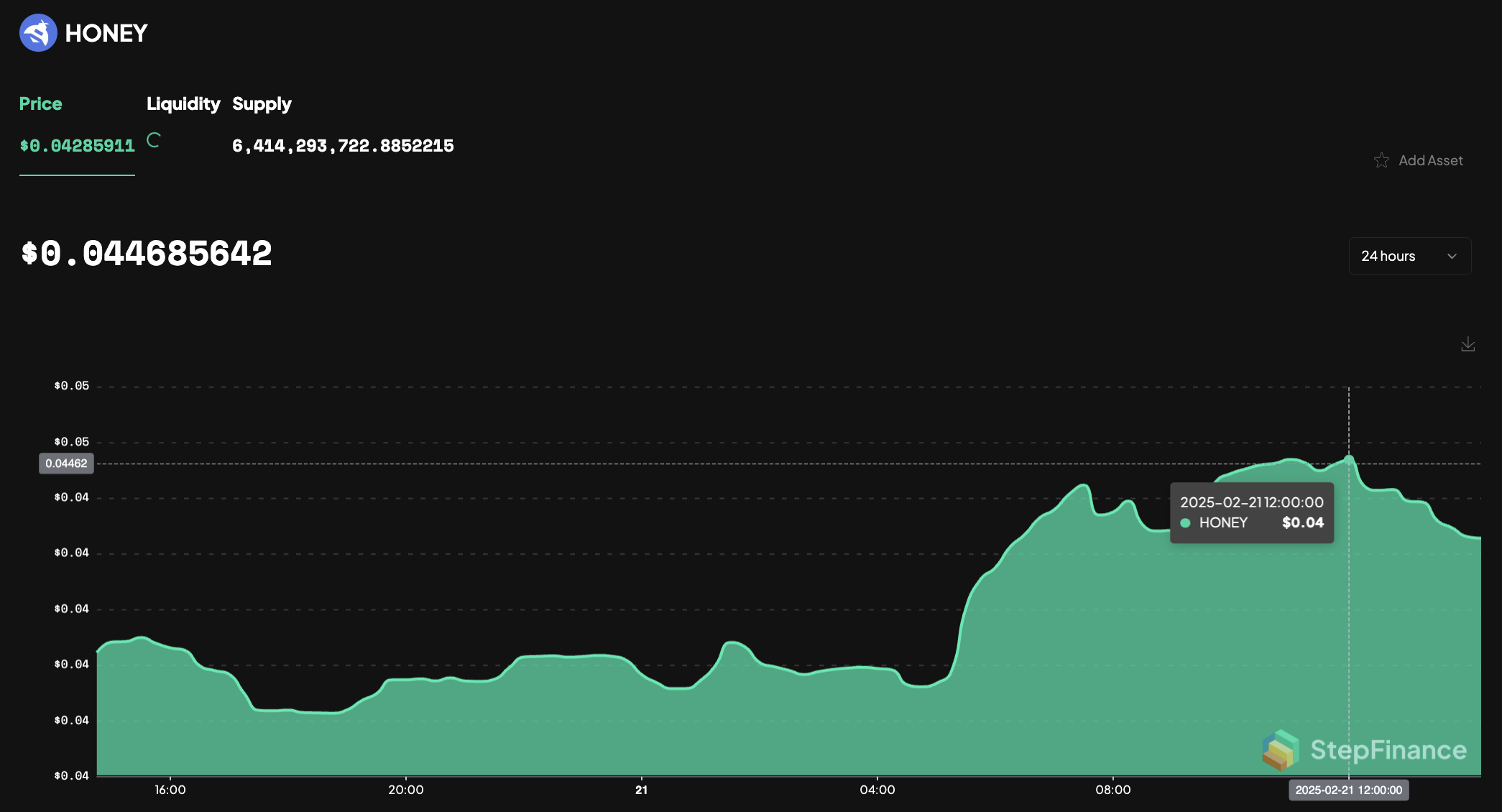

Hivemapper’s Mapping Flywheel

Hivemapper (HONEY) incentivizes a global fleet of dashcam-equipped vehicles to build fresh street-level maps, outpacing Google in timeliness and cost. By October 2025, contributors mapped over 139 million kilometers with 6,000 monthly active users, generating $114,000 in year-to-date revenue from map data sales. Solana’s low latency supports instant rewards per verified kilometer, encouraging broader participation.

The platform’s sustainability shines through tokenomics that allocate fees to stakers and mappers alike. Unlike static satellite imagery, Hivemapper delivers dynamic, ground-truth data for navigation apps, logistics, and urban planning. Its growth trajectory, detailed in Solana ecosystem reports, positions Hivemapper as a revenue contender, blending everyday driving with blockchain utility in the DePIN space.

Nosana’s AI Inference Edge

Nosana (NOS) specializes in decentralized GPU compute tailored for AI inference and rendering, linking idle hardware to developers worldwide. The 2025 launch of its GPU market sparked a surge in daily active nodes, capitalizing on Solana’s efficiency for high-throughput job matching. This positions Nosana as a nimble alternative to io. net, focusing on specialized workloads like generative AI.

Nosana’s revenue stems from job fees distributed to hosts, with Solana’s composability allowing seamless integrations with other DePINs. Early adopters praise its uptime and cost savings, metrics that propelled it into the top revenue ranks. As enterprises seek sovereign AI infrastructure, Nosana’s Solana foundation ensures it scales without bottlenecks.

Across these six leaders, patterns emerge: Solana’s sub-cent fees and rapid finality unlock micropayments essential for DePIN’s granular services. Helium’s hotspots, io. net’s GPUs, GEODNET’s stations, Render’s render farms, Hivemapper’s dashcams, and Nosana’s inference nodes collectively demonstrate diversified revenue streams, from subscriptions to usage fees. Analytics from DePINscan reveal a combined market cap exceeding billions, with Solana capturing over 60% of top DePIN activity.

Top 6 DePIN Key Metrics

-

Helium (HNT): $1.5M on-chain revenue (mid-2025) from data offloading & subscriptions. Powers IoT, 5G, mobile networks post-Solana migration. Real-world: decentralized wireless coverage. Source

-

io.net (IO): Doubled monthly revenue to $2.5M in 2025. Aggregates idle compute for AI, ML, scientific workloads. Monetizes global GPU resources on Solana. Real-world: decentralized cloud computing. Source

-

GEODNET: Decentralized GNSS stations for cm-level precise location data. Node operators earn from real-time feeds. Real-world apps: mapping, agriculture, autonomous vehicles. Source

-

Render Network (RNDR): Weekly revenue peak $300K (late 2024), thousands active nodes. GPU compute for creators & AI devs. Burned 121M RNDR. Real-world: scalable rendering tasks. Source

-

Hivemapper (HONEY): 139M km mapped, 6,000 monthly active contributors, $114K YTD revenue (Oct 2025). Dashcam-based geospatial data. Real-world: street-level mapping. Source

-

Nosana (NOS): Decentralized GPU for AI inference & rendering. Surge in daily active nodes after 2025 market launch. Connects hosts & developers. Real-world: AI infrastructure. Source

This concentration of talent fuels network effects, where one project’s data enhances another’s utility, like GEODNET feeding Hivemapper’s maps. Investors tracking top solana depin projects will appreciate the risk-adjusted returns, as physical deployments create moats against pure speculation. Looking ahead, regulatory tailwinds for decentralized telecom and compute could accelerate adoption, cementing Solana’s DePIN dominance through 2026 and beyond. The ecosystem’s resilience, tested by market cycles, rewards those deploying hardware today with compounding yields tomorrow.