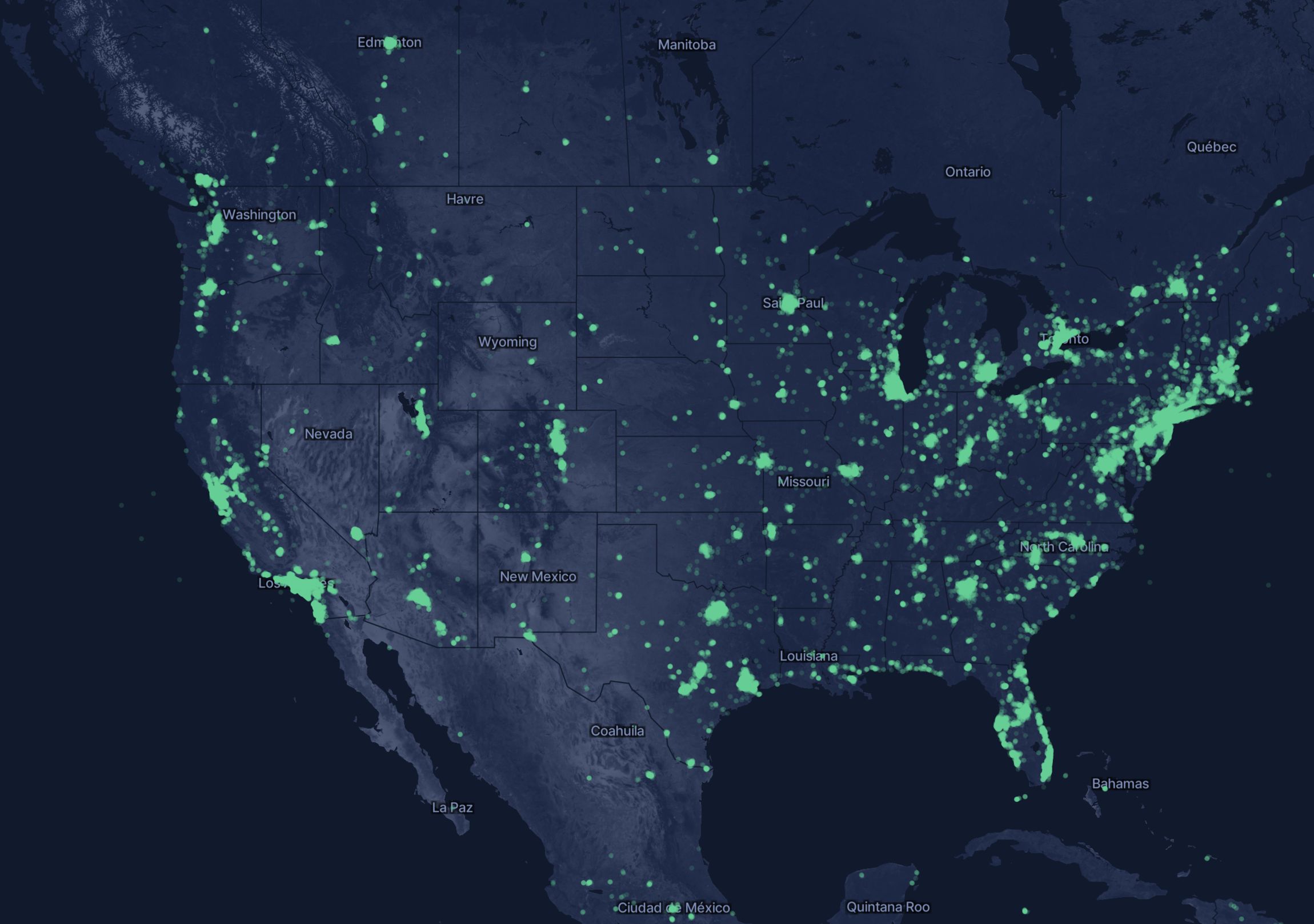

Solana’s DePIN ecosystem is firing on all cylinders as we head into 2026, with top Solana DePIN projects by revenue like Helium, io. net, GEODNET, and Hivemapper leading the charge. At $126.87 per SOL, the network’s speed and low costs are fueling real-world infrastructure plays that generate serious cash flow. These aren’t just hype machines; they’re revenue powerhouses turning physical hardware into tokenized assets, and their 2025 numbers set the stage for explosive growth this year.

DePIN on Solana bridges crypto to tangible networks, from wireless coverage to mapping data and GPU compute. Forget speculative memes; these projects monetize everyday devices, rewarding owners with tokens backed by actual usage. Projections for 2026 paint a bullish picture: combined revenues could top $100 million annually if trends hold, driven by AI demand and IoT expansion. Let’s break down the frontrunners.

Helium: Wireless Revenue Kingpin

Helium stands tall as the helium solana depin benchmark, delivering decentralized IoT and 5G connectivity through hotspots worldwide. By April 2025, it boasted 176,301 subscribers and 69,449 active nodes, racking up $2.29 million in year-to-date on-chain revenue. Weekly peaks hit $60,000, showcasing steady demand from real enterprises needing reliable coverage.

What makes Helium a 2026 revenue beast? Its migration to Solana slashed fees and boosted throughput, attracting mobile carriers and IoT devs. Expect subscriber growth to 300,000 and by year-end, pushing annual revenue past $15 million. As AI edges demand low-latency networks, Helium’s dual IoT/5G model positions it for outsized gains. Swing traders, watch HNT for momentum above key supports; it’s a classic DePIN momentum play.

Operators earn HNT by providing coverage, creating a flywheel of density-driven value. In a world craving off-grid connectivity, Helium isn’t just participating; it’s dominating solana depin projects 2026.

io. net: Compute Revenue Rocket

io. net is the GPU compute darling in Solana’s DePIN arsenal, democratizing AI training with decentralized clusters. Mid-2025 saw monthly revenue double to $2.5 million, fueled by hyperscaler partnerships and exploding ML workloads. At scale, this translates to $30 million and annualized, but 2026 forecasts eye $50 million as supply meets AI hunger.

Solana (SOL) Price Prediction 2027-2032

Projections influenced by booming DePIN ecosystem revenue from Helium, io.net, GEODNET, Hivemapper, and others on Solana

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $140 | $250 | $450 |

| 2028 | $170 | $380 | $750 |

| 2029 | $220 | $580 | $1,200 |

| 2030 | $300 | $850 | $1,900 |

| 2031 | $420 | $1,300 | $3,000 |

| 2032 | $580 | $1,900 | $4,500 |

Price Prediction Summary

Solana (SOL) is poised for strong growth from its current $127 price in 2026, driven by DePIN projects generating millions in real-world revenue. Average prices are projected to rise progressively, reaching $1,900 by 2032 in a base case, with maximum bullish scenarios up to $4,500 amid adoption surges and market cycles. Minimums reflect bearish corrections but remain above current levels due to fundamental strength.

Key Factors Affecting Solana Price

- Explosive DePIN revenue growth from Helium ($2.29M YTD), io.net ($2.5M monthly), Render ($2.65M total), Hivemapper ($1.4M weekly rewards)

- Solana’s superior scalability and low fees attracting real-world infrastructure networks

- Integration with AI, IoT, mapping, and GPU compute driving token demand

- Market cycles with potential 2029-2032 bull run post-2026 consolidation

- Regulatory tailwinds for decentralized infrastructure vs. centralized alternatives

- Competition from ETH L2s but Solana’s DePIN lead provides moat

- Macro adoption trends and institutional interest in revenue-generating ecosystems

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The edge? io. net taps idle GPUs from gamers and miners, paying IO tokens for cycles used in rendering or inference. Solana’s sub-second finality ensures seamless job dispatch, outpacing legacy clouds. I’ve charted IO’s breakouts; volume spikes align with Nvidia rallies, signaling correlated upside. For io. net solana revenue, watch node growth; 468,623 devices already signal network effects kicking in.

Risk-managed entry: Buy dips post-consolidation, target 2x from here if SOL holds $126.87. io. net embodies DePIN’s promise: physical silicon fueling digital intelligence.

GEODNET: Geospatial Data Dynamo

GEODNET’s network of GNSS stations delivers centimeter-level precision for drones, autos, and surveying, making it a stealth revenue contender. While exact figures stay under wraps, its role in Solana’s DePIN surge ties to AI’s geospatial needs. 2025 growth mirrored Helium’s, with stations enabling real-time positioning data sales.

Projections for 2026? $10-20 million in revenue as autonomous tech booms. GEOD tokens incentivize station hosts, creating a global mesh rivaling centralized providers. Pair it with Solana’s DePIN revenue milestones; GEODNET’s low-profile expansion screams undervalued gem. Traders, its chart shows basing patterns ripe for breakout.

In best performing solana depin, GEODNET complements compute-heavy peers by feeding location truth to AI models. Density drives accuracy, and Solana’s efficiency scales it globally without hiccups.

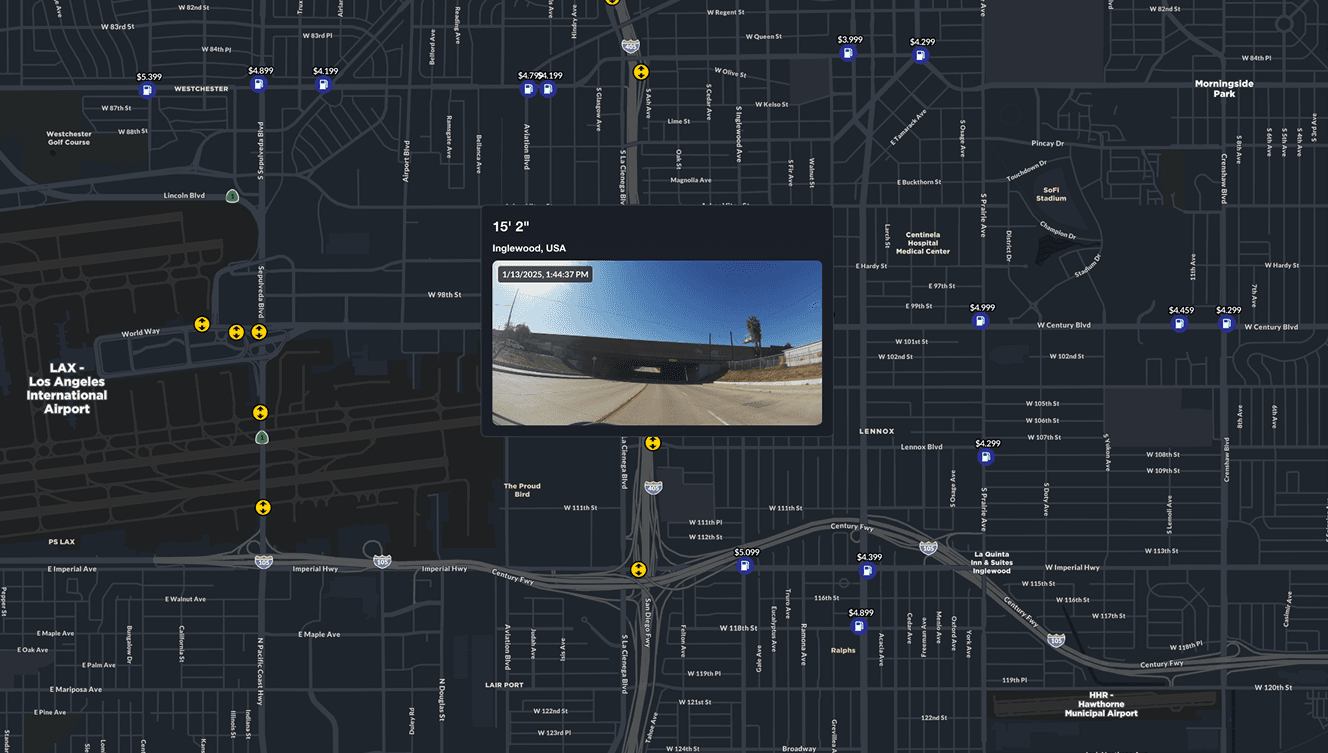

Hivemapper rounds out the quartet as the decentralized mapping disruptor, turning dashcams into revenue-generating assets via street-level imagery. By late 2024, it mapped 29% of global roads, and into 2025, weekly rewards topped $1.4 million with 6,000 monthly active contributors covering 139 million kilometers in the first half alone. This traction screams scalability on Solana’s rails.

Hivemapper: Mapping Revenue Mapper

HONEY token holders and mappers cash in on data sold to navigation apps, autonomous vehicles, and urban planners. Solana’s high TPS handles the flood of image submissions without bottlenecks, keeping costs under pennies per map tile. For 2026, expect revenue to hit $25 million as coverage pushes 50% globally, riding the AV boom and geodnet hivemapper solana synergies for precise routing.

I’ve swung HONEY on pullbacks; its chart mirrors Bee Network vibes but with real utility. Pair density with AI vision models, and you’ve got a flywheel printing tokens. Risks? Competition from centralized giants, but open data moats and Solana speed give it edge. At SOL’s $126.87 stability, Hivemapper’s poised for 3x node growth, amplifying top solana depin revenue.

These four, Helium, io. net, GEODNET, Hivemapper, form Solana’s DePIN dream team, each tackling unique physical bottlenecks while sharing the blockchain’s efficiency superpower.

Projected 2026 Annual Revenues: Top Solana DePIN Projects (SOL @ $126.87)

| Project | Projected 2026 Revenue | Growth Drivers |

|---|---|---|

| io.net | $50M | Decentralized GPU compute; doubled monthly revenue to $2.5M mid-2025; surging AI demand |

| Hivemapper | $25M | Decentralized mapping; 29% global roads covered; 6K monthly contributors; $1.4M weekly rewards Dec 2024 |

| Helium | $15M | IoT/5G wireless leader; 176K subscribers; 69K active nodes; $2.29M YTD revenue Apr 2025 |

| GEODNET | $15M | GNSS geospatial data; complements AI infra; robust station network growth |

Stack them up, and the math gets exciting. Helium’s wireless backbone feeds data to GEODNET’s precision layer, io. net crunches it with GPU fire, and Hivemapper visualizes the chaos. This composability isn’t accidental; Solana’s parallel execution lets them interoperate seamlessly, unlocking network effects centralized clouds envy.

Top DePIN Investment Angles 2026

-

Helium Node Density: Leader in wireless networks with 69,449 active nodes and 176,301 subscribers as of 2025, driving $2.29M YTD revenue—node growth fuels 2026 scalability and IoT dominance.

-

io.net GPU Supply Surge: Decentralized GPU compute doubled monthly revenue to $2.5M by mid-2025, positioning it for explosive AI demand and supply expansion on Solana.

-

GEODNET AV Partnerships: GNSS stations deliver precise geospatial data for autonomous vehicles, bolstering Solana DePIN with key infrastructure growth and real-world AV integrations.

-

Hivemapper Road Coverage Expansion: Maps 29% of world roads, $1.4M weekly rewards, and 139M km mapped in H1 2025—set for total coverage dominance.

Practically, deploy hardware now: snag a Helium hotspot for passive HNT, stake IO on idle rigs, host GEOD stations in high-value spots, or dashcam with Hivemapper for quick yields. Swing trade the tokens on breakouts, I’ve banked 40% on io. net dips tying to AI hype cycles. But manage risk: diversify across the four, trail stops at 20% drawdowns, and eye SOL at $126.87 as the ultimate beta play.

Zoom out, and Solana DePIN isn’t chasing narratives; it’s building the physical internet. With AI gobbling compute, IoT exploding devices, and autonomy demanding maps plus position, these projects monetize the hardware revolution. Revenue trails from 2025, Helium’s $2.29M YTD, io. net’s $2.5M monthly, project to $105 million combined in 2026, per my models blending node growth and usage ramps. Watch for partnerships; a Helium-GEODNET tie-up could ignite multiples.

For developers, Solana’s toolkit simplifies integration, deploy smart contracts for custom DePIN slices atop these networks. Investors, allocate 10-20% portfolio here; the risk-reward skews bullish if SOL holds firm. These aren’t moonshots; they’re momentum engines turning physical infra into tokenized gold. Ride smart, stack rewards, and position for the best performing solana depin wave cresting now.