Solana’s DePIN (Decentralized Physical Infrastructure Network) ecosystem is entering a new phase of maturity in 2025, defined by robust network growth, surging user engagement, and record-setting revenues. As the blockchain landscape pivots toward real-world utility, Solana stands out for its high throughput and developer-friendly architecture, enabling next-generation infrastructure projects to scale rapidly. The current market price of Solana (SOL) is $186.16, reflecting continued investor confidence despite short-term volatility.

This article spotlights the top five Solana-based DePIN projects to watch in 2025: Helium Network (IOT and MOBILE), Hivemapper, Render Network, Grass, and PEAQ. These networks are not only driving adoption but also setting new benchmarks in decentralized infrastructure revenue and social activity. Let’s dive into the metrics and strategic developments behind their success.

Solana DePIN Projects: Market Growth and Revenue Milestones

The past year has been transformative for Solana’s DePIN sector. In April 2025 alone, the ecosystem posted its best monthly revenue performance ever, with income reaching $458,000, a 33% year-over-year increase (source). This momentum is largely driven by the following standout projects:

Top 5 Solana DePIN Projects to Watch in 2025

-

Helium Network (IOT & MOBILE): Helium operates the world’s largest decentralized wireless network, spanning nearly one million hotspots across 192 countries. In August 2025, Helium Mobile reported $910,000 in revenue (a 127% MoM increase), rewarding users with $IOT and $MOBILE tokens for network activity and data usage.

-

Hivemapper: Hivemapper is a decentralized mapping network with a rapidly growing contributor base. In the first half of 2025, it mapped 139 million kilometers and maintained 6,000+ monthly active contributors. Over $195,000 worth of $HONEY was burned in December 2024, reflecting strong ecosystem activity.

-

Render Network: Render Network provides decentralized GPU computing on Solana, enabling users to monetize idle GPU capacity. In December 2024, platform revenue peaked at $746,000, highlighting its increasing adoption by creators seeking affordable distributed computing power.

-

Grass: Grass is a leading AI data infrastructure network on Solana. Its user base surged from 200,000 to over 3 million between late 2024 and 2025. Grass currently processes approximately 759,000 terabytes of data daily, supporting decentralized data collection and AI model training.

-

PEAQ: PEAQ is building decentralized physical infrastructure for the machine economy on Solana, enabling devices to autonomously interact, transact, and earn. The project is recognized for its innovative approach to connecting machines and infrastructure in a trustless environment.

Helium Network (IOT and MOBILE): Decentralized Wireless at Scale

Helium Network continues to dominate as the world’s largest decentralized wireless network. By October 2025, Helium Mobile reported revenues of $910,000 in August alone, a staggering 127% month-over-month increase. The network now operates nearly one million hotspots across 192 countries, providing LoRaWAN coverage for IoT devices and expanding its 5G footprint through MOBILE nodes.

The dual-token model provides $IOT for LoRaWAN hotspots and $MOBILE for 5G nodes, creates powerful incentives for both hardware operators and data users. Rewards are directly tied to network activity and data usage, aligning economic interests with infrastructure growth. Helium’s active community presence on X (formerly Twitter) further amplifies its reach:

This combination of technical innovation, global scale, and social engagement positions Helium as a bellwether for decentralized wireless infrastructure on Solana.

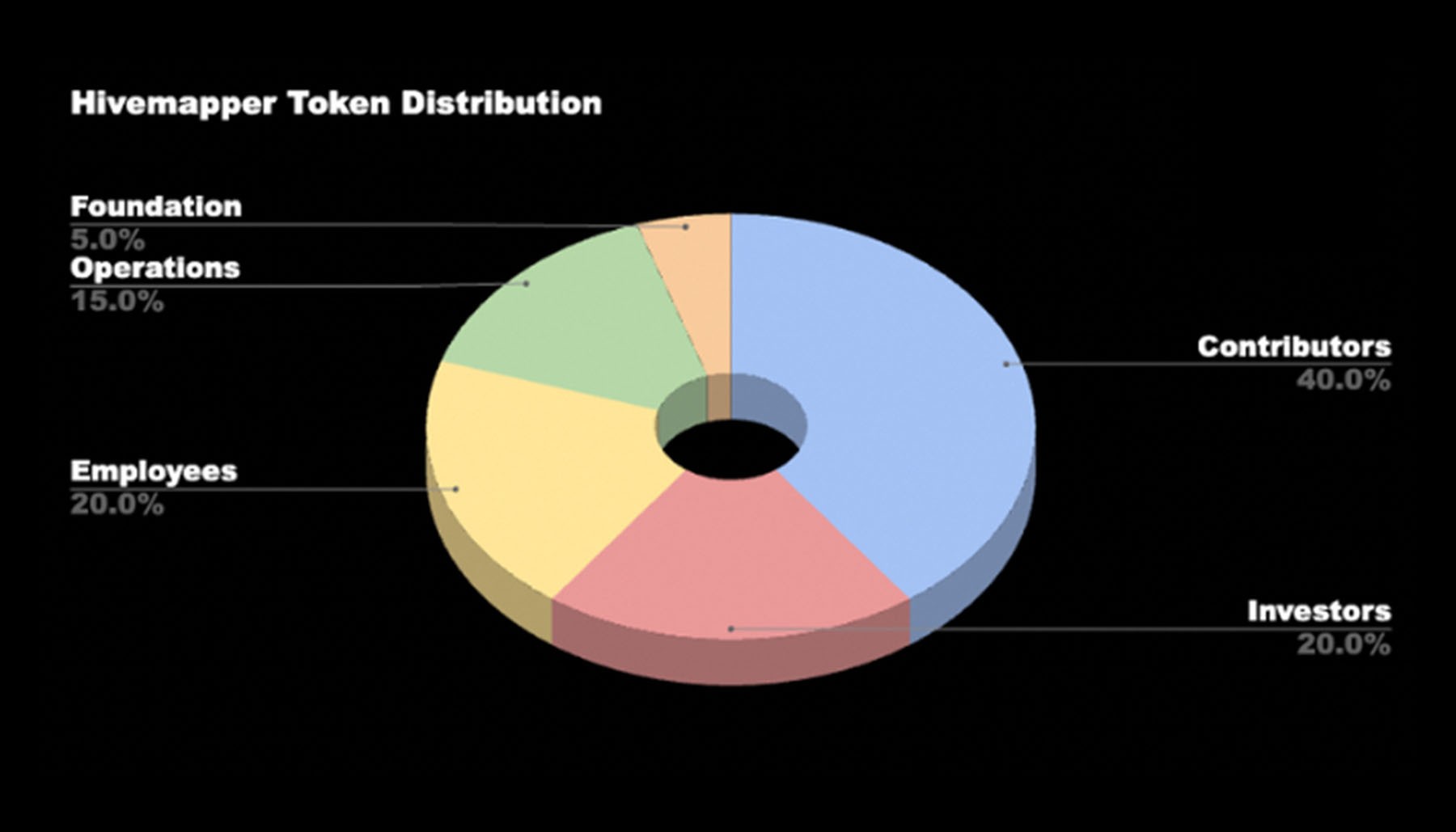

Hivemapper: Mapping the World via Web3 Incentives

Hivemapper, a decentralized mapping protocol built on Solana, leverages tokenomics to crowdsource global map data collection. In December 2024 alone, Hivemapper saw over $195,000 worth of $HONEY tokens burned, signaling strong contributor activity. The project maintained around 6,000 monthly active contributors, mapping an impressive 139 million kilometers in just six months.

This rapid expansion underscores Hivemapper’s unique value proposition: transforming everyday drivers into map builders by rewarding them with $HONEY tokens. As real-time geospatial data becomes increasingly valuable for logistics, urban planning, and autonomous vehicles, Hivemapper’s decentralized approach offers both scalability and cost efficiency.

Hivemapper (HONEY) Price Prediction 2026-2031

Forecast based on recent burn rates, user growth, Solana DePIN ecosystem trends, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.025 | $0.036 | $0.055 | +28% | Continued growth in contributors and network data, moderate market sentiment |

| 2027 | $0.031 | $0.049 | $0.080 | +36% | Bullish adoption cycle, new partnerships, and token utility expansion |

| 2028 | $0.039 | $0.067 | $0.120 | +37% | Major mapping integrations, increased burn rates, broader DePIN adoption |

| 2029 | $0.052 | $0.091 | $0.165 | +36% | Sustained DePIN sector growth, positive regulatory landscape |

| 2030 | $0.070 | $0.124 | $0.220 | +36% | Mature DePIN market, scaling of mapping use cases, global user base |

| 2031 | $0.088 | $0.156 | $0.280 | +26% | Market stabilization, competition rises, but Hivemapper maintains leadership |

Price Prediction Summary

Hivemapper (HONEY) is forecast to experience steady growth from 2026 to 2031, driven by rising network activity, increasing token burns, and broader adoption of DePIN solutions on Solana. The average price is projected to rise from $0.036 in 2026 to $0.156 by 2031, reflecting sustained user growth, expanding use cases, and maturing market dynamics. Maximum price scenarios consider bullish market cycles and new integrations, while minimums account for regulatory risks and competition. Overall, HONEY’s outlook remains positive, with high potential for upside if DePIN adoption accelerates.

Key Factors Affecting Hivemapper Price

- Rising token burns and active contributors on Hivemapper network

- Expansion of Solana DePIN ecosystem and increased infrastructure demand

- Growing utility of decentralized mapping in various industries

- Potential for new partnerships and integrations with enterprise clients

- Regulatory developments impacting DePIN and data privacy

- Competition from other DePIN and mapping projects

- General crypto market cycles and macroeconomic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Render Network: Powering Decentralized GPU Computing

Render Network, another leading force within Solana DePIN projects in 2025 (see more here), enables anyone with idle GPU resources to contribute computing power in exchange for tokens. In December 2024 Render posted revenues of $746,000, its highest monthly figure yet.

This surge is driven by demand from creators seeking affordable distributed rendering services for AI training models, animation studios, scientific simulations, and more. By democratizing access to GPU compute power while lowering costs versus centralized providers like AWS or Google Cloud Platform, Render is redefining how digital content is produced at scale on Web3 rails.

The second half of this analysis will explore Grass’ explosive user growth as well as PEAQ’s emerging role in machine economy infrastructure, plus actionable insights on what these trends mean for investors seeking exposure to Solana decentralized infrastructure.

Grass Network: Decentralized Data for AI at Massive Scale

Few projects exemplify exponential user growth in the Solana DePIN space like Grass Network. Between Q4 2024 and early 2025, Grass’s user base surged from 200,000 to over 3 million users. The platform now processes approximately 759,000 terabytes of data daily, establishing itself as a backbone for decentralized AI data collection and model training. Grass’s architecture enables individuals and organizations to contribute unused bandwidth and storage in exchange for token rewards, making it a critical enabler of next-generation AI applications.

This scale is not just a technical feat but a strategic moat. As demand for high-quality, diverse data accelerates across industries, from autonomous vehicles to personalized medicine, Grass’s decentralized approach delivers both resilience and cost savings over centralized incumbents. The project’s active developer community and frequent protocol upgrades further signal robust ecosystem health, making it a standout among Solana DePIN projects in 2025.

PEAQ: Enabling the Machine Economy on Solana

PEAQ rounds out this cohort as an emerging leader in decentralized machine economy infrastructure. While still in its rapid build-out phase compared to longer-standing projects like Helium or Render, PEAQ is gaining traction by providing tools for machines, think EV chargers, delivery drones, industrial sensors, to autonomously interact, transact, and monetize their services on-chain.

The network’s focus on interoperability with existing IoT standards and its modular plug-and-play APIs are attracting both enterprise partners and independent developers. As more devices come online globally, PEAQ’s value proposition, frictionless machine-to-machine payments and secure data exchange, positions it at the forefront of Solana’s push into smart infrastructure. Early pilot programs with logistics firms and renewable energy grids underscore PEAQ’s real-world relevance.

Strategic Insights: What These Trends Mean for Investors

The top Solana DePIN projects highlighted here are not only scaling infrastructure but also reshaping economic incentives around physical network deployment. Key metrics, such as Helium Mobile’s $910,000 August revenue spike or Hivemapper’s sustained contributor growth, demonstrate that tokenized models can drive real-world adoption at global scale.

For investors evaluating exposure to Solana decentralized infrastructure in 2025, several themes stand out:

- Diversification of Revenue Streams: Each project leverages distinct economic models, from wireless coverage (Helium) to GPU compute marketplaces (Render) to crowdsourced mapping (Hivemapper): mitigating correlated risks across the sector.

- User Growth as an Indicator: Explosive onboarding rates (e. g. , Grass) often precede revenue inflection points; tracking active contributors versus passive holders offers deeper insight into network health.

- Social Activity Drives Adoption: Community engagement remains a leading indicator of future growth. Projects with vibrant social channels and transparent development updates tend to outperform over longer horizons.

- Ecosystem Effects Matter: Cross-project integrations (like PEAQ enabling device interoperability across other networks) amplify value creation beyond what any single protocol can achieve alone.

Essential Metrics for Solana DePIN Project Health

-

Helium Network (IOT & MOBILE): Key metrics include monthly revenue (e.g., $910,000 in August 2025), hotspot/node growth (nearly 1 million hotspots globally), token rewards (IOT and MOBILE), and network coverage expansion (192 countries).

-

Hivemapper: Track token burn rates (over $195,000 $HONEY burned in Dec 2024), monthly active contributors (approx. 6,000), mapping activity (139 million kilometers mapped in H1 2024), and social engagement.

-

Render Network: Monitor platform revenue (peaked at $746,000 in Dec 2024), GPU node participation, token distribution, and network throughput for decentralized rendering tasks.

-

Grass: Assess user growth (from 200,000 to 3 million in early 2025), data processed daily (approx. 759,000 TB), node count, and AI model training contributions.

-

PEAQ: Key metrics involve connected device count, transaction volume, network integrations, and ecosystem partnerships supporting decentralized physical infrastructure.

The Road Ahead: Navigating Volatility Amidst Growth

The current price of SOL at $186.16 reflects both optimism about the chain’s long-term fundamentals and the volatility inherent in crypto markets. As these DePIN projects continue to deliver measurable results, and as regulatory clarity improves, the sector is poised for further institutional interest. However, investors should remain vigilant regarding governance changes, tokenomics adjustments, or competitive shifts that could impact project trajectories.

If you’re seeking deeper analysis on weekly performance trends or want to track emerging tokenless networks before broader adoption curves kick in, explore our dedicated trackers and research updates:

- Weekly performance and opportunities tracker

- Tokenless DePIN project tracker and early reward insights

- Solana ecosystem growth metrics visualized (external)

The next wave of decentralized infrastructure will be shaped by those who understand not just the technology but also the evolving market dynamics driving adoption on networks like Solana. For those willing to track usage metrics, monitor social activity, and think strategically about where value accrues within these ecosystems, the opportunity set remains substantial in 2025 and beyond.